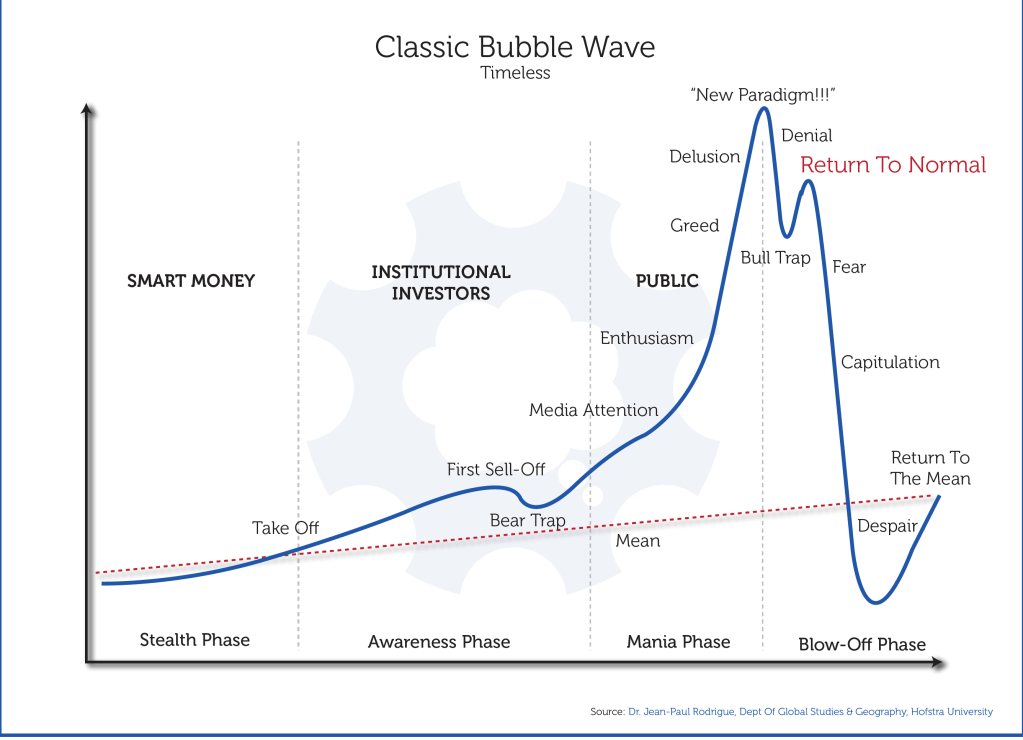

Well, there seems to be no stopping the “new” paradigm, even though it is the same as the old. That is – the same as the last 12 or so years.

Credit cycles tend not to end in crash, until they do.

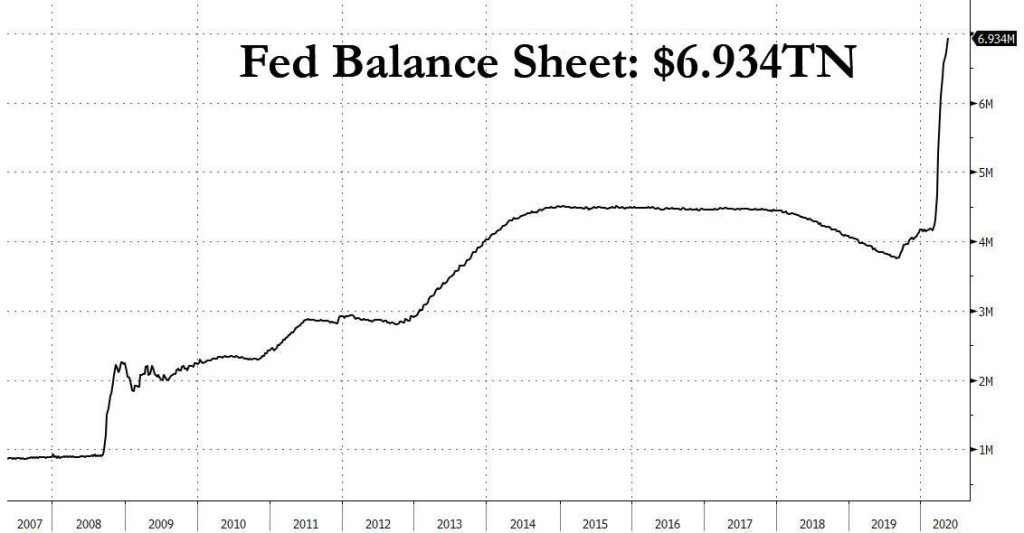

There is no need to bother including Europe, Japan, the rest of the world in the chart below, mostly looks the same, today is more about what the picture represents regarding “the future”.

Source: Bloomberg

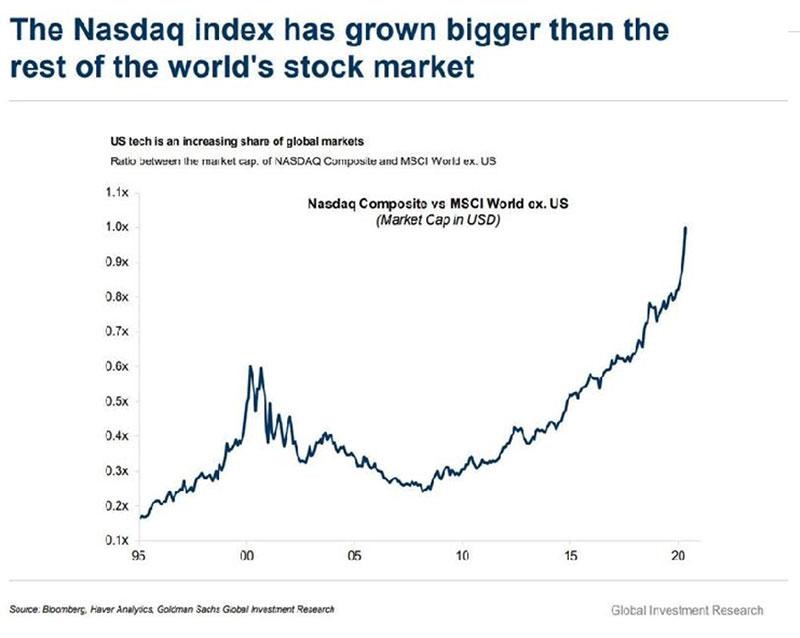

The above chart, and all it represents, has led to this below: (it’s ok to laugh).

The financial success that Central banks and other global “collectives” have endured during Covid seems to now manifest in a victory lap of sorts.

This is important to investors as the victory lap comes in the form of a green light.

The “green light” is a “go” to the New Green Deal, any climate change boondoggle, universal income and/or any other “modern” monetary theory you want to add, all funded by limitless money printing.

Now’s the time. Central banks themselves don’t see a problem and believe there is nothing they can’t fix, post this corona “success”.

Oh, and there’s negative interest rates to come too. So much to look forward to, it’s going to become quite difficult to swallow the reason we pay tax at all when money and bailouts are thrown around this freely.

Consequence free, is the understanding you’re missing if you’re not on board already. We’ll touch on potential consequences in our next note.

So, back to pictures, as promised.

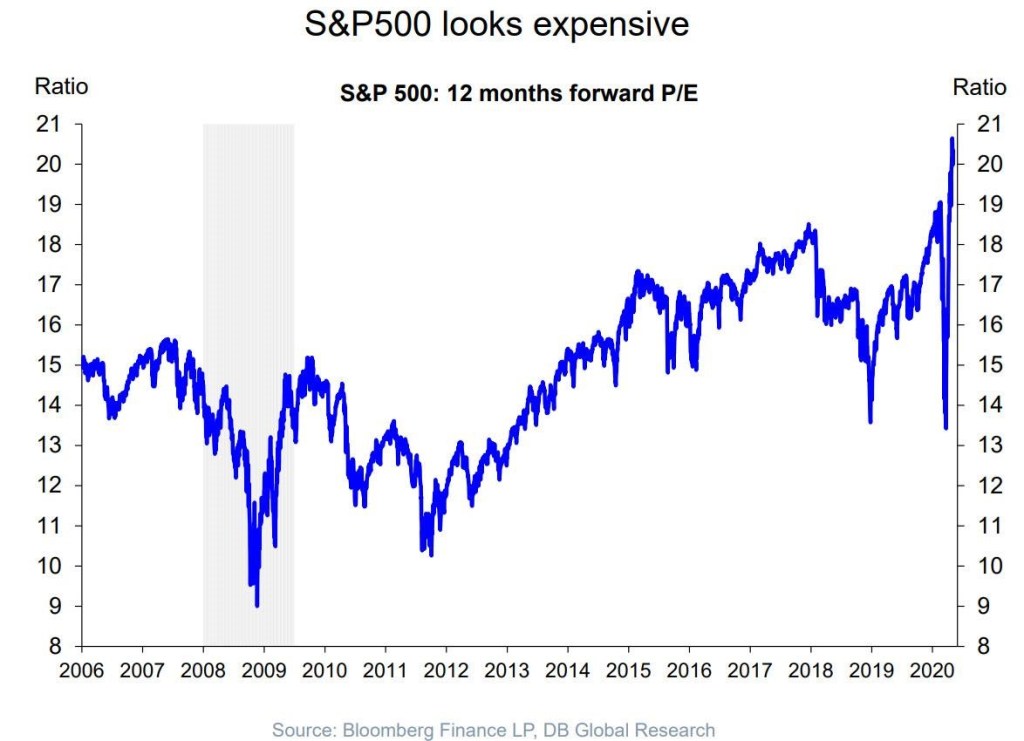

There really is nothing like an earnings collapse to inspire stocks back to all-time highs!!

Maybe just a little toppy:

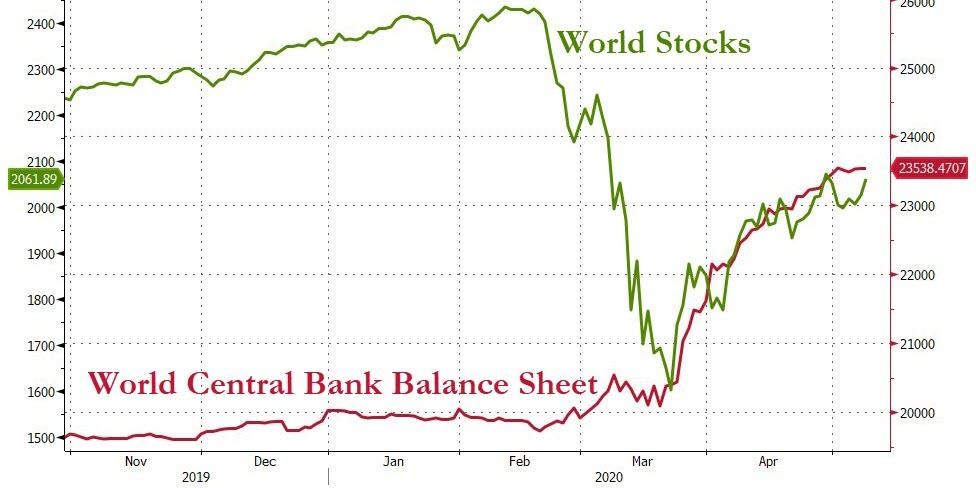

Don’t worry, confirmation right here, we’re good to go green:

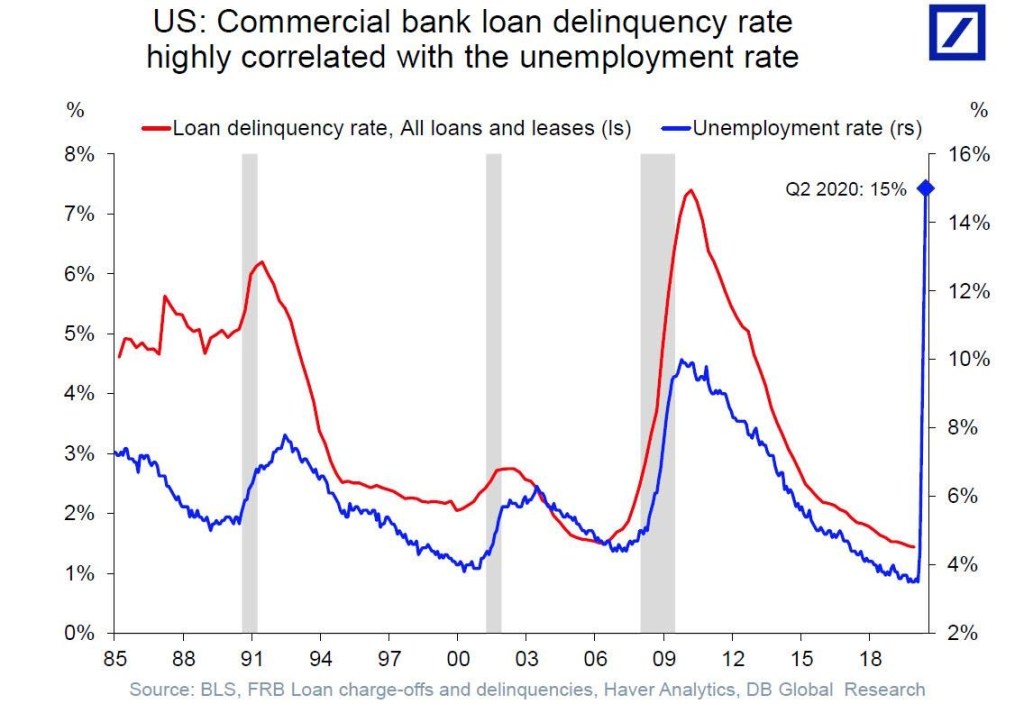

This will be nothing:

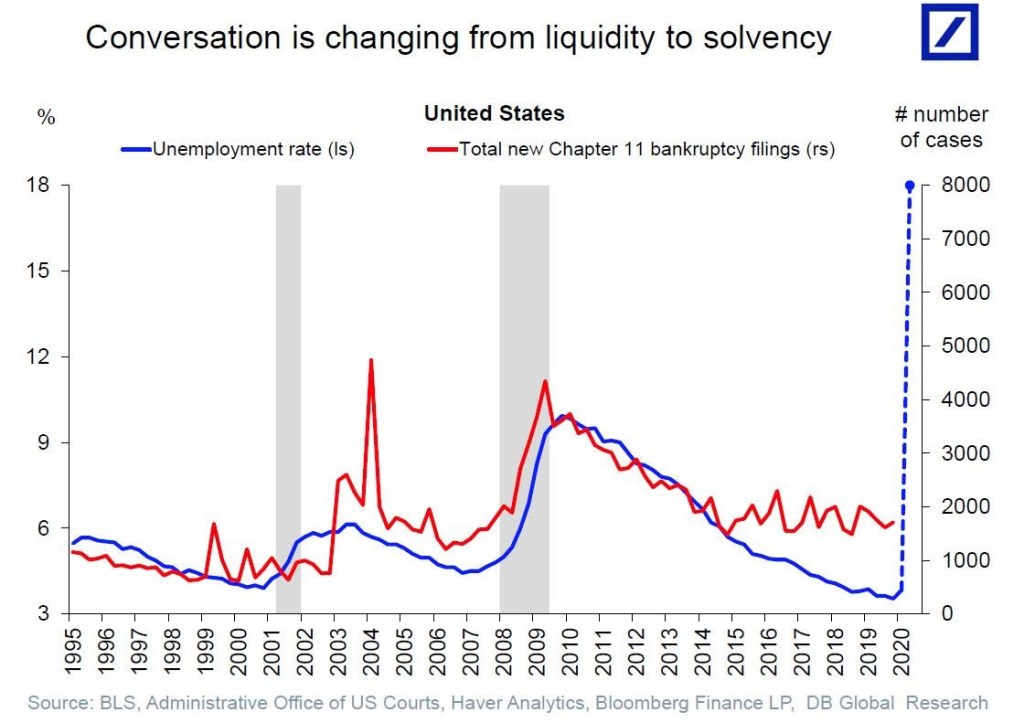

This may be a problem though:

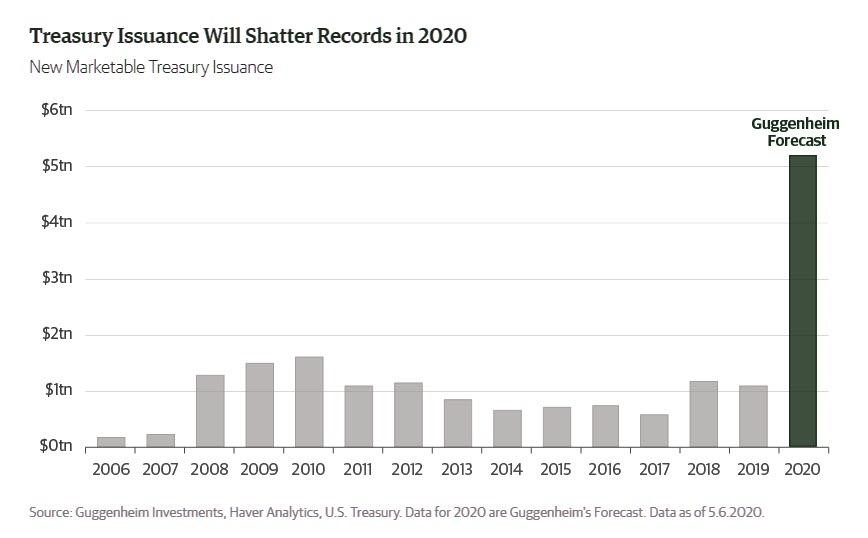

US loves issuing debt:

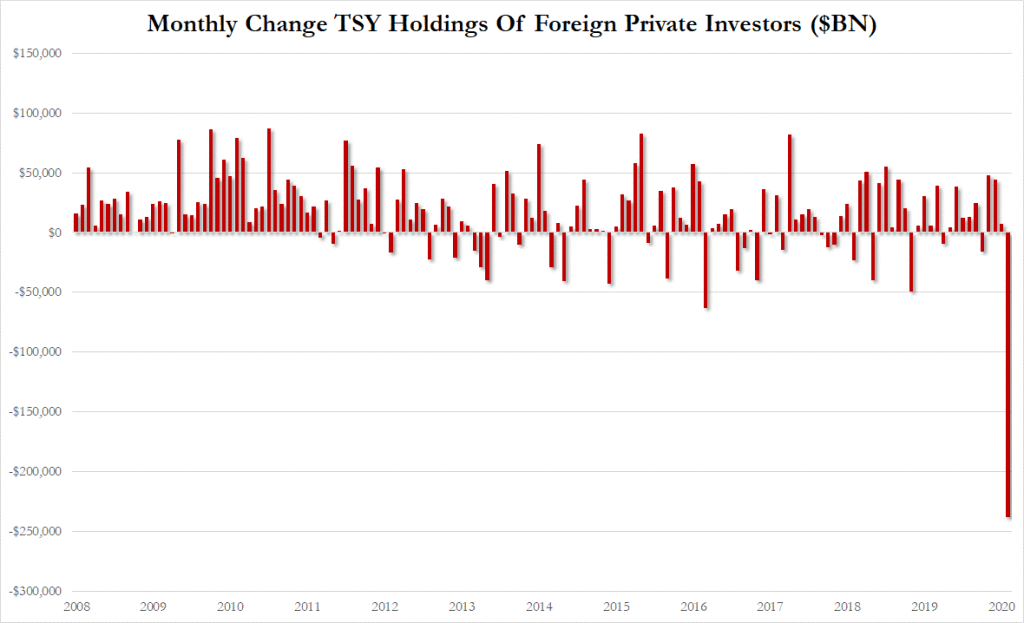

Foriegners are not liking it so much:

Couldn’t possibly leave the joy of this “recovery” without a small counter point:

And the final recovery word goes the plan laid out by SoftBank’s effervescent white knuckle man, Masayoshi Son.

Enjoy your happiness.

Recent Comments