The weird world of investing in FY 2016/17 was a place where you needed to embrace the cognitive dissonance of competing views; where rising credit risks produce lower rates; where a central bank can become a major shareholder of listed companies; where you can buy a fantasy basket of stocks and short volatility… or maybe take a long view, without risk – “passive investing”.

Just relax and pick up a book of the latest ETF offering (seriously, they’re not all bad but it’s a bit worrying when a new one turns up in one’s inbox every morning). More indexes than stocks!

All this thanks to the weird and wacky world of Central Banks and the continued need for them to prop up everything. It’s no wonder people are chasing lower cost ways to simply track markets that seemingly go in one direction.

Then, last week, suddenly something seemed to change. Did anyone hear a ring? A bell? The return of volatility?

We’ve certainly noticed it in Australian equities in the last few trading days. Up 1.7% yesterday, down 1.5% the day before and up then down this morning. Geopolitical concerns? Perhaps in the short term.

In the medium term, the almighty US Fed itself last week fired several warning shots across the bow of Mr. Market, signalling that despite the risks of popping the “bubble of everything”, it will continue to move to a tightening bias, raising rates.

Even more fun was the Fed Chair Janet Yellen’s declaration of determination to “normalise” (whatever that is these days) interest rates by the end of her tenure, September 2018. Can’t wait for that. This is what the growing US $20 trillion debt pile looks like (Source: Visual Capitalist) and it currently costs $430 BILLION a year in interest, at record low rates.

So back to more comments from the world’s most (arguably) important Financial Institution.

So back to more comments from the world’s most (arguably) important Financial Institution.

Last week there were statements from no less than 4 FOMC members, including the Fed Chair.

“Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I do not believe the next Financial Crisis will be in our lifetimes.” Fed Chair Janet Yellen (given the form of her predecessors we now think it’s guaranteed we will).

“In Equity Markets, price-to-earnings ratios now stand in the top quintiles of their historical distributions”- the Fed’s Stanley Fischer.

“The stockmarket rally seems to running very much on fumes”- the Fed’s John Williams.

One can’t discount that record-high equity markets, record-high debt and record-low volatility may have spooked The Fed. Maybe they just want to take a little air out of markets for fear investors may have taken on too much risk?

Or, could it be that after 8 years of “whatever it takes” to maintain global financial order from Western Central Banks that they’ve decided it’s time to take the training wheels off?

Since 2011, anytime time stocks began to break through a critical level of support some Central Bank official appears to issue a statement about future stimulus or maintaining “accommodative” monetary policies.

Whilst not taken seriously by markets initially, many have begun to digest the reality that Central Banks may be truly believing their own rhetoric that things are so “fixed’ that stock and bond markets may be allowed to find price equilibrium without such mothering, or worse, step back!

Ha! That nature would bestow such irony at this point is a thought too much to bear.

Even the BIS (Bank of International Settlements) chimed in last week with, “the rot in the global monetary system has not been cut out since the Lehman crisis of 2008” and it is watching closely warnings of banking stress as its impossible to know when the next eruption will occur, or how intense it will be.

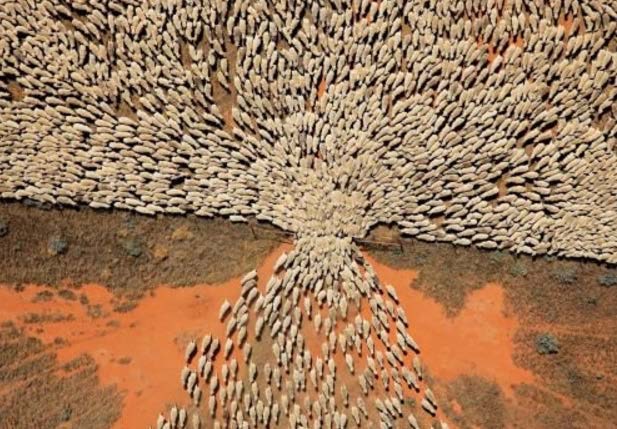

Hence we go back to risk management and “new” products, passive investing. One of the greatest bubbles yet, a full suite of products whose liquidity is yet be tested in the white heat of markets we saw in 1987, 2000 or 2008. This is what a lack of liquidity looks like.

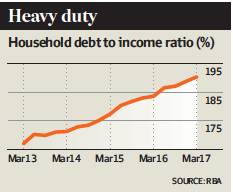

Back in Oz, we still find it amazing that, as reported in the AFR today, household debt to income continues to rise as the RBA, BIS et al continue to warn of the risks of too much concentrated leverage. Blasting through 190%

Perhaps people have been increasing leverage as they share our view.

The view that, if the stock market does start correcting in a meaningful way, the Fed will eventually have to reverse course!

This is our base case to stay with a little more cash on the side-lines. The Fed believes they can continue a rate rising path. This will not last for long because the economy will hit stall speed, if not already so.

It’s more likely they’ll have reached into the deep and vast toolkit, applying forward guidance, once again.

That’s when we’ll be told it is harder than then they thought to raise rates in September because of a slowing economy and, instead, they may be looking to easing measures.

If they don’t reverse course, given the sheer levels of debt and leverage in the system then we’ll have to just sit back and enjoy the show.

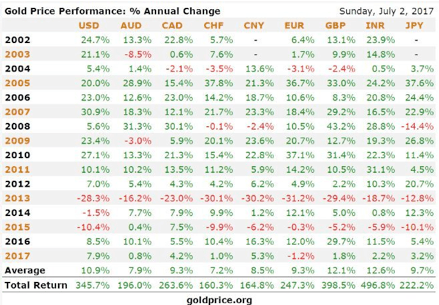

If we do get the expected reversal of course and the subsequent reintroduction of QE and the like then this will be extremely bullish for Gold and the often talked about, reflation trade.

What’s been surprising about gold so far, this year is that it has held up.

We remain diversified across all asset classes with an emphasis on overweight cash to deploy on the back of another Central Bank Policy error before they really crank the printers up again. There is no plan B for our Fiscal leaders. As we’ve learnt, reform was never an option.

Recent Comments