Slightly confused at last week’s 5-day turnaround between the US Secretary of State Rex Tillerson’s statement suggesting “a softening of stance toward Regime Change in Syria”, and the subsequent delivery of 58 live tomahawk inventory to said Syria? Us too. What changed or was it always going to be this way?

If it raises your attention as to why Bashar al-Assad, Syrian President and UK educated medical doctor, saw it fit to do the one thing most likely to rile the Western masses to war- that is, by ensuring the death of children, live on camera, by means of chemical warfare, then we’re with you.

Why?

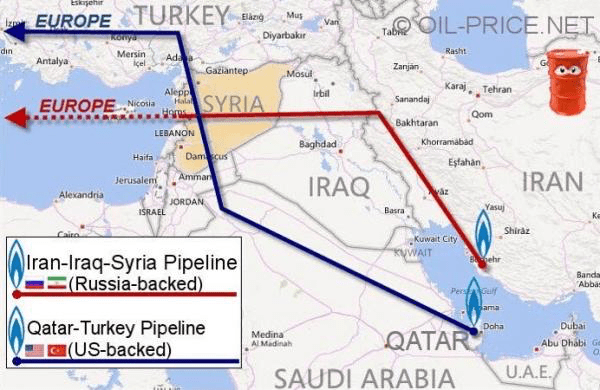

Let us remind ourselves of the first, but not necessarily the main, “why”:

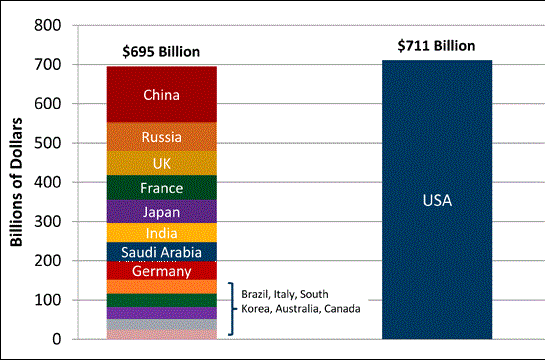

Then, to the second and quite possibly the main “why”- that being the why as to yesterday’s, “we’ve been wanting to see this for a while” MOAB drop in Afganistan and rumours of a further 50,000 troop buildup on the Korean peninsula. It is, of course, US military spending, relative to the rest of world, courtesy of anyone who bothers to collate the results of a minor google search of global military spending.

And BTW, the chart below was for 2013…

Just as the reality of the above chart starts to rise like a summer dawn then another reality follows. Unbalanced stuff like this (below for more clarity) generally gets unwound through some kind of military and/or economic reality, a reality that seems to many, a long way off in our generation. In this we concur, for now, but the risks are growing and the decline is obvious. We’re still not sure when the reality of massive debt weight and over commitment occurred to the general populations of Rome, Britain, the Ottoman or even the French Bourbon as “dangerous”.

An important consideration from an investor’s perspective is that long established empires, in general, don’t “de-exist” over night.

It is not with political bias that we deliver the information contained in the above and further below; we simply comment from the point of view of some poor souls who take seriously these issues, and the perspective of having other poor souls that may well want advice. This has always been our preferred option, as opposed to “when the shit hits the eventual fan we’ll all be in the same boat” type advice.

We actively seek ways of mitigating the downside of this potential reality whilst remaining invested and diversified. If one stays in cash, risks exist but get larger as the inflation timeline moves forward. Property risks are rather obvious right now but so important in long-term wealth creation. Bond risks are poorly understood and stocks, if you can pick the right ones, can help you grow wealth, or send you “south”.

But seriously, if markets freeze (…again) on your watch, you can expect price “discovery’ on newly created investment products, like ETF’s, to be extremely difficult. To be specific, if you read your ETF PDS, without the intervention of a “market maker” you’ll find a distinct inability to sell!!

In saying this, and before we go back to military spending fascinators, it’s important to reiterate that we could have a very long ways to go before we reach a conclusion in this systemic cycle.

To reiterate again, fiscally, only a major systemic debt relief (system reset) or massive inflation are the historical solutions to the current hyper-debt issues that plague most parts of the major mature global economies.

In the meantime, if you want to stay diversified, then here are some ideas of where to look.

One obvious place is Asian Emerging markets: Whilst short term entry is always challenging, the offer of greater return over risk in the medium term is backed by lower social commitments, and general lower balance sheet debt offers compelling value. We look forward to exploring these ideas further.

In the meantime, let us go back to the second why, and the more than probable reason why Trump, despite our hopes, is only going to be more of the same as his lame predecessor.

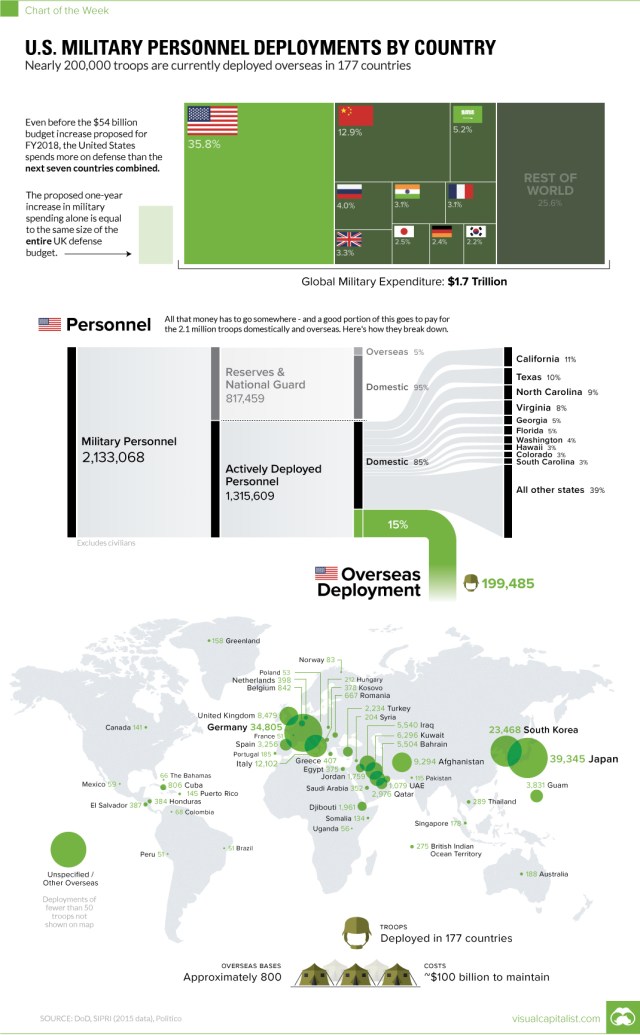

This below from John Whitehead at the “Rutherford Institute” gets close to summing up the costs of the US military efforts:

- The government is $19 trillion in debt.

- The Pentagon’s annual budget consumes almost 100% of individual income tax revenue.

- The government has spent $4.8 trillion on wars abroad since 9/11, with $7.9 trillion in interest. As the Atlantic points out, we’re fighting terrorism with a credit card.

- The government has somehow lost more than $160 billion to both waste and fraud by the military and defence contractors.

- Taxpayers are now being forced to pay $1.4 million per hour to provide U.S. weapons to countries that can’t afford them.

- The U.S. government spends more on wars (and military occupations) abroad every year than all 50 states combined spend on health, education, welfare, and safety.

- Now President Trump wants to increase military spending by $54 billion.

- Add in the cost of waging war in Syria, and the burden on taxpayers soars to more than $11.5 million a day. Ironically, while presidential candidate Trump was vehemently opposed to the U.S. use of force in Syria, and warned that fighting Syria would signal the start of World War III against a united Syria, Russia and Iran, he wasted no time launching air strikes against Syria.

Clearly, war is a huge money-making venture, and the U.S. government, with its vast military empire, is one of its best buyers and sellers.

Thanks to the guys @thevisulalcapitalist for this below.

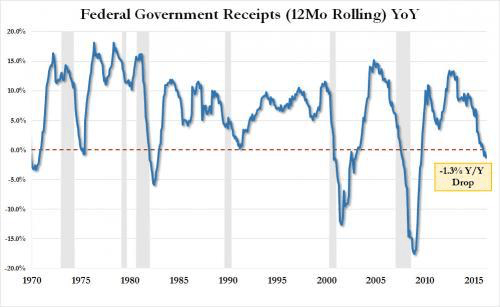

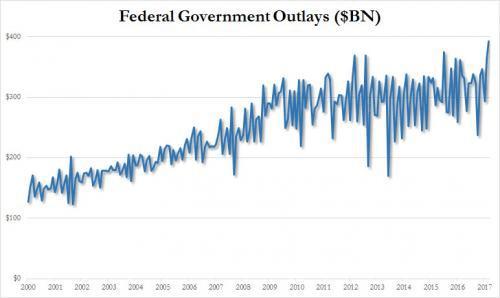

Apart from being thoroughly impressive, these kinds of toys do cost quite a bit for a business with declining revenues. And it was revealed just last night that US Govt revenues had there biggest YoY drop since 2008!

How much of a factor is Military Spending? Not as much as Social Security!!

The breakdown of March spending was as follows: A lazy $392.8BILLION, 57 Billion.or 17% HIGHER THAN A YEAR AGO. UNSTOPPABLE!!

- Defense: $58 billion

- Social Security: 79 billion

- Medicare: $75 billion

- Interest on debt: $30 billion

- Other: $151 billion

Smell more money printing anyone? You betcha!! Before the end of the year?! Can’t wait.

Smell more money printing anyone? You betcha!! Before the end of the year?! Can’t wait.

Couldn’t help but throw this in.

And lastly, THANKS.

We’re working on a gold piece for early next week. For now, let the USD1290 close last night do the talking.

Happy Easter Break to ya’ll! Peace!

Recent Comments