Dry Tinder can refer to a few things in 2017.

For today, it’s what sits below financial markets after the “Hope” rally of the last 4 months.

It’s about what renowned fund manager Bill Fleckenstein reminded us of recently- any downside that gathers even a sniff of momentum could accelerate very quickly into dislocation. And when he said quickly, he didn’t mean that as soon as the peak is seen the market will collapse. He meant that if we gather momentum to the downside, between the paid to play crowd, ETF’s, the public that has piled in and whatever negative impact derivatives may have, he doesn’t think you could have created a more combustible mix if one had set out specifically to do so.

And we agree. What else would you expect from a financial system that experienced near death in 2008/09, and those at the controls who decided to push the limits of the ship with more of the same since (https://www.youtube.com/watch?v=bT8CRi9k4bo)? The only thing that stands in the way of dry tinder ignition is the world’s academic central bankers.

So much so, that we could well be in the curious state of continued falling GDP growth, rising inflation and rising rates, all at the same time.

For now, the experiment goes on but it’s pretty clear extreme over-indebtedness is draining growth on a global scale, and the way to solve this is clearly not by taking on more debt. Thanks, Lacy Hunt, the person who should be USFed chair.

For the more economic literate, Lacy also noted in a recent realvisionTV interview that because of “unresolved underlying debt issues” he is still “long” US Treasury’s, which is logical if the whole “growth” story turns recessionary and results in more QE money printing later in the year.

In the meantime, tonight, the grand poobah of Central Banking, the US Fed’s “grandma” Yellen will deliver the US its third rate rise in 11 years, as the market expects.

It’s the “what now from here” commentary that will set the tone for market response in the short term.

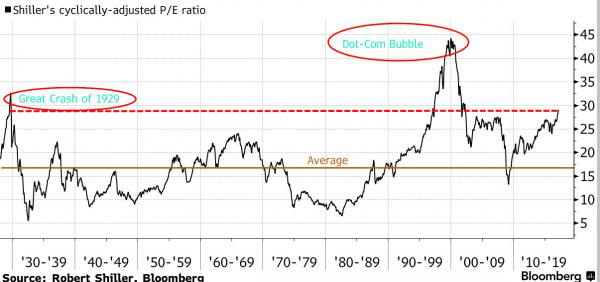

This chart below may give you the indication you need, one way or the other!! It came with comments from Robert Shiller himself, commenting that the last time he heard stock market investors talk like this it was the year 2000.

Curiously, the people that we’ve shared this chart with recently are equally divided on what it means. Many simply said, “we’re only half way there?”. Ah, to have faith in Central Banking!!

Anyway, the US interest rate rise may likely take a back seat to the Dutch election tonight.

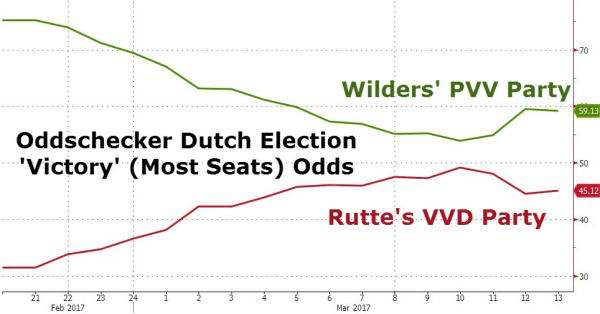

Right now Wilders’s (some say, “the Dutch Trump”) party is well in front, as you can see from this afternoon’s Ipsos poll below.

It appears a very long road to win and then form government for Wilders but even so, it does show that pressure is still building inside the EU.

With French elections on April 23 and Germany on September 24th, a win for Wilders party could be viewed by investors as another nail in the coffin for the European Currency.

Either way, Reuters reports that shortly after the March 15 election, the Dutch parliament will discuss whether it will be possible for the Dutch to withdraw from the single currency, and if so, how.

The Euro’s problems are compounding and could get much worse quite quickly. No point going into the whys of this today.

We’ll know more tomorrow.

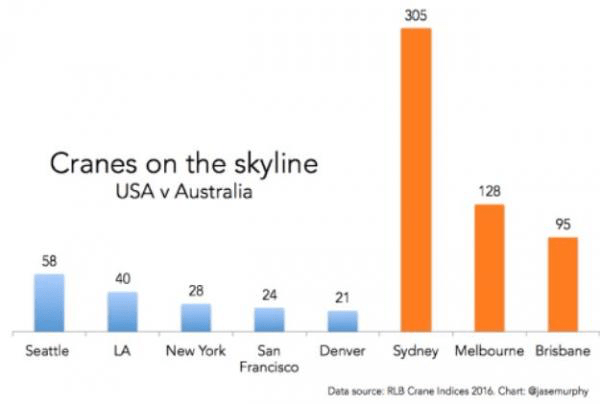

Domestically, the “noise” around the Australian property market has continued to rise in recent weeks so we thought we’d share this little tidbit below from ZH, as a gentle reminder of where some “hidden” risks may lie for Australian investors.

The level of financial concentration and risk in Australia is mind-boggling:

– just four banks completely dominate the financial landscape (Commonwealth, Westpac, ANZ, National), with a combined market cap 26.61% of the ASX 200. The biggest is Commonwealth at 8.72%. That’s bigger than BHP, Rio Tinto and Woodside combined. 21.82% of the entire stock market is 4 banks.

– these four banks control >80% of all loans in Australia and (with AMP & Macquarie) ~40% of all investment funds under management.

– total “assets” of the four banks are ~230% of GDP (3.58T / 1.56T). By contrast, net government debt is only ~17% of GDP. (Expect this to change drastically when the government is forced to bail out the banks)!

– lending is overwhelmingly concentrated in residential real estate with the big four all having >60% of their loan books committed to residential real estate. By contrast, USA ~34%, UK ~17%, Canada ~41%.

We may need to follow this note up with Part 2 tomorrow.

Recent Comments