We reiterated in a recent post that many global “investors” may be waking up to the ever increasing possibility that the financial system, as we know it, is pushing the outer limits of survival. You should need no more evidence than negative interest rates and central bank buying of both bonds and stocks in order to maintain an aura of market “stability”.

This type of policy setting, accompanied with the usual dose of “QE” should equity markets threaten to drop double digits is truly twilight zone economic policy.

But… we’re not going to burden you with such issues in today’s notes. We know the walls are closing in but we’re a bit Trumped out right now, so more pictures than text today!

Let’s start with a snapshot of how some key markets have done since the New Year.

So far, possibly the biggest news has been the rollover in the USD, after being torpedoed by an early January Trump tweet, stating lower was better! Ironically, it came soon after “The Economist” December edition featured a muscular USD George Washington on its cover, representing its “stronger for longer” USD thesis. Regardless of what happens to the US dollar, we look back with fond remembrance the days when The Economist was full of interesting economic stories, instead of the out-of-touch Keynesian/Krugman like mouth piece it is reduced to now. Shame.

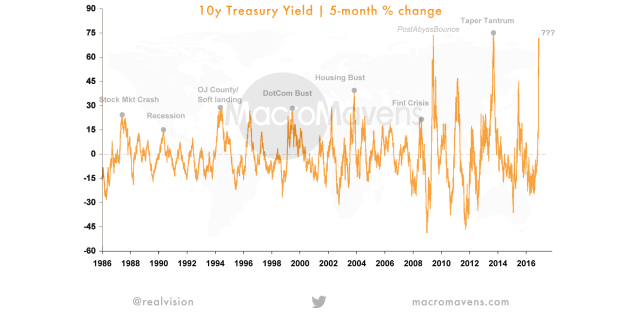

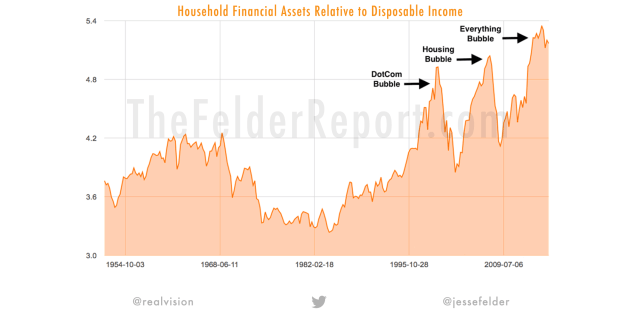

It doesn’t really matter what problems exist in producing charts such as the ones below, but we’re pretty sure that whatever problems there are will be “fixed” with a massive boost of freshly created fiat, as usual. But… will it work this year??

Management Suppression can lead to hyper volatility.

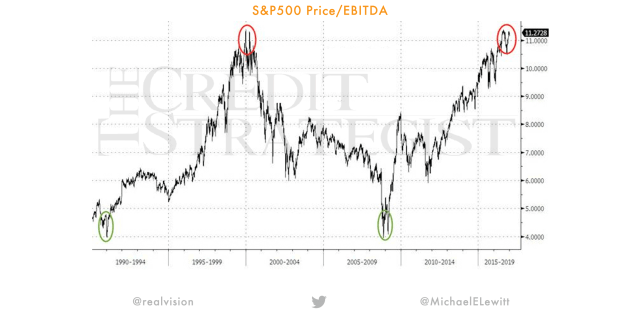

Most. Expensive. Stock Market. EVER!

Who cares, as long as you’re making money, right!?

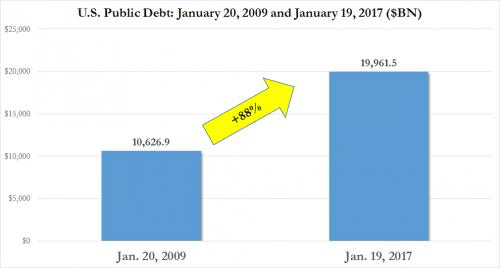

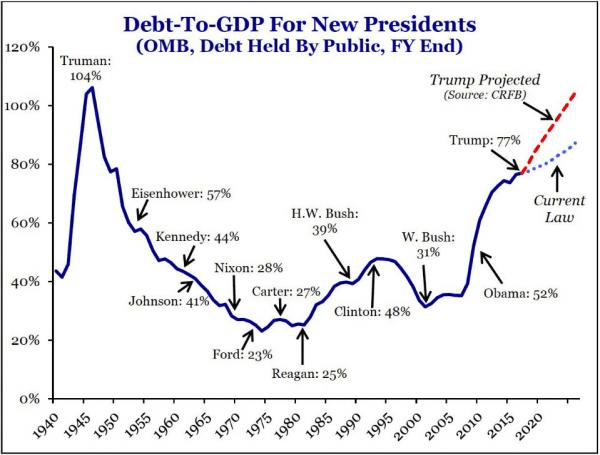

Going back to the US election outcome, the Obama administration must be disappointed they got so close to cracking the 20 trillion mark but just came up short. Gave it their best.

Is there really a need to wonder whether the blue or red lines below will prevail in 4 years time!? Maybe there should be a third vertical “black run” line. Like WWII. Except we don’t have any WW right now.

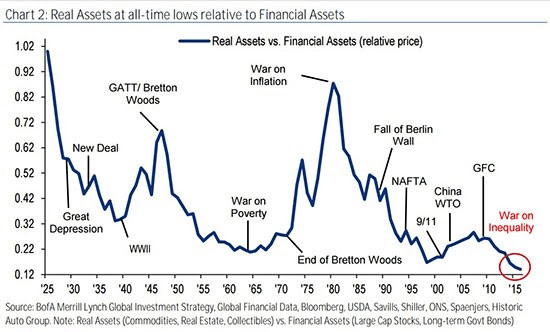

And representing the tremendous back-up of Risk we have the chart below.

It would be breaking our promise to keep things simple today by explaining in detail what this Target 2 really means. We’ll probably find out when the ECB gives Italy “The Bill” for wanting to leave…….do you really want to leave???

Needless to say, as we’ve reiterated before, there is no way Southern and Northern Europe should have the same currency. The bureaucrats in Brussels have pushed the envelope so hard to maintain this dysfunctional reality that the only way left for change is through social push. And as that social push for reform in Europe intensifies, and it will, so will it put pressure on the one thing that the highly benefited politicians fear the most, CHANGE.

Unresolved European discontent remains the greatest financial risk through 2017, in our opinion.

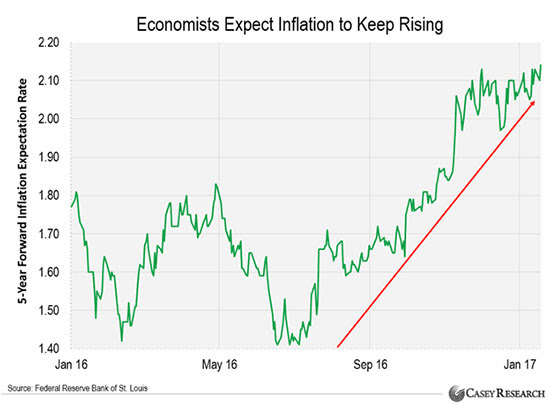

And if you needed any further encouragement to protect yourself from poor policy and oncoming monetary inflation, here it is:

So bye bye. All the best. You’re always welcome to call and discuss portfolio positioning if you wish.

Recent Comments