Welcome to 2017! Happy New Year.

We hope you’ve used some down-time in the last couple of weeks to review whatever goals you may or may not have had in 2016, and find yourself recharged for 2017.

After the events of last year, it’s interesting to ponder what might be in store for us investors this year.

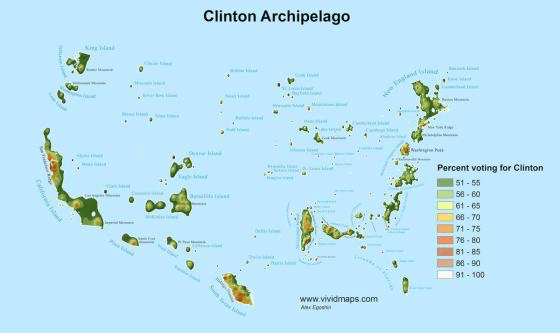

First off, what a remarkable six weeks we’ve had since the “surprising” presidential triumph of Donald Trump! We particularly enjoyed this summary map of the US and where the support for Hillary came from.

Given the overwhelming pre-election consensus for a Clinton victory, coupled with near unanimous forecasts for a stock market rout in the event of a Trump win, we would have expected market participants to be somewhat put off by the election outcome.

Of course, in the “everything is awesome” contemporary financial era, exactly the opposite has occurred; Investors are completely enthralled with the potential of the incoming Trump administration to cure the world’s lingering economic ills. Right now, that is all it is- “potential”.

Share markets have been unanimously euphoric in the wake of the Trump victory speech, but it’s the happenings in a much larger (and more connected to the real economy) market that has our attention: The Bond market.

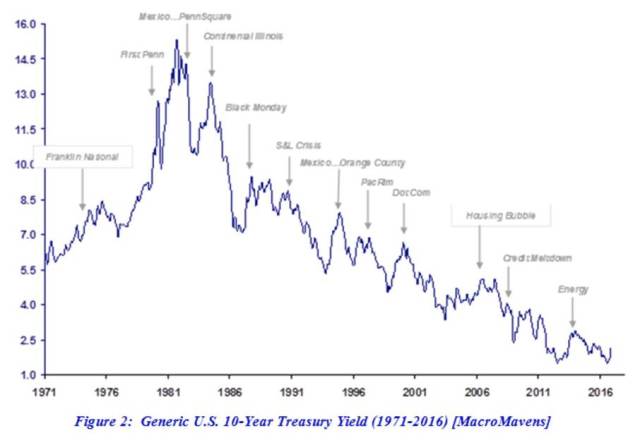

The awakening of the Bond Vigilante from a multi-decade Bear slumber, perhaps because of all the future growth promised by the incoming Trump administration, means interest rates are sure to rise.

This has resulted in massive losses in bonds, coupled with a rise in equity markets, as outlined below.

By historical comparison, the post-election performance divergence between stocks and bonds has reached rather extreme proportions in a very compressed period of time.

And while there is no guarantee this cannot continue, history favours resolution in one direction or the other in fairly short order.

As Trey Reik, from Sprott Asset Management comments, ” Equity investors are favouring prospects for growth unimpeded by excessive inflation or concerns for Fed policy being behind the curve. Bond investors appear troubled that policies of the incoming administration pose inflationary risks (and likelihood for a more hawkish Fed) which were improperly priced in pre-election rate structures. Something has to give! In our mind, the current separation between stock and bond sentiment is potentially reminiscent of experiences in 1987 and 1999, in which 50% backups in yields did not initially trouble the stock market, until they finally did. An added similarity to the 1987 investment landscape is the contemporary bevy of investment-product innovations (ETF’s, risk parity, algorithms) which have yet to be tested by conditions of true market stress”.

It’s the last sentence in Trey’s comments that really gets our attention, and should have captured yours too. The bevy of investment-product innovations yet to be truly stress tested… ETF anyone?

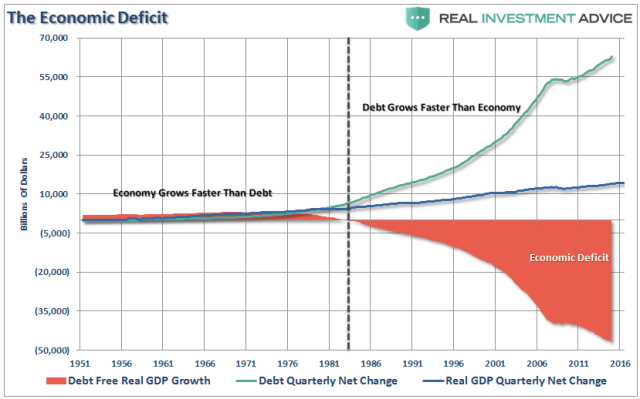

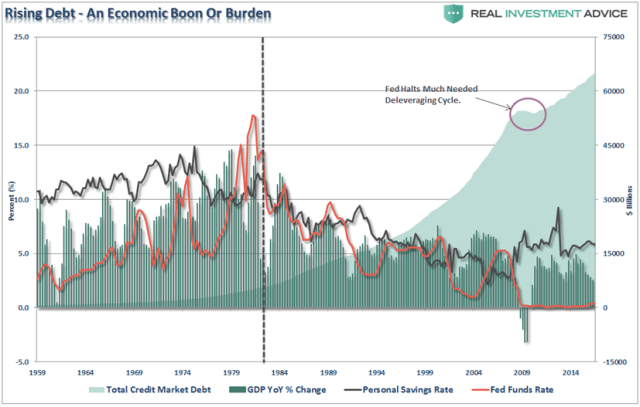

The fact of the matter is global debt levels continue to expand at a far greater pace than GDP growth supports. Again, the US stands as our example.

Despite the mathematical futility of these policies producing anything like we remember growth to be, monetary debasement by global central banks continues to run at fever pitch. Bank of England, Japan and Europe’s combined QE money printing is now at $185 billion per month. The US Fed itself still feels compelled to purchase $50 billion of securities each month to keep shape. One really cannot overstate the size of this number.

Trump campaign promises of fiscal stimulus and lower taxes will take some time to enact, if it is to be enacted at all. The result of these policies will almost certainly worsen the US current account position from an existing acute level and will ultimately take many years for positive impacts to be felt.

The Fed has been unable to raise rates for the last 8 years and December 2015’s rate “lift off” and subsequent forecast of four 2016 rate rises led to an eruption of financial market stress in early 2016. This caused a massive back track to no more hikes for 2016 and leads us to ask, what is different this year?

The similarities to the same time last year are too pronounced to ignore and if history was to repeat itself, a correction of the last few month’s market action will commence in earnest. This will lead to the FED once again, abandoning postponing any further rate hikes due to deteriorating economic circumstances, leading to a continuation of the pattern below.

However, as it was last year, there may still be “tools” in the shed to hold it all together, in which case we give you the following prognostications.

Hopefully our predictions may save true believers from wasting any unnecessary time pondering existential risks to global economic markets and potential wash through to Australian battlers, so here it is:

Eurozone wobbles under serious imbalances between North/South, political moves to the right and subsequent successful referendums to “leave” the EU will be countered by trillions of € handouts to financial institutions/governments everyone.

This will result in very little change to financial market status quo.

Declining growth, rising unemployment, smashing of the debt ceiling and all the after effects of one of the worst administrations in US history is all fixed with massive money printing and handouts to financial institutions/government everyone.

This will result in very little change to financial market status quo.

Busting of a very large real estate bubble in China results in the creation of massive stimulus interventions by the BPOC and appropriate bailout of everything and everyone.

This will result in very little change to financial market stays quo.

And to help you sleep even better, based on the events of the last 8 years, any other problems caused by an over indebted, undercollatoralised fractional reserve financial system will be solved by more of the same policy that got us here in the first place with… wait for it… very little change to financial market status quo! Sleep well.

The reality to us is that continued rising debt and leverage, globally, against a back-drop of falling GDP growth creates a high pressure environment where the slightest misstep is likely to create a very serious blow-off.

And nowhere presents a greater existential risk than Europe.

Not since the 1930’s have economic and social conditions lent themselves to unstoppable social upheaval than now.

Greece was salvageable because it’s population is just 11 million. Put 51% on the social “tit’, financed by the EU, coupled with austerity and it is just manageable.

The numbers in Italy (54 million) and Spain (74 million), by way of unemployment, debt and non-performing loans are simply too large to comprehend.

It’s currently taking as much as the ECB can give, €60-€80 billion per month, and the situation continues to deteriorate.

You must understand by now it’s going to take something quite remarkable to reverse the trend. Think Alien Pyramid enclaves in Antarctica or just Unicorns in general.

If you’re relying on something remarkable to happen, as an investor, how much money do you want have on the side of a remarkable outcome?

We look forward to trying to assist you in managing these risks through 2017.

Recent Comments