What the hell’s going on at “The West” these days? We read a report in this morning’s digital version, citing comments from OECD Chief Economist, William White, who warns us that global risks are far greater than what they were at the start of “The Crisis”. You know, the crisis that finished with this current recovery?

The article reads:

“The global situation we face today is arguably more fraught with danger than was the case when the crisis first began,” Mr White said in a speech last week. “By encouraging still more credit and debt expansion, monetary policy has ‘dug the hole deeper’.”

Mr White was chief economist at the Bank of International Settlements back before the crisis and his warnings were pooh-poohed by then Federal Reserve chairman Alan Greenspan and his deputy Ben Bernanke, allowing financial imbalances to balloon until the system collapsed. It seems no lessons have been learnt.

The article goes on to quote him on the effect of a massive build up in Emerging Market debt denominated in USD and a very low margin for error in the financial system should something “unforeseeable” arise.

We wouldn’t be surprised if Gareth Costa, author of the piece, is currently sulking at his desk after being whacked on the back of his head with a rolled up copy Saturday West, his superiors lecturing him on the folly of printing such “news”. Doesn’t he know that financial fear mongering makes people nervous about too much debt and exposure to property, thus contributing to the decline in the paper’s real estate and New Home related revenue?!

The situation is far more pronounced over at the Murdoch (realestate.com.au) and Fairfax (Domain) camps, where the only growing part of business for years has been these two real estate portals.

In fact, rarely throughout the OECD world has there been a political and financial system so complicit in creating a bubble as Australia’s property scene:

- Negative Gearing (ensuring higher income earners maximise their debt position)

- First homebuyers grants (ensuring lower income earners can maximise their debt position)

- Doubling of first homebuyers grants

- A hyper competitive mortgage “broking” sector, in addition to traditional bank lending

- Super low interest rates

- Politicians with large property holdings

And now, legions of foreign “bag holders” to complete the picture.

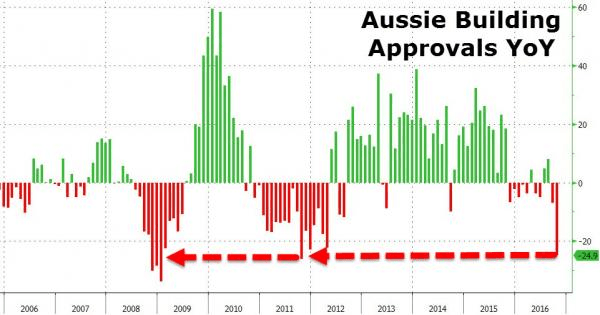

As you can imagine there may be some nervous investors out there today after it was announced that Australian building approvals had fallen by the greatest amount “since Lehman” last month. 24.9% YOY.

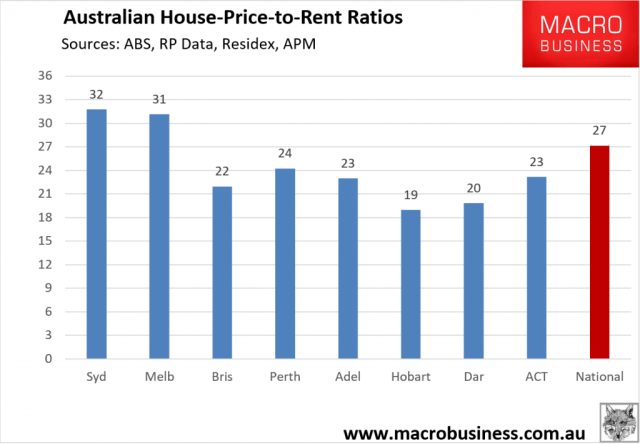

Valuations in the extreme

We could go on but we’ll let the market do the talking over the next few months.

On to more important matters for equity investors: Now that the next 4 years of US growth has, over the last few weeks, been fully factored into the market, we have to sit and wait. Wait to see what happens over the next 2 weeks. Wait for the “12 months in the making” second US rate rise in 10 years, due to be announced on December 14, and the outcome of some minor Euro political events (like an Italian referendum).

In the meantime, the rise in US equity markets and particularly US financial stocks (Greatest. Monthly. Gain. EVER), has ensured enough wriggle room for the Fed to raise rates. It’s now 100% factored in.

What does “100% factored in” even mean these days anyway? UK remain, Clinton?

However, in this case, we agree they’ll go with another 25 basis point rise.

This is almost a perfect duplicate of 2015 so measures should be in place to not repeat what happened after last years rate rise, right?

Although last years rate rise was also “factored in”, it didn’t stop share markets tanking, risk assets falling and gold rising sharply.

As we said, we think the rate rise will happen anyway but is this (below) how its supposed to work!?

It’s going to be a very interesting couple of weeks. Make sure you understand what you own, install asset diversification strategies in your wealth management, and in the meantime, remember you’re always welcome to drop us a line.

Recent Comments