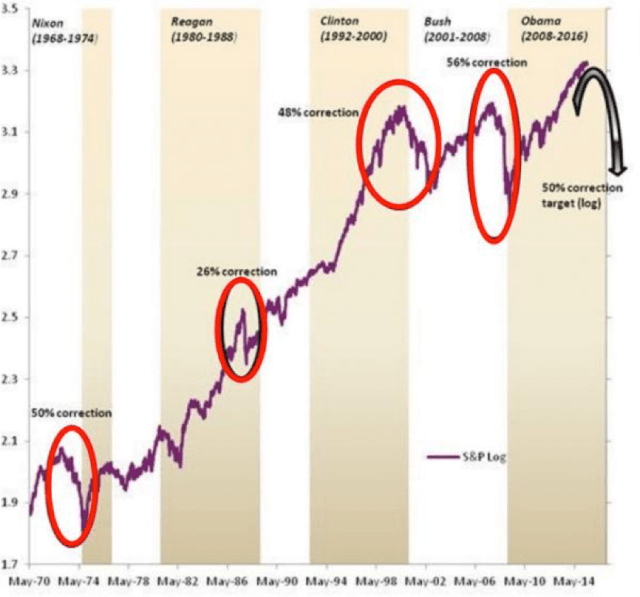

Before we start on financial market reaction to last week, please remember this:

“In the last 100 years there has never been a two-term presidency come to an end that wasn’t followed, within 12 months, by a recession (thanks Raoul Pal, Grant Williams)”

Well, last week the unthinkable happened: Donald Trump was voted in as the President-elect of the United States. Since that fateful day we have been trying to get a feel for just what exactly this means to financial markets.

The immediate reaction? Stocks down and gold up only to be replaced with an incredible, October 8th 2008 style (Exchange Stabilisation, PPT??) stock market. Levitation and gold smash hit the same day and continued throughout the week.

The long and short of it is this: stock markets in the US fell by 5% and then rose by 6%, ON THE SAME NEWS. The reasoning behind why this should make you nervous we’ll touch on further down but suffice to say financial reform won’t happen in a week! This is something we need to be wary of.

Is this perhaps the premature reaping of the benefits associated with massive increases in direct government spending on infrastructure and defense, whilst also enjoying the idea of the financial freedoms that come with the removal of debt ceilings or fiscal reform?

One might think that this sort of inflationary promise (which couldn’t possibly start before 2018) coupled with the recent emergence of the Bond Market’s apparent inflation genie, would be the backdrop for an increase in inflationary protection measures (i.e. Gold).

Well, if you thought that, you’d probably be reconsidering your position this morning…

We can tell you that last Thursday morning, as the Gold price lay flat, 6800 tonnes (that’s two times the yearly production) of paper gold was traded though the Comex! There is no doubt that this systemic rinse in paper longs has Sovereign Players lining up for discounted physical. More on that later.

Back to the market reaction to Trump’s infrastructure stimulus scheme. Let us not forget that it takes a very long time to plan, design, fund and build the types of infrastructure projects the market is currently factoring in.

The market reaction we’re seeing at the moment is totally “cart before horse” and very typical of the style of markets we see today. At best, late 2017 marks when we may see some real shovels hit dirt!

The reality of the whole thing is this: the US economy right now is literally no different than what it was a week ago.

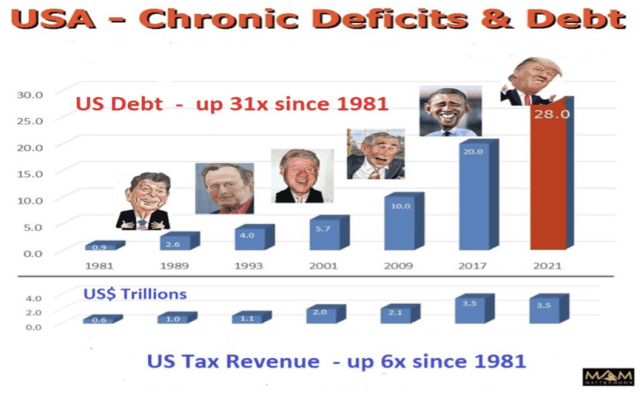

On that note, expect a spat of overtly pessimistic economic data to be unleashed in the coming weeks. The Obama Administration took accounting gimmicks to levels beyond anything Clinton or W. Bush ever aspired to. The coming months will unravel the narrative of a recovery as the bean-counter wonks revise their models and political pressure is inevitably reduced.

We fully expect to see the data plunge to emerge shortly, with the US to announce towards the end of the first quarter next year that “recovery recession” began in the second half of this year.

So, add that little tidbit to this below and we are sure you’ll agree the chances of a US recession are much more likely than that which is currently being “priced in” right now.

We can also predict how Trump will work his way through this. Spending. So long debt ceiling, hello Trumpeconomics!!!

We’ve all heard the “Make America Great Again” mantra; he has repeatedly emphasised returning the US to growth (where’d it go??) and, importantly, insisted that inflation is the only way to deal with the massive public and private debt mountains.

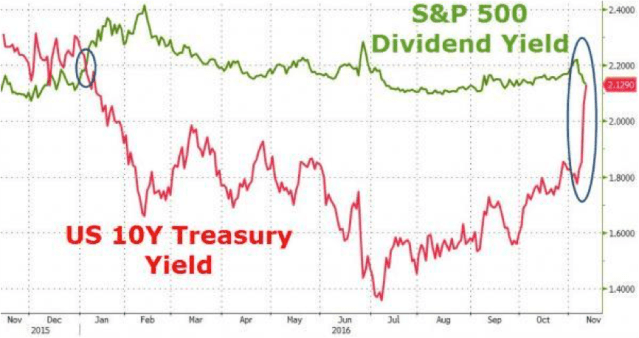

The Economy has smelled this early. This brings us to a slightly more complicated but no less important market: bonds.

Inflation expectations erupted higher last week, with bonds sold off noticeably aggressively (yet more evidence of a coming inflationary spike). Indeed, global bond investors lost $1 trillion last Thursday!

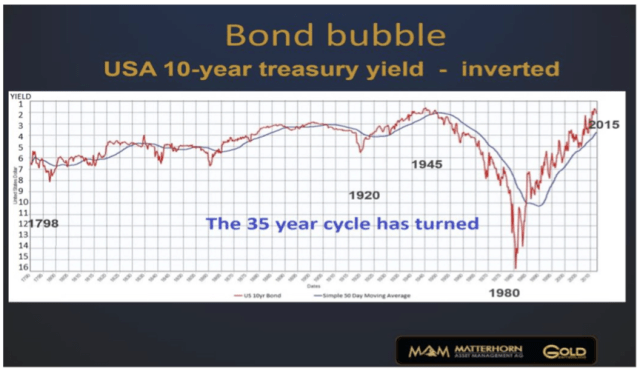

Remember, the bond bubble is THE issue to be concerned with: the largest bubble in the history of bubbles. Even Bank of America warned last week that there “has been a violent rotation in the structure of the bond market over the last couple of weeks, with powerful implications”.

This is the simple way of looking at it.

For a more complex, long term view, see below. As we often ask ourselves, “can an over indebted Financial System really handle higher rates?”. The answer inevitably seems to lie in the limits of printing more money, of which there appears to be none.

Finally, to the gold structure.

At least we have this to say about gold: in order to set a long term position at a fire sale price, ignore the temporary volatility and be thankful of this money market madness.

The scale of ridiculousness of the 6800 tonnes of swap/future/paper contracts traded in the wake of last week’s election result cannot be underestimated for a couple of reasons:

Firstly, it represents the use of momentum to rinse out speculative longs, and its replacement by the safer hands of the commercials, Bullion banks in particular. A complete flush out reversal.

Secondly, wholesale traders in Europe are reporting a massive build up of physical orders (Sovereigns are always slower to react).

Smart money is lining up to buy the useless metal whilst paper speculators had their shirts removed last week.

We won’t bore you with any more charts on this matter, save for this last one below. Enjoy.

Recent Comments