“Negative repercussions are becoming overwhelming”, was the cry from Deutsche Bank to the ECB this week. It came in response to the latter’s monetary policy of Bond market domination and negative interest rates.

Broader Sovereign and Corporate Bond Markets certainly agree. Rates are indeed rallying strongly. At a time where longer duration liquidity is tight and the ECB is backing off, it’s QE as a result of “Negative Repercussions”

There has been a tectonic shift in recent weeks: Bond markets, in positioning themselves for the long awaited 2016 US interest rate hike, may have in fact already done the Fed’s work for it.

Therefore, we remain in the “one and done” camp for the Fed’s next move. Let’s not forget that this time last year the Fed was promising 3 to 4 rate hikes. But enough on this boring topic.

In all seriousness, matters such as those briefly mentioned above are just sideshows at the moment.

We’re sure you remember being promised armageddon, fire and brimstone if Brexit got up in the weeks leading up to the vote. Well, right now we’re being assured by mainstream media of another complete apocalypse in the “unlikely” event of a Trump win.

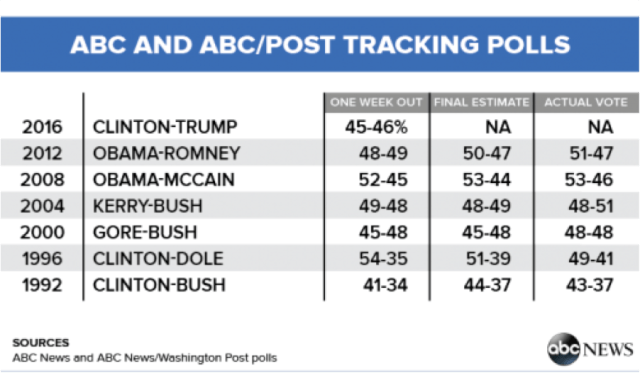

As we know all too well, the polls and bookies got Brexit wrong. Let’s have a quick look at some historical context around US Presidential election polls.

We admit to a bout of writers block since the US election race rally started to heat up. Though the race itself has been rather difficult to ignore (given the near constant updates on news and social media), we thought we’d just stay out of it and wait for the gasps when people realise how close Trump will get and why.

It may be an obvious thing to state that the polarisation of views on the personal aspects of the candidates arise solely from the source of peoples news: Views formed by news or, regrettably, in the case of more than half of the population, a lack of it.

The truly fascinating element about what’s happening here (and we mean here, right now), and the element that may in fact decide the outcome, is the pace at which the general public are finding new sources of information. Once their eyes are opened there seems to be no stopping this domino effect of mass media.

We’ve found more recently a fast growing understanding as to why this election is going to be much closer than people think.

This is all happening DESPITE virtually all mainstream media in the Western world (especially Australia) shamelessly open in support for the incumbent administration.

It’s so conspicuously obvious it really is embarrassing.

What the hell has happened to journalism? At least in this regard we have good news. There is actually (believe it or not) some fantastically informative and unbiased reporting going on, but good luck finding it anywhere mainstream. You have to look for it.

So, for those who haven’t yet found their objective and informative news source, and are having trouble understanding who would vote for a buffoon like Trump and why, here’s a clue: it’s not really about him.

It’s about protest and change, and it is happening.

Voters in the US realise there is no recovery: there is only a bailout of the financial system for the benefit of those with the most to lose, namely the wealthy and the institutions/politicians they lead.

The problem now is there are more people with less to lose, and it’s gotten to the point where they might actually turn off the Kardashians, roll themselves over, and switch tabs to a voting centre. We’ll know in a week.

In the meantime, the AFR reports today, “ASX sees red on Trump”! We’d like to humbly suggest that the ASX is seeing red for a lot more reasons than that.

In fact, we were quite interested today to notice the All Ords close in a startlingly similar position to where it closed exactly10 years ago. Didn’t see that coming.

All Ords 10yr chart to today:

Now, to the inflation front: Last night, one of the worlds best known Hedge Fund Managers, Paul Singer from Elliott Management, joined other prolifics (including Bridgewater’s Ray Dalio) in expressing serious concern that inflation may be closer at hand than we think. We have little doubt that the last 6 months of strong commodity prices will show up somewhere soon. (We also know the central Bank of Aurum has been experiencing large increases in costs for many years).

“that a rapid inflation increase is the $30 billion hedge fund’s biggest concern in the current environment, and that such a spike would not only collapse bond prices, but potentially lead to a stock market crash.

“This may seem like a strange thing to worry about under the current circumstances, but the tide toward inflation could turn rather abruptly,” wrote the money managers in their Q3 letter dated Oct. 28. “If inflation starts accelerating to an annual rate of high single digits or greater, it will be quite difficult for the mix of strategies that Elliott favors to ‘keep up.'”

Singer’s biggest recurring fear is certainly this: the artificial market created by central bankers over the past 7 years will undergo rapid “renormalization.” Lingering over Elliott’s portfolio management is the persistent fear that central bankers (who collectively cut interest rates 673 times since the financial crisis) have so upended the natural price levels of stocks, bonds and many other assets, “that the economy and markets are operating in denial of reality.”

Paraphrasing from the latest Greenlight letter, sent on the same day, in which David Einhorn said that “we have central bankers who are determined to see flashing lights that aren’t there…. we are more than seven years into an economic recovery, yet central bankers behave as if we’re still in crisis”. Elliott writes that “every sniffle is being treated by central banks as acute respiratory distress syndrome worthy of ‘code-blues’ and teams of frantic pumpers and fixers… what this policy landscape has engendered is a widespread belief, or at least a strong suspicion, that stock and bond prices won’t ever be allowed to go down in any meaningful way.”

Such a mentality, according to Singer, “has encouraged massively risky behavior.”

Singer also touched on one of his long-running favorite investments, gold, and noted that its flat performance during the third quarter, and the move down in response to the increasing belief that the Fed will soon rate interest rates, seemed puzzling: “Given the market gyrations that have accompanied each of the Fed’s previous attempts at hiking policy rates over the last few years, now would seem to be an inopportune time to abandon the only actual safe haven that investors may reach for as an alternative to the really bad deal offered by fixed income instruments given current pricing.”

Looks like Mr Elliott is still buying that useless yellow metal.

Recent Comments