Do you ever wonder why global monetary settings are still in crisis mode, despite the apparent “recovery”? If things are going so swimmingly, why is it that we cannot have a rate rise, anywhere.

The answer is leverage and collateral: too much of one and not enough of the other.

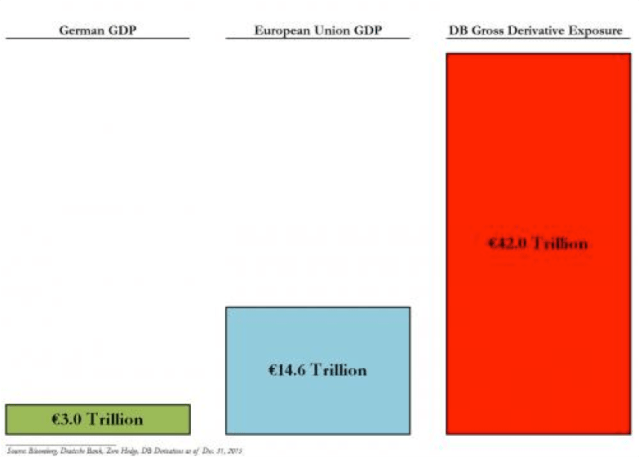

These days the style of leverage can vary. There is no shortage of Australians backing up their income to maximise leverage into property, and this type is relatively easy to understand. However, the kind of leverage Europe’s largest Investment Bank Deutsche Bank (DB) has is a completely different beast. It’s the kind that when you look at the chart below in amazement you’ll wonder just how exactly our fractional reserve banking system came to be so completely abused.

Ironically, 60-70% of the world’s derivative pile is in swaps, designed to assist Financial Players to “manage risk”. Hilarious.

We’ve shown this chart below many times over the last few years and the “smartest banking guys in the room” will often ridicule the unwashed with lengthy explanations of low to negligible “counterparty risk” because “It all nets out and I know this cause I’m smarter than you and my CEO told me so”.

All the swaps, all the CDS’s, Prime Broker lending and, potentially, any product requiring a market maker. ETF for breakie anyone?

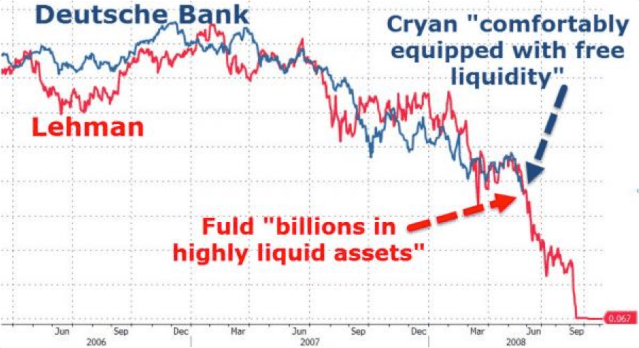

Financial markets were alight this morning with news of many large Hedge Fund managers starting to move their accounts across to other clearing providers and prime lenders as pressure mounts on Deutsche.

Pressure has been building for months around Deutsche, culminating this week with the CEO proclaiming that the Bank is “comfortably equipped with free liquidity”.

Heard that before…

It seems unfair for DB to be singled out for a multi billion dollar securities “fine” from US regulators for GFC related transgressions when it could have been any one of 5 or 6 large global banks, but this was happening anyway.

And let’s face it, it’s unlikely the German Government will wait long to rescue DB, (despite assurances they wouldn’t) once they realise it all starts to not net out, things are going to get pretty heated.

The biggest problem with any bail out is the precedence it sets for other shaky Euro Banks, and there are plenty to go around. For now, negative interest rates and €80billlion a month of QE support keep the fleet afloat, but even that may not be enough.

It will be very interesting to see how the Euroland keep this together, for example, what the Germans may be able to do the Spanish and Italians may not. We don’t know how this plays out and its probably nothing a new round of multi trillion dollar QE money printing can’t fix but we’re getting closer to finding out.

Our point here is not to say “we told you so” when it doesn’t all net, our point is born out of frustration of a lack of reform since the GFC, and the difficulties this produces when trying to help investors sensibly allocate their investment funds.

Reform will mean big losses to those with shitty collateral, and because the leverage is so large and difficult to understand, these losses, at this point, are incalculable.

We remain vigilant with this background and welcome queries on asset allocation protection strategies.

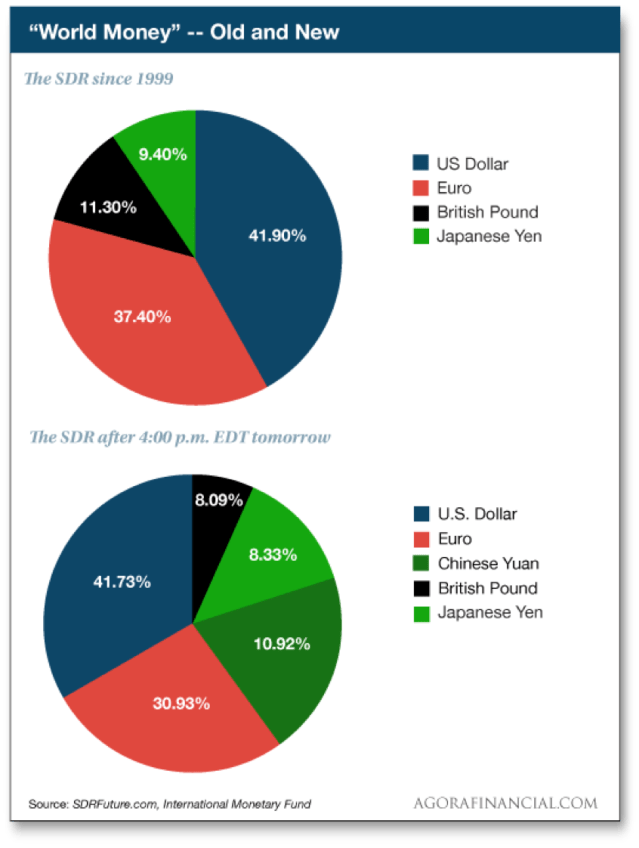

To finish we couldn’t let the last 2 charts go to waste. Tomorrow is an historic day. It’s the day the Chinese Yuan gets to officially join the IMF’s SDR basket. More on this next week.

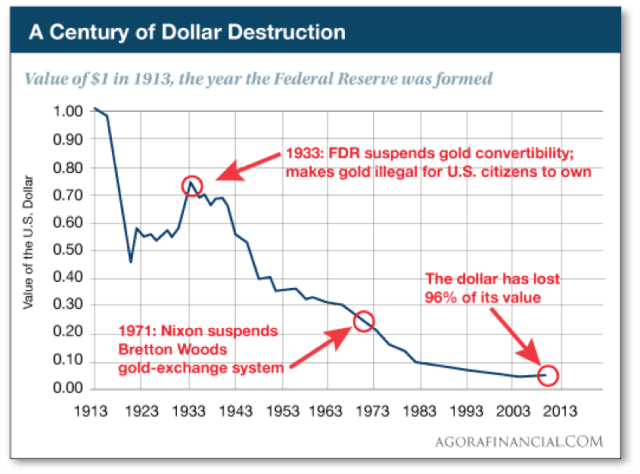

And just making sure you all understand why a little bullion in your portfolio is a sensible long run allocation. Nobody’s liability.

Recent Comments