It’s official. A large number of investors have been trapped into thinking the financial future will be a repetition of the past.

We understand their conviction. US stock markets are at all-time highs. Government bonds are at or near all-time highs. However, central banks worldwide remain at 0% interest rates or less because the situation is too precarious to even raise rates a paltry 0.25% for fear of collapsing the entire system.

And as for that 1999 party thing, what else could summarise the current state of flux better, with all 3 major US equity indexes hitting new all time highs for the first time since 1999 last week! Party on.

Australia’s Central bank, the RBA, joined the party just a few weeks ago to celebrate the worst global recovery in living memory, with a 0.25% cut to 1.5%. This essentially gives anyone without too much debt and a heartbeat to go on the green light to go out get some more. Imagine how much you’ll be able to borrow at 0%. For poor diligent savers, this was the largest cut this cycle!!

That damn “stubbornly low inflation” was again deemed the main culprit, even though we are yet to find a retiree who will tell you their expenses haven’t risen considerably faster than official inflation numbers over the last few years.

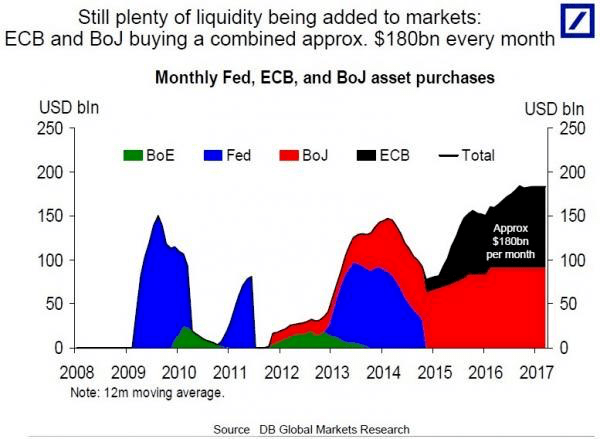

Perhaps the reason to worry less in Australia is because of all the “dry powder” we have. The RBA isn’t yet buying sovereign/corporate bonds to keep the illusion of low and stable rates intact, as the ECB does in Europe and BOJ in Japan, nor does it appear in the top 5 shareholders of most large ASX listed companies, as the BOJ does in Japan.

As these policies continue, in conjunction with the promise of further stimulus “bazookas” from the central banks of Japan/England/EU/… the world, added to the “better than expected” job numbers from a stagnant US economy and its full steam ahead for markets!!

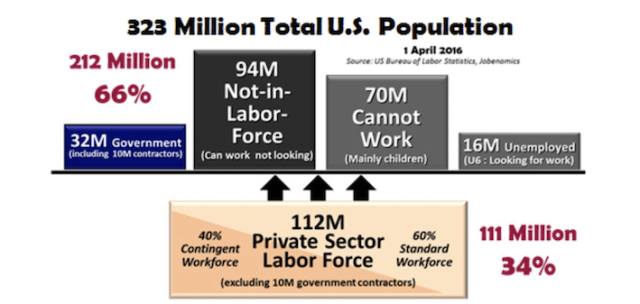

And how about those US numbers?

The fact that US job numbers are still steadily improving with a back drop of slowing GDP and falling corporate profits is fantastic. It’s exactly what was required for the second round of rate rises in the US, promised for the last 2 years and will surely not be forthcoming (unless Trump gets in) this year for fear of tanking the “recovery”!

For anyone who’s been hiding under a comfortable rock the past year, this is the recovery that has 95 million people not in the workforce, 50 million on food stamps and Q2 GDP at 1.2%! Yes, that’s some recovery. No wonder the protest votes grow.

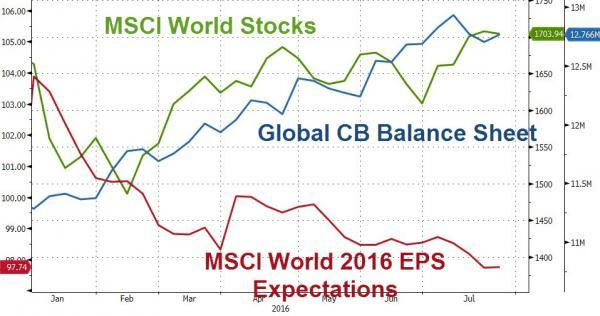

We’ll not go too much into the US except to remind you that central bank policies are pushing more and more money into higher risk assets, regardless of price. The Schiller P/E (price to earnings ratio for shares) is now at 27x, compared to a long-term average of 16x, and rising.

Like we said, valuations seem a little stretched.

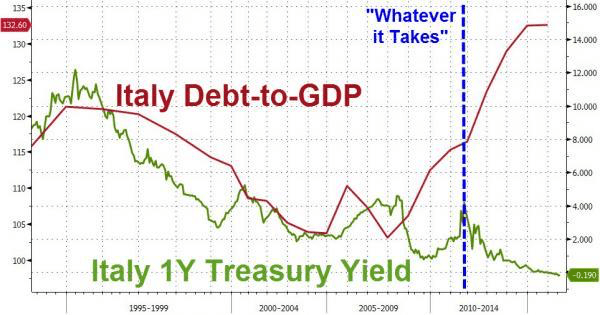

This chart speaks for itself. Love to see how this looks in France.

Hard to ignore this one.

As far as Australia goes, we may well require a little more than “dry powder” when the weakest link fails in this global financial daisy chain.

Remember the first Greek crisis of 2010 (the first Greek one of this decade, history shows Greek expertise in fiscal crisis!) when we absolutely said that there would be no way that Greece would be allowed to leave the Euro as it would lead to a massive debt “right off”? This was as opposed to “mark to maturity eternity” on the balance sheets of European banks and that the balance sheets of these “massive” banks could not handle this truth!!! Ha, well, where are we now? Italy, Spain, Portugal…who the f cares? We hope you realise that Central banks will continue to double down on this policy as change and reform of “the system” simply cannot be allowed.

It’s rather ironic that an analyst from Germany’s largest bank stated last week, ” without an external economic shock it is hard to see policymakers being prepared to take dramatic, fiscal action to jumpstart the global economy and bounce it out of a financial repression defined by low and falling real yields to one that at least initially is defined by rising nominal yields through higher inflation expectations. Ironically the shock that is needed would require a collapse in risk assets for policymakers to then really panic and attempt dramatic fiscal stimulus.”

Take the banking “stress test” in Europe last week. After Friday’s close, the European Banking Authority did what it does every other year: it releases the results of what it calls ‘the stress test”, which is simply an exercise in boosting confidence.

In 2016 it did not even test for Europe’s two biggest threats, negative interest rates or “Brexit”. Laughably, it also did not test any banks from Greece or Portugal, knowing full well what the results would be. However, in order to retain some credibility, the same test that passed several “failed” institutions such as Dexia, Bankia and Novo Branco had to fail one bank.

This dubious honour fell to Monte Paschi, the oldest bank in Italy. Amazing that Santander and DB get a “pass”. Remarkable for a country (Italy) whose non-performing loans actually equal the GDP!!!

It’s like we said earlier: if you’re paying too much interest you need more debt, according to the system as it is. In the case of Italy and Spain, this is especially poignant: The more debt they have (and the harder it is to pay), the lower the rate goes. Um, can we have some of that???

We’re going to need a bigger stress test!!

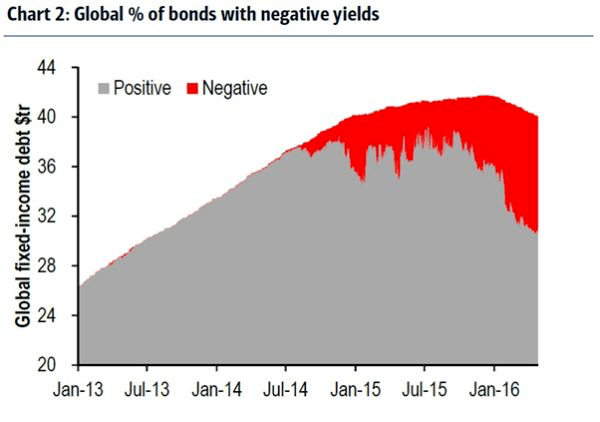

This is what €80billion of QE PER MONTH gets you.

Source:Zerohedge

Best…stock market…ever. US P/E 27 v Average of 16…what could possibly go wrong?

Now, let’s talk about gold.

We thought we might conclude with an excerpt from last week’s FT, normally a bastion of status quo support, attempting to balance the argument around PMs.

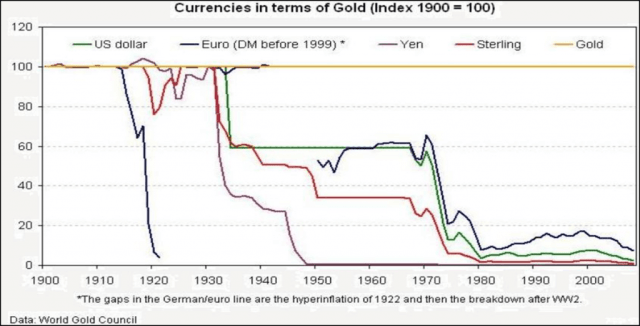

“Gold prices have rallied more than 30% since the lift-off in US interest rates in December. A sharp reversal in pricing, sentiment and positioning driven by a myriad macro and micro factors has left the gold bears and bulls as polarised as ever.

The bearish camp, which has featured prominent and respected analysts like Goldman Sachs, tends to have a constructive view on the US dollar, the ability to raise interest rates, normalise global monetary policy, and generally a benign view on the global economy and inflationary risks.

The bullish camp, which I subscribe to, tends to have a more pessimistic view on the global economy and the unintended consequences of monetary policy without limits, and sees the recent price action as the beginning of a multiyear bull run in gold.

My view that there is a perfect storm for gold is based on three closely interrelated dynamics, whereby central banks and global markets are both testing the limits of monetary policy and credit markets as well as the boundaries of fiat currencies.”

It concludes:

“Time will tell if central banks and governments will be able to engineer a smooth solution to the challenges ahead, or if the remedy will be worse than the disease.

Monetary policy without limits will lead to a very wild and bumpy ride and a larger crisis than the one we have been trying to resolve: a perfect storm for gold.”

Reform will take place. How will you be positioned when it does?

Recent Comments