Thank goodness for this bloke, making the long trip in his chopper to Japan to show them how to get things going, really, he was in Tokyo for meetings with Kuroda-san this week.

Not directly connected to the above, for those with a bit more time, we hope you take the time to read Marc Faber’s July commentary, attached.

We were pleased to get Marc’s permission to share this months work.

Many people falsely criticise Marc as being a “perma-bear” but if one has, as we have, followed his work for many years, it can be seen that Marc may be as equally bullish on stocks and property as he has been in gold, cash, and bonds in the past.

To his reader’s enjoyment, Marc has been inclined to share some interesting philosophical views on leadership and management from time to time.

We hope you enjoy.

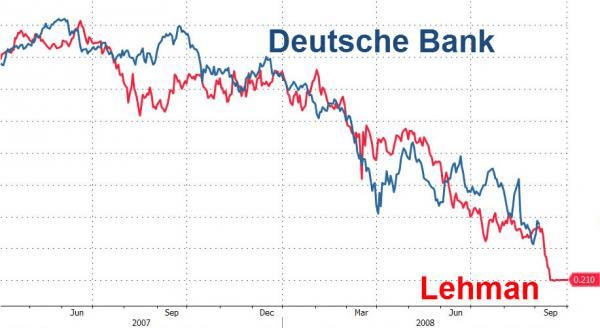

PS- This is not a problem yet.

Recent Comments