Let’s keep notes short and easy to read this weekend, shall we? Monday will reveal much.

Volatility is back!

Somewhere in the past three years (arguably earlier!) to the left of Lehman above was the start of the GFC. “Peak GFC” really started to heat up on March 16th 2008 with the purchase of Bear Stearns for $2 a share by JP Morgan to avoid a fire sale of the unsaleable. Lehman ultimately filed on September 15th, 2009.

We’re not saying that the bodies won’t start floating to the surface on Monday as a result of this SD sigma six derivative black swan mess. Like we said, having a little more time to deal with said mess is a best case scenario come Monday.

There is every chance that many important “counter-parties” were completely blown up yesterday and will not be able to perform on Monday. Especially as MASSIVE CARRY TRADES run on very thin margins. Again, is central bank support going to be enough?

Remember, Britain leaving the EU over the next 2 years is not the real story of the short term- it’s systemic survival. Longer out than the short term is the survival of the Euro project itself. The project looks horrible without the world’s 5th biggest economy. We’ll have plenty of time to ponder this.

For now, the real news is how this “surprise” event, the sigma 6 derivative mess surprise event, will test an over-levered financial system and the story of how the Financial tail has been wagging the real economy dog, for…..well, for too long now!!

Can god-like Central Bankers continue to hold back the tide or will it continue to recede at pace, revealing who is swimming naked, naked of collateral? After all, last time we had something like this on our doorstep it was actually the scramble for collateral that left Lehman out to dry (and perhaps even their failure to participate in Bear Stearns?).

We were actually quite disappointed we didn’t get the Bernanke style “sub prime is contained” statement from one of these central bankers yesterday. We did, however, get a feeble “we are well prepared for this” from BOE central master Mark Carney! Awesome. Good for you Mark, can’t wait to see how that turns out.

It was also interesting to the receive all the teleconference Brexit update invitations from domestic institutions yesterday afternoon. The usual suspects, Colonial First State, BlackRock, Perpetual………didn’t bother to log in but we can just imagine the “stay calm and sit tight” message being trotted out.

Stay calm? Sounds a bit like the Japanese Finance minister, who called a press conference yesterday afternoon encouraging the public “not to panic”!! Funny shit from the sub-chief of the incredible failure of an economic experiment known as Abenomics. Don’t know about you but when a finance minister appears on screen to ask you not to panic you know for sure that you should be!!

This is not to say one shouldn’t sit tight. Maybe markets do not even open on Monday and you have no choice but we doubt this. It’s more than likely you’ll be sold the “business as usual” and “trading is orderly”, rhetoric, until it’s not.

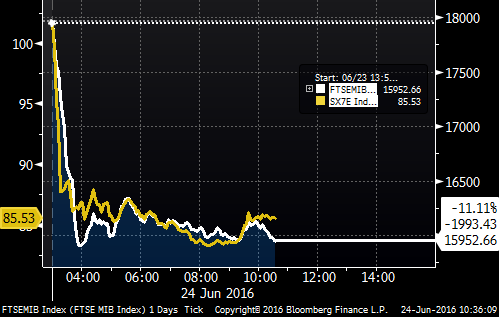

We know EU banks did not get off the floor, and EU equities only did by a bare margin.

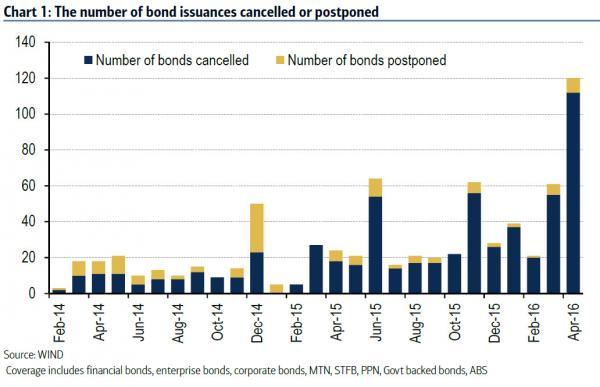

Obscured from the mess of Brexit yesterday was the release of the record-breaking bankruptcy notices from China!!

Thus, we have this:

Now, GOLD.

Although this “asset” has shone this year for a multitude of reasons, whilst this levered derivative global bucket shop gambling den allows this leverage to set prices, gold could well be in for a decent deflationary correction, as a result of this shitstorm.

Take some money off the table for the short term if this worries you but this financial system’s days are numbered, and shortening. Even “Motley Fool” investors should see this by now.

Peace!

Recent Comments