With so much going on in the world economy at the moment we thought that today we’d let some pictures tell a tale or two, followed by a little update on the latest measures our Central Bank leaders have cooked up at their Spinal Tap 11, School of Economics.

It looks like a Brexit would create the need for a new brew, as would Trumponomics and, whilst we’re at it, whatever happened to Greece, Spain, Portugal, and Italy? Are they ok? Does that €80BILLION a month potion have them sedated, for now?

The first picture is a classic but we’re not sure if said life boat would be too seaworthy with a few English soccer fans at the helm.

Brexit (odds still saying remain)

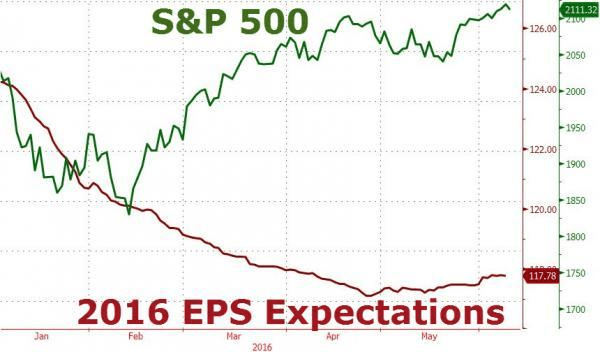

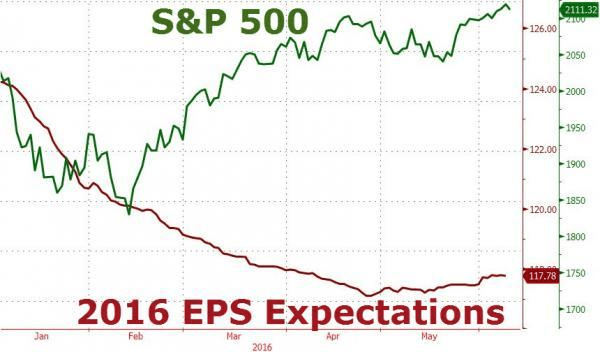

Some More Recovery

You’ve just gotta laugh at this chart

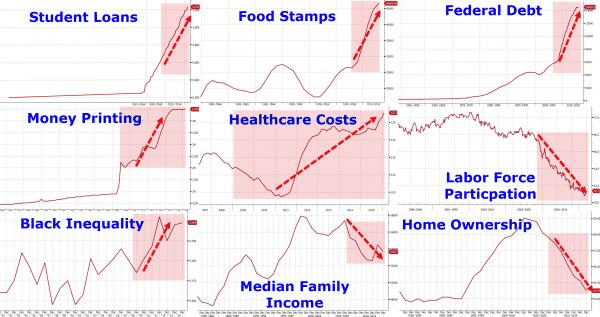

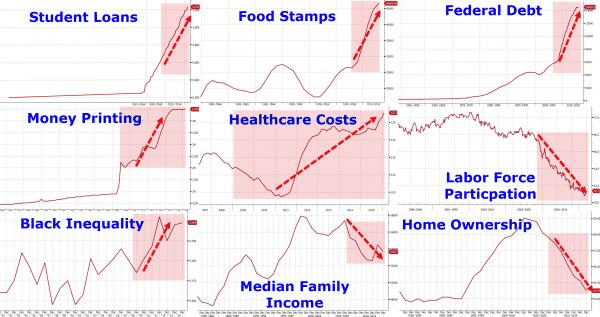

Obama “Success”

Source: Bloomberg/Zerohedge

Collateral Damage?

France

Hillary

Yellen

Draghi

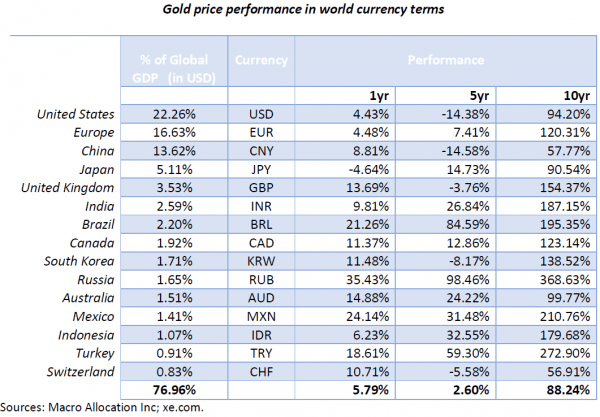

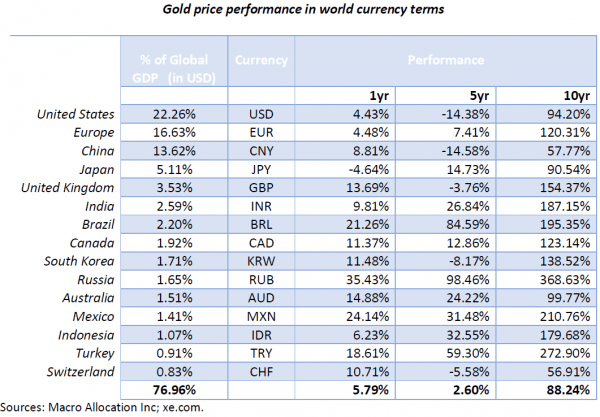

Gold

How’s that recovery then? It seems all markets, including a rising gold price, don’t seem to be buying what central banks are selling at the moment.

From US job numbers to World Bank global GDP downgrade this week, to inevitable social unrest, could it be there is a crisis of credibility in central bank status quo options?

There was really no turning back when Hank Paulson had Wall St bailed out by Congress so his former employer, Goldman Sachs, could get paid on the short derivative “protection” positions purchased from a blown up AIG.

As central banks move into the final stages of this experiment in monetary “twighlightzoneconomics”, let’s have a look at where we’re at.

Europe: ECB (European Central Bank) via “super” Mario Draghi announces that in addition to the recently increased from €60 to €80 BILLION PER MONTH QE it will begin purchases of “certain” corporate debt. Yep, you heard right. Gov buying a company’s debt. Straight up! This really moves them into the final stages now, which brings us to their next step when this inevitably fails- to buy shares, which Japan already does, so onto Japan.

Japan: BOJ unashamedly a massive stock market participant and there is virtually no Sovereign Bond market left in Japan, its all the BOJ. So distorted and problematic this is that one of the nation’s biggest banks, Bank of Tokyo-Mitsubishi UFJ, announced it will quit as one of 22 primary dealers buying the nation’s debt. Japan leads the world in QE4EVA. The next “massive stimulus” package can’t be far away and neither will it be a long wait to see how global markets react to Japan’s complete monetisation, and eventual forgiveness, of the nation’s debt as the load is too large to carry.

US: Two years of “we’re going to raise rates because everything is so awesome” has turned to, “everything might be a bit shittier than we were letting on so maybe no more rate rises and can we have some MOAR QE please”.

China: WOW. Continued, uncontrolled Credit Expansion. Sure to end well in a weakening global economy.

As an investor, if you think this background is not a serious matter, you’re mistaken. And this is a mistake that may prove costly.

We’re not sure how much time you’ll have to get your investment house in order except to say that things are speeding up.

As always, the lines and door are always open to discuss risk mitigation strategies further.

Recent Comments