And last night, there we have it. One rate hike and boom- done. We called it months ago. That’s how it goes when nothing else works. Sublime to absurd.

It’s taken some time to get a feel for global financial market reaction to the inclusion of Japan and the deepening of Europe’s commitment to Negative Interest Rate Policy (NIRP). Can you even remember when Zero Interest Rate Policy (ZIRP) was questionable? So yesterday.

The biggest surprise to us about NIRP is the great “YAWN” (not an acronym but suggestions welcome) that it has been so far. Status quo maintained? Check. No system blow up? Check. We must be on the right path then, right?

One talks to people on the street about NIRP and it’s like, “negative interest rates”? “Hope that never happens to me, you mean they charge you to deposit money”?

We’re like, “yeah, and you probably didn’t realise it’s not your money anyway, unsecured creditor, arrrrhh, never mind, you might realise one day”.

But back to the NIRP yawn because this is very interesting for the next few years. As ridiculous as the situation is relative to any form of nature-based economics, the system has not yet blown up, has it?

There you go! If maintaining status quo was the only objective, the last 7 years and 21 trillion(approx) of stimulus has been a raging success.

But is everything as it seems? We don’t know so we thought we’d present some mainstream reporting as food for thought. Italics are our brief notes.

Here’s some well laid out policies that Central Planners would very much like you to believe in, if you please. (h/t Grant Williams, Ben Hunt):

- The US economy is strengthening thanks to the stimulus efforts of those in charge. There has been enough written on this massive economy in decline.

- There are no currency wars. Hmm, could’ve fooled us. We’ll see how history judges the “negative interest rate race”. Gold has always loved a good paper race to the bottom. Cheap currency = sell more shit.

- Brexit would be a disaster for Britain. Who are they kidding? The disaster would be for all EU beaurocratic parasites, who’s existence they owe to the extra layer of “governance”. Bureaucrats of Greece all still getting paid! Job done.

- China will manage a soft landing. This one is possible, should they take the Japan route. Unsustainable but possible, until it breaks.

- Abenomics is working. LOL. This was the best. An unmitigated disaster if benchmarked against how they sold these reckless policies to the electorate. Success, if hanging on to status quo by a fingernail is measured.

- Negative Interest Rates do not do any damage. Yeah, probably right here, unless you’re a saver or pension investor, globally, that was expecting some rate of return more than zero for the many years spent sacrificing and saving, other than that, awesome.

- Eliminating high denomination notes and severely restricting cash transaction will crush terrorism. Really think about this in relation to the point above. What would be your first reaction if a bank was going to charge you 1% on your cash? Now do you understand?

- Banning cash will be a great thing for society. If you read this and don’t understand what this means, you get what you deserve.

- Gold is a barbarous relic. Oh, please sir, may I have another promise note, a claim on a cell in a spreadsheet, anything that’s going to up and not down? Sure, they say, plenty more where this came from!!

Make no mistake about how this is going to work from here. Governments will continue to rack up deficits, financially repressive economic policy will prevail and we could very well be sitting here in 5 years time with a SNAFU (situation normal) sniffle, wondering what is next.

The reason we say 5 years is that’s about how much further down this Keynesian/Krugman economic wormhole Japan is, relative to the EU, US and (god forbid), the lucky country, Australia.

So. You’ve got some time to get your ducks in a row. Should property, stocks, and cash continue on the current trajectory, how are you going to make money and protect your assets moving forward?

We will be pleased to scour our investment universe for such assets to bring to you. One must look far and wide, but more importantly, it’s about managing what is in front of you well. We look for great investment from wherever they may come. Not just ASX listed businesses capable of growth and income in the aforementioned environment but also commercial land, agricultural land, growing tech companies, precious metal producers, and fund managers who are a little better at this than we.

In the meantime please find below some charts we’ve found of interest recently.

Presenting the US Federal Reserve Chairwoman, Janet Yellen. She may be next in line to tell you with these faces that NIRP and helicopter money is ok.

Recently she was asked the following question from a CNBC “journalist’ at her press conference.

Does the Fed have a credibility problem in the sense that it says it will do one thing under certain conditions, but doesn’t end up doing it? And then, frankly, if the current conditions are not sufficient for the Fed to raise rates, well, what would those conditions ever look like?

The 261-word gem of response went like this:

“Well, let me start — let me start with the question of the Fed’s credibility. And you used the word “promises” in connection with that. And as I tried to emphasize in my opening statement, the paths that the participants project for the federal funds rate and how it will evolve are not a pre-set plan or commitment or promise of the committee. Indeed, they are not even — the median should not be interpreted as a committee-endorsed forecast. And there’s a lot of uncertainty around each participant’s projection. And they will evolve. Those assessments of appropriate policy are completely contingent on each participant’s forecasts of the economy and how economic events will unfold. And they are, of course, uncertain. And you should fully expect that forecasts for the appropriate path of policy on the part of all participants will evolve over time as shocks, positive or negative, hit the economy that alter those forecasts. So, you have seen a shift this time in most participants’ assessments of the appropriate path for policy. And as I tried to indicate, I think that largely reflects a somewhat slower projected path for global growth — for growth in the global economy outside the United States, and for some tightening in credit conditions in the form of an increase in spreads. And those changes in financial conditions and in the path of the global economy have induced changes in the assessment of individual participants in what path is appropriate to achieve our objectives. So that’s what you see — that’s what you see now.”

There, you got that??

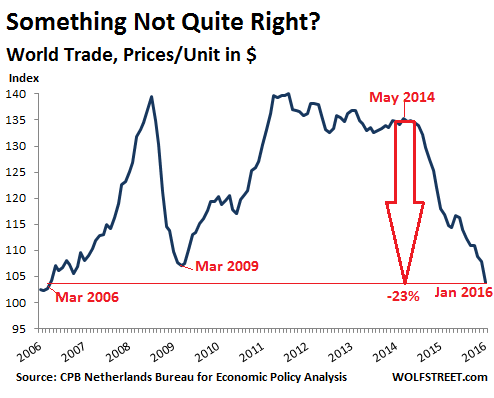

In the short term, something may be amiss here.

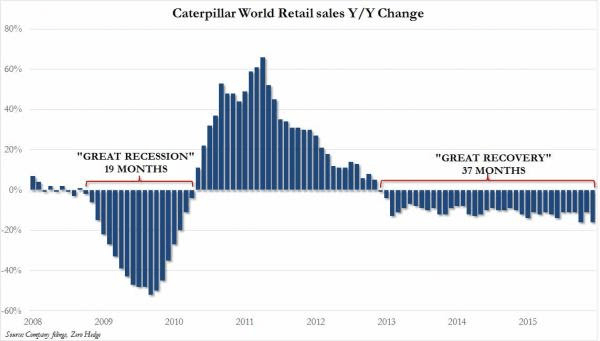

We could never leave out Cat’s take on the “Global Recovery”.

And below, just too many ships?

Recent Comments