No need to touch on the touchy failing financial system in which printing money is the answer to a common cold and Negative Interest Rates are no longer part of twilight zone economics. No, we’ll look at something a little closer to home and promise not to threaten Australian house prices will go down, ever, again.

We were so close to topping up/buying BHP around the time of their half-year results on the 23rd of Feb, on the back of what we thought might be the savaging of the share price might get if they cut their dividend by more than the market expected to protect the business from a credit downgrade.

As it happened, BHP did reduce the divi by more than anticipated and the share price closed slightly up at $17.63 on the day. Since then it traded as low as $15.60, had its credit rating downgraded, and closed today at $18.21. Investors are asking, is this a short squeeze or is a bottom in place?

Unfortunately, BHP has not been back to test the low $15’s, yet. The recent rising prices of energy, iron ore and the threat of China returning massive stimulus to halt it’s sliding economy has held the BHP share price up.

Right now, to consider buying/topping up a high quality/low-cost miner like BHP, RIO or even South32 requires some assessment to the question of whether or not we’ve seen a “bottom” in the related commodities.

Many financial commentators are suggesting we have after a great day yesterday.

Speaking of yesterday. What actually happened? Those who bought in late on the back of this below got a bit hurt today.

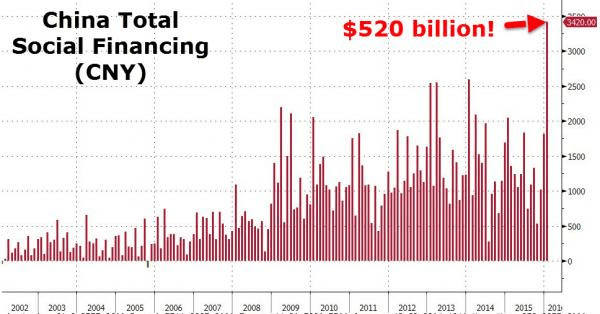

It’s worth remembering what the Chinese did in the first month of this calendar year, as represented below. Massive credit injection. That’s half of the USA’s QE3, IN ONE MONTH!!!

Could the recent price surges come on the back of such a massive QE type surge? It’s hard to say.

Our guess is, anyone believing a bottom is in for an oversupplied energy and materials sector (accompanied with falling Global GDP growth) without the associated large-scale write-downs (BHP excepted, they one of the few to have done so), leading to huge collateral/margin calls and associated banking credit pressure is taking a big risk…

Waiting for this type of capitulation is a risky game too. Lots of FOMO.

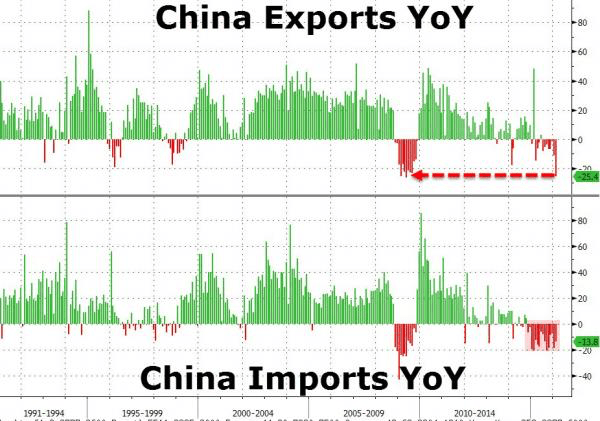

Also released today was Chinese trade data. Worse than expected may be an understatement. Exports crashed 25.4% YOY (4th largest ever) and imports 13.1%, the 13th month of decline in a row.

Source:Bloomberg/Zerohedge

Back to BHP. It’s important to remember BHP is now an Energy and Iron Ore company. By revenue, including Coal, about 35% energy and 30% Iron Ore.

And as far as global energy goes, as clearly laid out by no less than finance ministers of Saudi Arabia, UAE, and now Kuwait in response to Iran’s lack of response, things have not bottomed and they won’t be cutting production any time soon. We doubt the Russians will either. Why should they be the ones to curtail production?

That will leave the heavy lifting/cutting to the higher cost producers, as it should. A race to the bottom, bankruptcy’s loom for whom? It’s not hard to tell.

We’re obviously not suggesting a BHP bankruptcy but the same cannot be said for some large, high-cost competitors.

So no, until we see proper evidence of capitulation we’ll refrain from chasing this short squeeze up.

Recent Comments