Loved this headline above from Bloomberg to summarise the Asia trading session today.

Does this mean we’re back to bad news is good and the more bad news we get the better for stocks because central banks will continue to goose stock and bond markets in order to prolong any day of reckoning?

Well, for now, it appears so. Relief for investors, “they’ll never let it happen”. What’s the “it”? We’re sure that a 10% fall in stocks didn’t use to be a problem. That was then and this is now.

Before we move on to share some information on this “ recovery” we find it difficult to believe that the seriousness of a NATO member, Turkey, along with its Saudi partner sending troops into Syria is not more widely reported.

Fortunately, it appears that Russia (and Iran…and Israel) is aware (they’re actually legally in Syria) of the consequences of retaliation and, for now, will not bite at the bait. At all stages they understand it is best to refuse the invitation to war from US allies but have indicated strongly that if pushed too far it will not be Istanbul that gets a “nuke” for breakfast but some smug politicos in DC, etc….

Back to econs and investment matters. Ok, so we had a slight hic-up around the most recent Japan stimulus failure but that’s all in the past as of today too, as the title of this missive suggests.

Just to put some colour on the latest Japanese attempt to do their part it might be easier to timeline it.

Timeline of Bank of Japan’s Kuroda-san (BOJ Governor) Negative Interest Policy Move (NIRP).

- Jan 21st. Kuroda-San states to market there will be no negative interest rates in Japan.

- Jan 22nd. Finance Minister, Amari-San, the famed designer of Abenomics, resigns on bribery allegations.

- Kuroda-San goes to Swiss economic snow love inn, Davos, to mix with World Leading (Keynesian, there are no others anymore) Economists.

- Jan 29/30th.Returns from Davos with a Negative Interest Rate policy and the promise of more to come.

- Jan 30th. Japanese stocks rise, Yen falls. Success for Kuroda.

- Feb 1 (first business day after the 29th) to 14th. Yen goes ballistic (NIRP meant to send currency down) stock market craters. Complete failure for Kuroda.

- BOJ threatens more of this failed policy until it works.

This takes us back to Kuroda-San’s comments from a conference (BOJ sponsored) in Tokyo from April last year.

I trust that many of you are familiar with the story of Peter Pan, in which it says, “the moment you doubt whether you can fly, you cease forever to be able to do it.” Yes, what we need is a positive attitude and conviction.

This honest summary best describes the efforts of central banks better than just about anything we’ve read in recent times. (EU’s Jean-Claude Junker’s, “when things get serious you have to lie”, is hard to beat).

Central Banking has long lost sensible decision making policy and the only mandate these days is doing something when stock markets look shaky and fixed interest liquidity gets scary whilst your knees are knocking together as “recession” looms larger and larger.

Bottom line, the effects of these policies are getting less and less as expansion of credit continues to fall in a grossly over-indebted (don’t even think about the derivative overlay, no policy maker does) drives the devilish deflationary monster in asset markets. Ironically, this is what policymakers have been trying to avoid over the last 7 years!!!! That’s why you can’t work out actually where all the money has gone (we think China built some infrastructure, though).

“People are very spooked about what they can’t see, and at the moment they can’t see where global growth will come from,” Justin Urquhart Stewart, co-founder of Seven Investment Management in London, told Bloomberg last week. “In a market like this, less certainty around the U.S. election cycle will add further nerves. The last thing investors need is more background noise.”

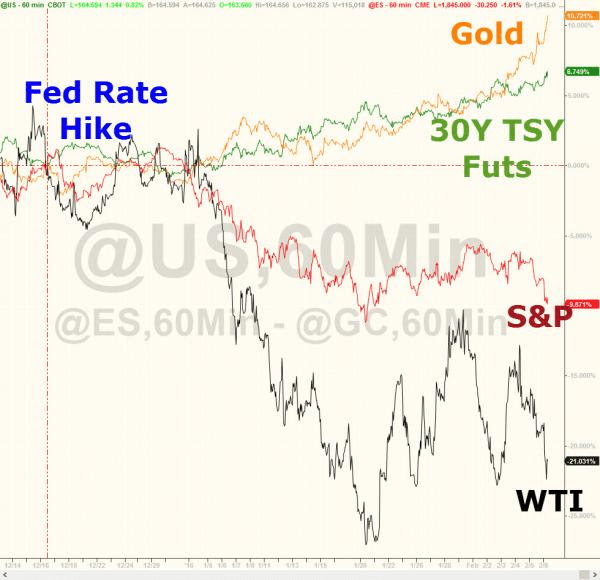

Anyway, thanks for interest rate rise, hope we can have more.

The rise of Gold on the back of all this is good and the fixed US/Global economy is not the most interesting anomaly in the space.

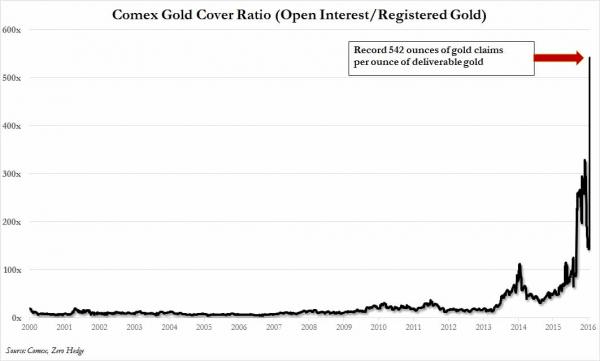

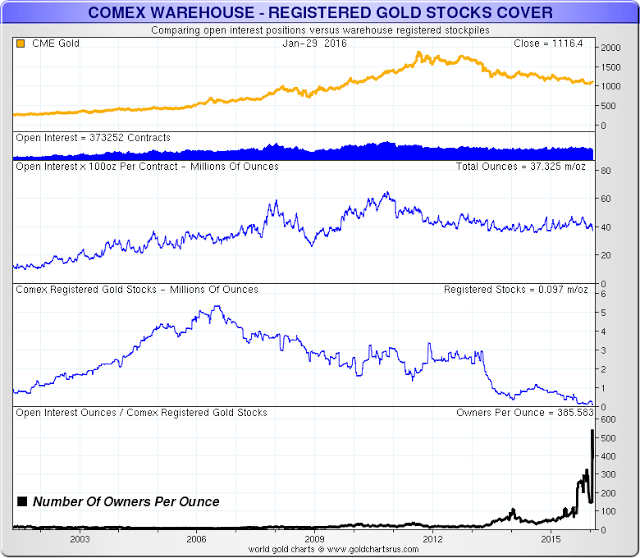

On the main US Commodity exchange, COMEX, seriously, 542 paper claims to every physical ounce of Gold??!!

Oh yeah, “they find it from somewhere, they’ll never let it happen”.

The Comex is not too far from the main event. We’ve often mentioned the unreformed, protect at all costs, “too Big to Fail” Financial Monsters existential crisis.

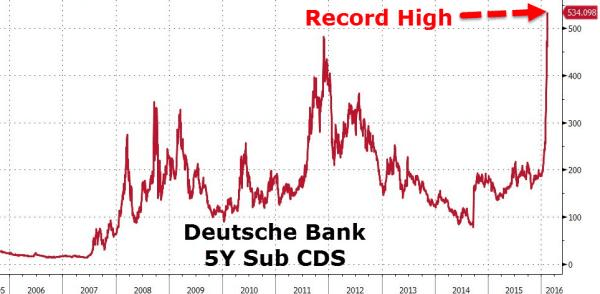

The bellwether of Too Big To Bail or Fail may well be Deutsche Bank and with it the German government. Someone is getting very nervous here!!

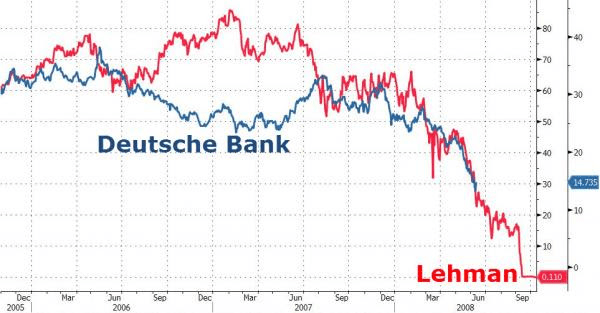

Ironically, the 2 charts below refer to Credit Default Swaps, supposedly, insurance against an institution’s corporate debt failure. As we found in 2008/09, who the F*#% will pay? Governments, again? Whether they will or won’t pay may not matter, for the moment let’s simply look at them as indicators.

Fixed?

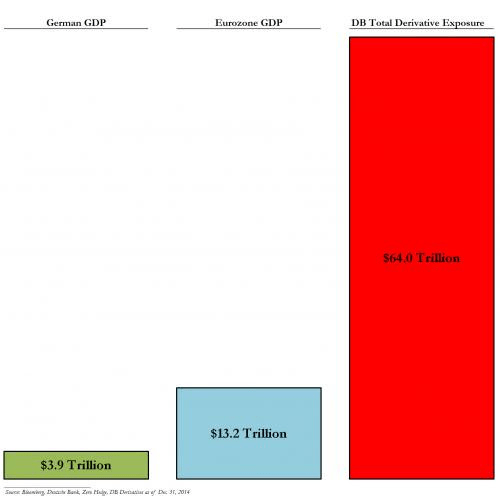

And finally, again, for the 4th time in 4 years, just to help you understand, everything you need to know about modern banking failure is contained in the following chart.

Smartest guys in the room will tell you it all “nets” out, everyone owes everyone and why not, they’re the ones who’s credibility relies on its continuation. But there is no room for error and that error may well be in play right now as you read this.

Another round of central bank “all in” policy will have less and less effect but in that short term, a couple of short term rally’s may buy a little more time, for the brave.

Recent Comments