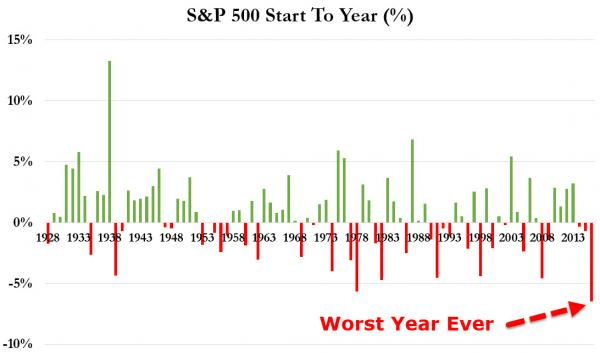

Brutal. Can be the only way to describe what happened in Financial Markets over the last week. Worst start for stock markets, ever!

One of the driving catalysts was a Chinese move to more aggressively devalue their currency in the face of rapidly deteriorating domestic economic conditions.

Once they realised the damage they were doing they pulled back on Friday and yesterday. But the damage had been done and markets will just sit back and wait for the next wave.

We penned, this time last week, that something wasn’t quite right in the middle kingdom but even we were shocked with whats happened .

Spot fires everywhere. Some are difficult to understand such as the onshore/offshore Yuan spread but the resulting volatility is clear.

Something really snapped yesterday morning Do remember the not manipulated LIBOR that was subsequently found to be manipulated (and every other market since, except precious metals)? It’s the London Interbank Offer Rate. It’s what Banks use to set rates with each other.

Hong Kong has it’s own HIBOR (Hong Kong Interbank Offer Rate). This happened yesterday. All of a sudden banks woke up this morning and decided they trusted each other less? As we found in 08/09, this happens for a reason and tends to be like “smoke exiting the building”

The other very odd thing yesterday morning was the implosion of the South African Rand (ZAR) in Asian Trade (Africa, US, Europe all closed)!! This shocked traders.

One needs to heed the form of the ESDZAR cross rate!

Anyways, back to China. Something is very wrong in the worlds economic growth powerhouse.

From Kyle Bass;

“What I think the narrative will swing to by the end of this year if not sooner, is the real issue in China is not simply that profits have peaked. The real issue is the size of their banking system. Do you remember the reason the European countries ended up falling like dominoes during the European crisis was their banking systems became many multiples of their GDP and therefore many, many multiples of their central government revenue. In China, in dollar terms their banking system is almost $35 trillion against a GDP of $10 and their banking system has grown 400% in 8 years with non-performing loans being nonexistent. So what we are going to see next is a credit cycle, and in a credit cycle you see some losses, but if China’s banking system loses 10%, you are going to see them lose $3.5 trillion”.

Or, a magnitude of much more like 21.5%, according to recent Fitch analysis.

Big numbers, the PBoC is going to need to work hard and fast to stay in front of this one. And they are.

A jump in the overnight cost for borrowing yuan in Hong Kong is “reflecting further PBOC efforts to stamp out speculation,” according to Michael Every, head of financial markets research at Rabobank Group. Hong Kong-based Every told Bloomberg in an interview, following a massive spike in overnight borrowing rates for Offshore Yuan that “a 66% rate is murderous for others being swept up in this who are not speculating.”

PBOC advisor Han earlier warned that short selling the yuan “will not succeed,” adding that “it is pure imagination that the Chinese yuan will act like a wild horse without any rein.” But as Every notes, the unintended consequences could be a problem, “imagine you needed access to CNH for other purposes for a few days,” concluding ominously that “in other EM crises we see that central banks usually win a round like this,but lose in the end.”

According to the people’s daily, its all psychological.

More patience is needed for the Chinese economy which is in a transition period, as it transfers from old to new economic growth drivers while also facing a backdrop of a slowing global economy, the People’s Daily reports citing academics. It would be too opinionated to judge that the Chinese economy would suffer a hard landing based on short-term fluctuations as many factors have had an impact on the yuan’s recent depreciation and the stock market’s falls.

“The fundamentals of many economic crises is the psychological panic problem, and we need to take good care of the market and foster new drivers; conclusions on the Chinese economy can’t be made in a rush based on the short-term or partial changes,” said Zhang Tiegang, professor at the Central University of Finance and Economics.

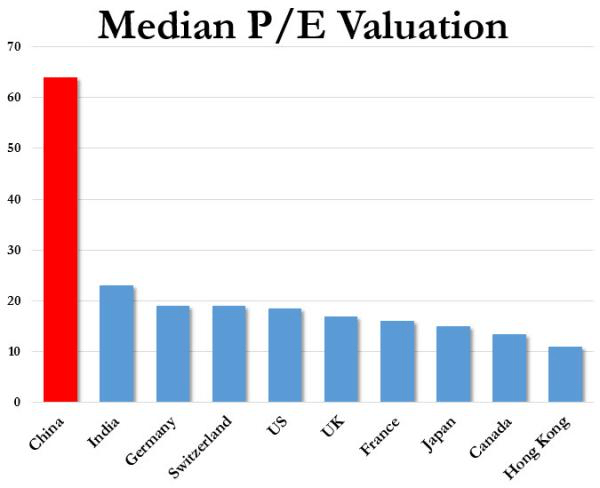

Really? This might be a bit more than psychological. 65 times earnings!!!

All charts Above: Bloomberg and Zerohedge

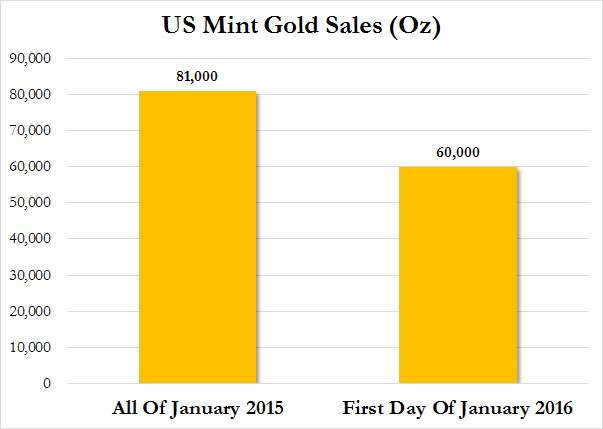

And that useless yellow metal that nobody wants?

This is what a currency collapse looks like in Gold.

What happened below? Did one of the Kardashians tweet something on Gold?

– Simon Phillips

Recent Comments