Before we move onto that which most effects investments of a non-active manner in Australia, that is, overseas events, we thought it timely to make a brief comment on the state of play here Down-Under.

We’d not want to be in the Prime Minister or Treasurer’s position at this juncture. This morning in the Australian, they were pinning the hopes of the entire economy on consumer and business “confidence” for 2016, as well as the innovation statement of pre-Chrissie.

A consumer tapped out with debt and business extremely concerned about slowing growth within the economies of Australia’s 4 main trading partners, China, Japan, Korea and the US.

According to DFAT theses, four countries represent 48.1% of Australia’s trade and 55% of exports. China and Japan alone represent 42.9% of Australia’s exports.

We’re quite sure last month’s downgrade to Australian growth from the Federal Government will not be the last as data starts to come in from the last quarter 2015 commodity rout, with no relief from the AUD.

On the back of this, the budget deficit forecast downgrade to A$37.4bn will be tested and the government will have very little room to move. This leaves the heavy lifting of the soon to be much-needed stimulus to the RBA? From 2% to ?? We’ve had no change since the 6th of May last year.

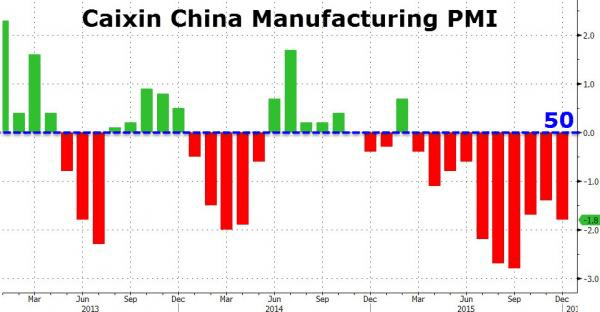

The latest instalment of the China slowdown story came this morning by way of some Manufacturing numbers.

Initial reporting/analysis (if you could call it that) from CNBC and other MSM shills early this morning told us nothing to worry about in manufacturing as they’re (China) moving to a “consumer and services” economy and everything will be ok!!

As you can see from the market reaction (below the below) and medium term trend below investors are starting to ask questions and everything seems pretty far from ok.

Late in the morning, the authorities closed the entire market as it was down 7.2%! If it drops by 5 they close for 15 minutes and more than 7%, for the day!!! Happy New Year! We’re shutting it down!

Although this is the biggest story for the New Year, the title of this piece is the price of risk, or more importantly, the mispricing.

We mean that, thanks to Central Bank meddling in every market, the price of risk is totally distorted, causing investors to take much more than they would ordinarily have been comfortable with, just for a few extra basis points of income.

Our point is, and has been for a while, there will come a serious cost adjustment. The price of endless mismanagement.

For most investors, they just want to get on with life and the New Year knowing that Central Banks do have their backs and they will do whatever it takes to maintain status quo.

Here is some news for you, they are, and it’s not working.

Homeowners, Shareholders and Bondholders have been protected from heavy losses since the scare of 2008/09. Thankful they should be to date, but as we’re discovering, there are limits and, quite possibly, consequences.

Globally, in 2016, as liquidity stresses continue to back up, right now the real areas of stress are in high Yielding Bonds (where it always starts) and Big Commodity Traders. We’re sure the Europe bad news cycle can make a recovery sometime late in the first half, as usual.

In the big commodity trading space, the likes of Glencore and Noble Group are under severe balance sheet pressure.

On December 29 (tricky timing) Moody’s Investor Service downgraded Noble Group’s debt to Junk, outlook negative, putting extreme pressure on its balance sheet.

The response, sell Noble Agri for $750m. A MARGIN CALL BY ANY STRETCH. It won’t be enough, the horse has bolted, banks realise there is not enough collateral and are making more and more demands.

Same at Glencore. Is one of these two institutions the “Lehmann” of the 2015 commodity rout, or are they TBTF (too big to fail), or just up to their eyeballs in shitty derivative paper, levered 100’s of times on thin physical holdings and promises? Time will tell.

The other potential “Lehmann” is actually our old favourite and most probably a steroidal Lehmann under extreme liquidity pressure in 2016, ETF’s. Exchange Traded Funds. The last of the 3 letter acronym structures to blow!?

Put simply, if an investment requires a “market maker” to make a market, what happens if they decide not to?? Good luck with that.

There has now been $2.2 Trillion of troubled High Yield bonds peddled to yield-starved investors since the financial crisis. There are well north of $60 Trillion of Bond ETFs out there with anyone’s guess on how many fast money speculators are playing the “Rolling Down the Yield Curve” Strategy as the yield curve flattens.

With serious liquidity issues clearly evident, it should be interesting as a potential positioning scramble ensues.

The result, a crowded theatre with a tiny exit. Custodial risk, counterparty risk and liquidity risk, all at once.

Nowhere will feel the brunt of this more than Global ETF bond funds. ETF Bond funds have allowed retail investors to pile into corners of the fixed income world where they might not belong but forced to dwell, “chasing some yield” in a Zero and Negative interest rate world.

And if you still don’t know what happened in 2008 and what a “counterparty failure” means then you need to go see the movie, The Big Short.

It’s great that Brad Pitt backed the Michael Lewis book and got an ace director to make sure the complexities of the story were able to be understood. Compelling.

Are ETF’s the next big short, we may not have to wait until the end of the first quarter 2016 to find out and with it, the real price of risk.

And finally, some peace for your weary soul, having come this far.

Recent Comments