There we have it, folks. Lift off! US Fed raises rates this week for the first time since June 29, 2006. After 12 months of preparation and jawboning. 0.25%. For posterity.

What difference will it make and how far will they go before they have to fold? Under the current economic environment, we still find it hard to see more than 1% before more QE!

Since we first mentioned stress in High Yield Credit a couple of weeks ago it was interesting to see three large US Hedge Funds invested in this space shut their gates last week. “We’d like for you to have your money back but it may take some time to sell down assets in an orderly fashion”, they said. Brings back memories. Bear Stearns? Sub Prime Containment? We’ll see. It took 18 months from Bear Stearns to Lehmann.

Back to rates, so far, miserably low and negative interest rates around the world, designed to stuff more credit down the throat of an incredibly credit-bloated patient to “boost” economic growth have failed. There is much anecdotal evidence we’ve shared to support this in recent times.

The Baltic Dry index is such an economic indicator, based on the accumulation of shipping rate data across all major routes and vessel sizes. It’s collapsed to its lowest point in more than 30 years.

Maybe this is because some of that 0% funny money built too many ships or demand for raw materials is falling as fast as commodity prices because growth is also collapsing.

“It doesn’t help that Chinese steel production is about to see its most dramatic decline in 20 years”, said Herman Hildan (from Bloomberg interview), a shipping equity analyst at Clarkson Platou Securities in Oslo. “Demand is collapsing”.

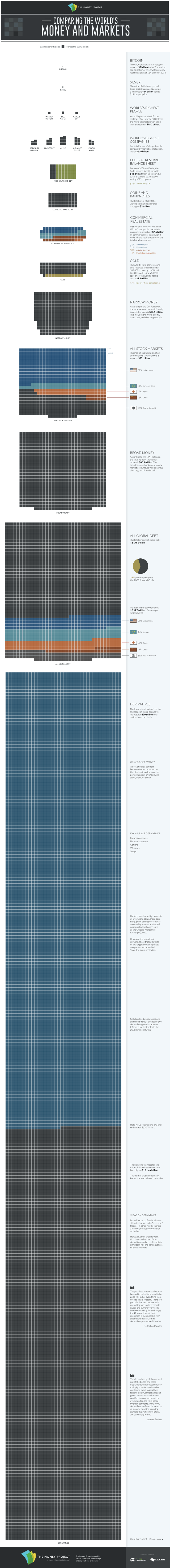

So, If it is not awesome growth that has driven this interest rate rise then perhaps it’s that naughty inflation bogeyman that caused the US Fed to raise rates?

Again, a collapsing commodity and energy complex, accompanying falling growth is strongly suggesting an onset of Deflation than Inflation. As we’ll explain below, this is a nightmare for governments, especially when 40 year low interests rates have failed to provide much notable inflation other than in the intended space of bonds and stocks (in the countries most aggressively pursuing these policies).

The recent US Fed rate rise will only accelerate the growth of the gigantic deflation and recession cloud moving over the global economy. The rising US dollar has already accelerated economic problems in emerging markets by a serious degree.

Russia, Japan, Brazil, Canada are already in recession and China is slowing rapidly, taking a large chunk out of GDP growth. Australia and other commodity producers are slowing down because of reduced demand from China. Capital is flowing out of BRICS and other emerging markets at unprecedented levels. An interest rate rise now will further exacerbate these problems and tip even more countries into recession.

Furthermore, deflation increases the real value of debt and accelerates defaults. We’re already seeing this in Energy and other junk debt. These losses will soon spread to more highly rated corporate debt and, ultimately to the banks.

Deflation also diminishes tax receipts. The combination of bank losses, higher real debt burdens and diminished tax collection are a government’s worst nightmare.

So why the rate rise now?

In a word, credibility!! Protection of the last strand of credibility the US Fed (and others) has. Right now faith in central bank policy is the fibre holding financial markets together, and has been for the last 6 years. Without it, collapse is assured and, perhaps, necessary. A purge of toxins that should have happened in 2009!

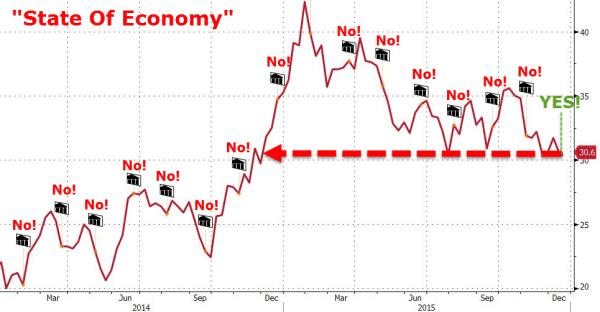

But let that doubt you may have in your mind not lessen the belief of what Central Banks will be prepared to do as this deflation problem gets more serious.

As the deflation nightmare takes hold and seven 7 years of near-zero interest rates haven’t generated the inflation needed, how the hell can inflation develop.

The answer is simple, outright debt monetisation.

Governments will pick spending programs to stimulate growth and then incur huge deficits to support the spending. The deficits will be funded with Government debt. The Central Banks will print money to buy the debt. Again look at Japan. There is no Bond market. It’s all the Bank Of Japan.

The gov answer will be, “well, if we can’t get corporates and the public to borrow and spend and spend and borrow then we’d better do it for them!!”

In Short, expect more of this below! Much more!! Doesn’t sound so bad, does it? Life goes on. You see, it’s Xmas and we promised some good news to some and like Xmas, it might not end well so enjoy it while you can!!

There appears a long way to go before the tide turns and we see some inflation but history shows it can sneak up very fast.

Finally, here’s a real treat, a present from the guys at Visualcapitalist.com

Merry Xmas!

Recent Comments