Dennis Gartman, author of the institutionally well followed ‘The Gartman Letter,’ has asked questions about gold’s peculiar price action last week and raised the question as to whether there was official central bank manipulation of gold prices.

Gold was 2.4% higher in October but fell 2% last week as the Fed again suggested they may soon increase interest rates. Gartman’s assertion is significant as he is no so-called ‘goldbug’. In fact, he is the darling of Wall Street, Bloomberg, CNBC and is highly respected and followed by large hedge funds and financial institutions.

He has been bearish on gold in recent months but the recent turmoil in currency markets has Gartman bullish on gold also in dollar terms since August.

Gartman is on record regarding his belief that gold is in a long-term bull market in all currencies.

Here is the key extract regarding potential gold manipulation from the Gartman Letter on Friday:

“As for the precious metals, the selling late Wednesday and all day yesterday was indeed severe, and even our positions in gold/euro and gold/yen have seen severe damage wrought upon them.

We find it hard to believe that the mere suggestion by the Federal Open Market Committee in its post-meeting communique on Friday that “liftoff” on the overnight Fed funds rate may take place at its December meeting can be responsible for this sort of egregious, serious, and now relentless selling, and we are almost of the mindset associated with the likes of the gold bugs and GATA that some malevolent “force” was behind the selling.

However, we are not going to travel down that road at the moment and sit tight with our positions, believing that the continued “experiments” with QE undertaken by the Bank of Japan and the European Central Bank shall work to the detriment of their currencies and to the support of gold. Nonetheless, the last 36 hours have been terribly dismaying …”

As usual, Denis is a bit slow to the party. Anyone with a slight interest in the gold market knows the efforts that have been made to maintain “price stability” over the last 4 years, thus enforcing the mirage of effective monetary policy. The only effective part of the 51% increase in debt, accompanied by 0% (and negative) interest rates and god knows what created in the exotic derivatives space, has been to maintain a system that is way past its used by date.

What we’re particularly interested in is the build of pressure as a result of said policy.

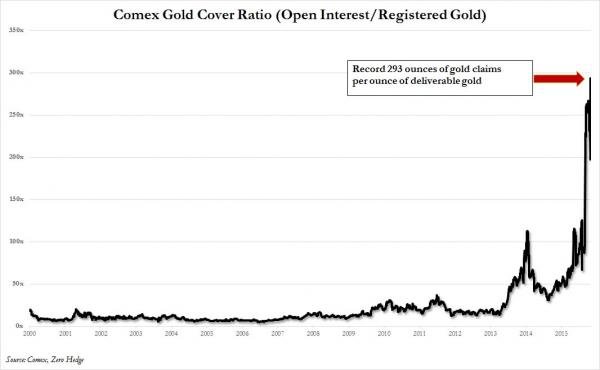

First, there is this below. A new record this week at the US Comex (Commodity Exchange). Claims to deliverable, 293:1.

Don’t think this means that you can take your ounce of gold, sell it to 293 of your friends for $1550 each, promise to deliver it later, pocket the $454150 and drive off into the sunset. No, you cannot.

There was a time when systemic risk, the promise of currency debasement and trillions in newly printed stimulus would be positive for gold as investors look for ways to manage the risks and protect their wealth in uncertain times.

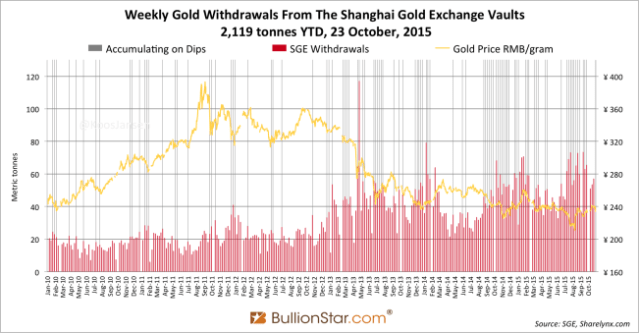

Well, here’s a fact for you. Many have been, and still are, using a fire sale gold price to continue to build vast stacks of metal.

For example, as illustrated below, 2119 tonnes through the Shanghai Gold Exchange vaults year to date!

Let’s not even bother with other country demand and just add India’s 1000 tons to the above demand and we’re already around 600 tons over Global supply. Again.

As in the case of the London Gold Pool trying to keep the price at $35 through the 60’s and early 70’s, (this policy was public, as opposed to now) the policy is unsustainable.

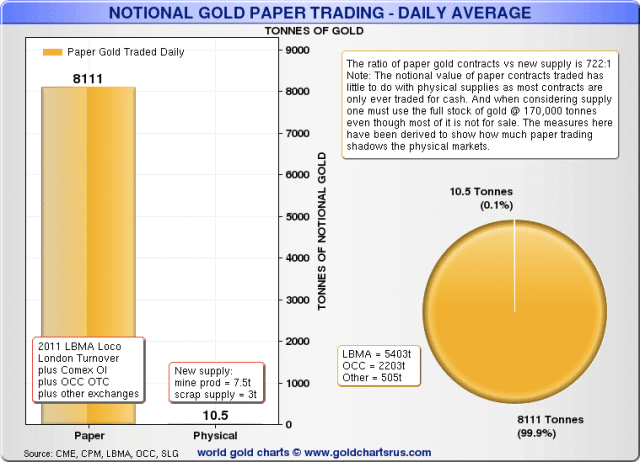

Just to add a little more colour to the nature of the financial market casino we live, check this out, the following takes in most major exchanges.

As we’ve often said, gold has and will continue to represent insurance and wealth preservation in the face of increasing global economic instability. Focusing on short term price movement may distract you from this time proven fact.

Central Banks are still going to continue to flood the world with unlimited amounts of paper money to save the financial system from collapse.

Sadly, doing the same thing that created the problem in the first place is unlikely to make a difference, and the prospect of a major deflationary collapse followed by a hyperinflationary blow-off grows.

Precious metal investment is just a sensible part of a well-diversified investment portfolio. And based on the above information above, it seems many may be disappointed at delivery time!

Recent Comments