Italy sold six-month bills at an average negative yield for the first time on Wednesday as the prospect of further monetary easing in the euro zone pushed investors to pay to hold Italian debt.

Italy sold 6 billion euros ($6.6 billion) in bills due in April 2016 at a yield of minus 0.055 percent, down from a 0.023 percent yield paid a month ago on the same maturity.

Since then, the European Central Bank has indicated it could unleash new stimulus measures to shore up inflation as early as December, including possibly cutting its deposit rate further into negative territory.

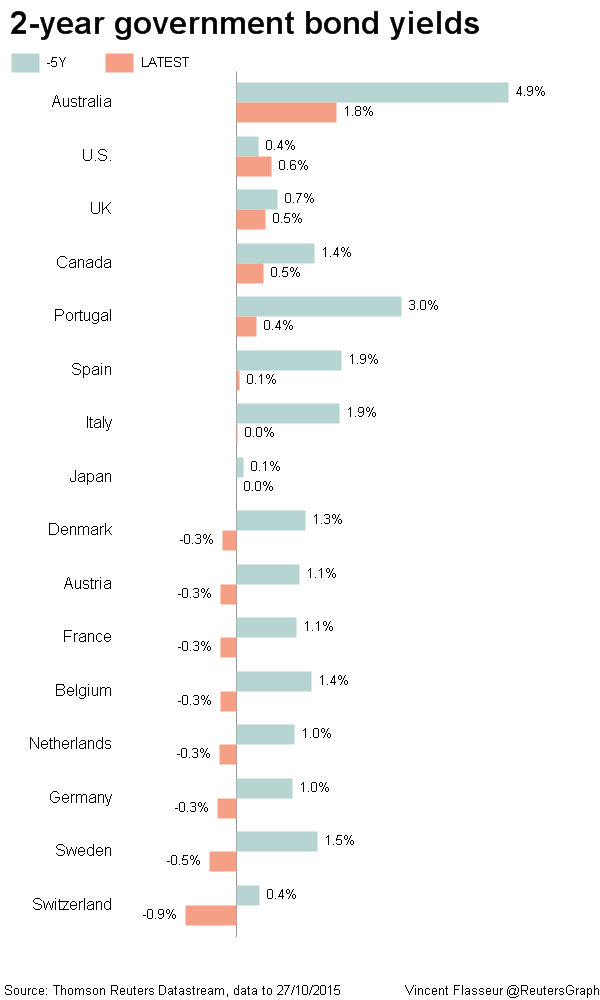

We expect this to be only the beginning of Europe’s (and soon the US’) journey through the monetary twilight zone that is NIRP, as central banks around the globe no longer have any choice but to intervene any and every time there is even a modest 5% drawdown in risk assets, as we saw in September.

Why after 6 years of stimulus and rate cuts why are we still seeing such aggressive policies?

It’s because deflation, the bad kind, is lurking around the corner. Not the good kind like cheaper fuel, cheaper computers or houses.

Debt deflation is the real worry here. Debt deflation means that debt payments are becoming more expensive. If debt servicing becomes more difficult, it eventually leads to the dreaded default and restructuring. This cannot be allowed.

If you consider the the threat of debt deflation, the move of every Central Bank makes sense. ZIRP, NIRP, and QE all have the same purpose: to lower interest rates and push bonds higher thereby making gigantic debt lods more serviceable.

A whiff of dedt deflation give central banks severe agita, which is why they move to try and create some inflation through currency devaluation, it makes their debt loads more serviceable.

Soon we’ll be discussing Spain’s €1.8trillion external debt and a banking system that’s €4.2 trillion in size but the size of the problem is a story for another day, as is the fix.

On a local front this morning, in another sign of China’s pullback, Aussie new home sales crashed 4.0%, month on month, to go with falling commodity prices.

With this back drop what do you think the chances are of a an RBA rate cut on Melbourne Cup day? Large.

It’s at this point we point out the obvious and ask, what happens if these policies continue to fail.

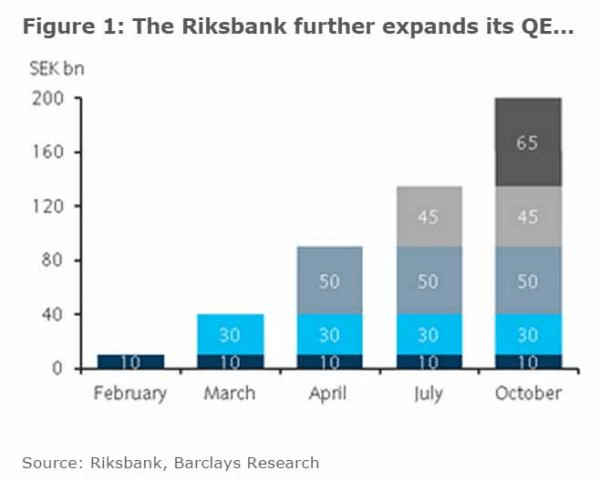

Our guess is Central Bankers will turn to their chief Economic Nobel laureate cheerleader, Paul Krugman (as japan and Sweden have done) and ask, what shall we do now?

His response will be:

Recent Comments