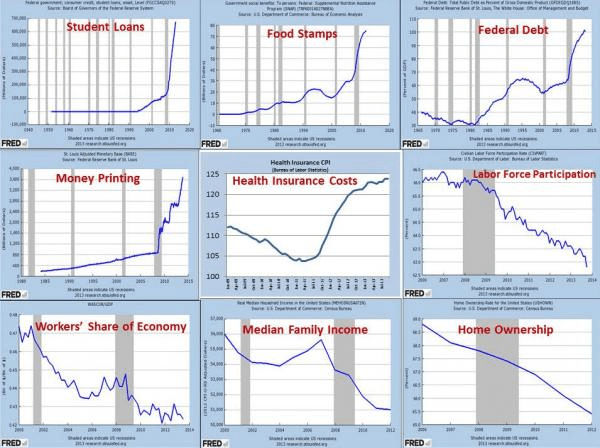

So, for the 4th time this year the US Federal Reserve could not lift rates by even .25%, for fear of crashing the system, after 6 years of emergency stimulus.

It was ironically humorous to see the “business as usual”, “just keeping things steady”, “we’re in safe hands” reply from Financial Commentators.

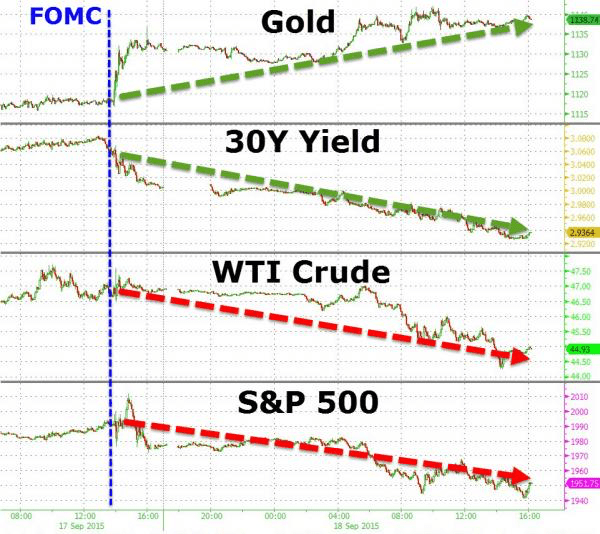

This has been the market response since. The US stock market fell solidly last night. Basically, Investors have dumped stocks for Bonds and Bullion.

The Fed statement should have included an apology, “after 5 years of attempting to convince you the recovery is coming along well, actually, it’s not”.

But fear not.

There is now more likelihood of more monetary stimulus than there is a Fed rate hike. The US Fed credibility may be completely trashed but do not think they won’t do more money printing stimulus over genuine financial reform.

In fact, if Emerging and General Financial market turmoil continues expect a global response. The Fed, the ECB, BOJ, The PBoC, RBA and anyone we’ve left out to co ordinate the next round of monetary stimulus. In the case of the Bank of Japan (BOJ), they’re really at the “throwing money out of helicopters” end of the road as they’re already buying everything. Bonds, Stocks, ETF’s, the lot.

Despite it’s epic failure so far, this type of monetary policy may continue to buy time.

But one must be aware this massively stretched out debt and derivative elastic band will snap back and investors need to be very nimble and insure accordingly.

For now, we are not at plan Z yet. Plan Z, otherwise know as “The Nuclear option” is to completely bypass conventional conduits of money and go straight to through, as acknowledged by none other than Milton Friedman and Ben Bernanke, to dropping money out of the sky.

Looks like we can add Macquarie Bank to Friedman and Bernanke. This from them yesterday;

“There are several policies that could be and probably would be considered over the next 12-18 months. If private sector lacks confidence and visibility to raise velocity of money, then (arguably) public sector could. In other words, instead of acting via bond markets and banking sector, why shouldn’t public sector bypass markets altogether and inject stimulus directly into the ‘blood stream’? Whilst it might or might not be called QE, it would have a much stronger impact and unlike the last seven years, the recovery could actually mimic a conventional business cycle and investors would soon start discussing multiplier effects and positioning in areas of greatest investment.”

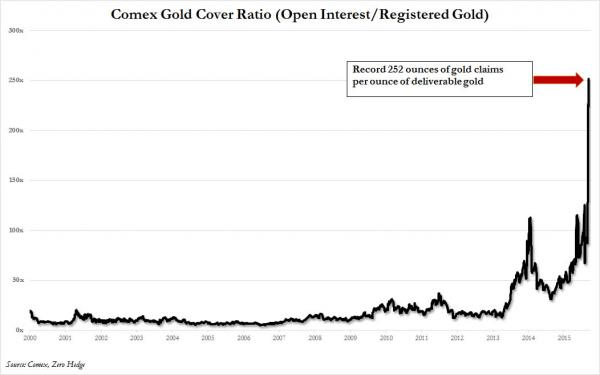

Speaking of stretched out rubber bands, check this out this from the paper gold players. This has an endgame too, although it may be closer than helicopter money.

The as demand for the precious metal continues to exceed supply by a substantial margin stress in the “paper v physical” market continues to grow.

This is really getting ridiculous. More on this in a separate note.

Recent Comments