We’re going to give the Gold Bears a shove today but before we do it’s hard to move on without addressing recent market gyrations.

On Monday, US Fed board member, Stanley Fisher was interviewed on CNBC, post the weekends Jackson Hole Policymaker/Central Bank love in.

With regard to the dreaded US interest rate hike due this month, he basically gave the strongest indication yet that they are aware of some collateral damage in markets if they raise but they are going to move anyway.

And look what happened to markets since. They puked up last weeks wipe out gains and Mr. Fisher now knows what they intend to do if they move. What now? Quite a bind.

Could it be that they (The Fed, collectively) actually believe their own rhetoric enough that they’d actually raise rates? That’ll make life interesting. But if they don’t it’ll be recognition that everything is not actually so awesome despite what we’ve been fed (nice pun) over the last 6 years.

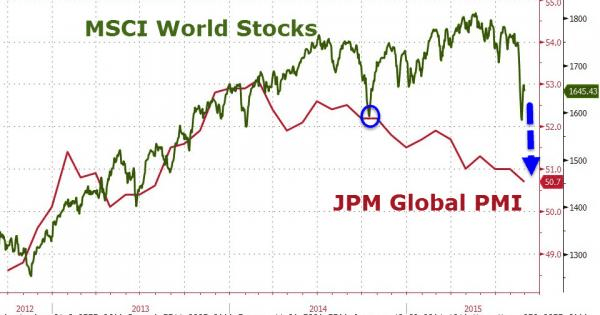

With indicators from macro-fundamentals (e.g. retail sales, core capex, inventory-to-sales) to market-oriented measures (VIX levels and backwardation, HY credit spreads, commodity prices) all flashing various colors of dead canary in the coal-mine red we thought we’d ad a few more below if you’re not convinced.

The only number the Fed might fall back on is employment as they do not include the long term unemployed! Its laughable. The why is for you to work out!

As we said last March, if everything is so good, just do it, raise those rates for the first time in 9 years!

Now, about those most recent charts.

How about those global manufacturing numbers?

Canada GDP: Note to all from below, two quarters of shrinking growth is a recession. Hope Joe Hockey is taking notes from another commodity economy that has not been saved by Chinese property investment.

Was going to put South Korean export numbers in the next chart but you should have the picture, it’s not pretty.

Over to Gold:

Should the scenario arise that investors wake up to the fact that the last 6 years of unprecedented monetary policy, and, continuing to repeat the same policies that got the global economy into this mess are not working, the question of confidence in Central Bank policy will duly follow.

Should this case percolate, the only tightening investors in anything that’s not nailed to the floor will feel, will be in their sphincters, ETF investors look out!

In such an environment, with Gold Demand currently exceeding supply for a number of years, what might one expect from the price?

We do not think we’ll have to wait that long to find out. The longer the paper markets trade “naked”, the more they’ll be embarrassed when the tide goes out.

We enjoyed this summary on recent silver action from Dave Kranzler:

“in silver, did you know they had confirmed volume on Thursday of 122,482 contracts traded? Did you know this represents 612 MILLION ounces of silver …or over 87% of annual global silver production ex China and Russia? How in the world does 87% of a full year’s production trade in just several hours? Doesn’t this go against commodity laws? AND, silver was pummeled on Thursday so it was supposed to represent PANIC SELLING. Who was panicking and needed to sell all that silver so fast? …especially since the U.S. Mint just raised premiums and started rationing dealers because they couldn’t keep up with DEMAND! Let’s not forget the Royal Canadian Mint, they have suspended sales of silver Maples! Why or how could this be? Everyone has been selling silver but the mint could not source any? This defies pre school logic!”

And, amazingly, China is taking this through the front door 2 weeks ago:

And increasing:

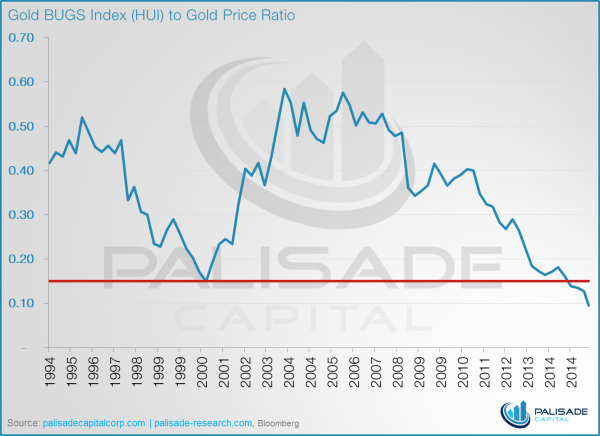

Gold producer to price ratio! Never been cheaper and the chart below is in USD!! The Australian dollar price is well over $1600!! …….WOW, to the sub 1000 producers.

Great buying for those not invested.

Recent Comments