Doesn’t really matter.

After a week like the last, investors need to ask themselves, do they feel lucky?

Luck, like Central banks are still in control and will can continue to bail out an over indebted, over leveraged financial system. Do they have the tools?

Is there actually enough collateral in the system once everyone starts moving toward the exits? Since the last blow out, Central Bank policy has been successful, up until last week, in perpetuating the meme of confidence needed to prevent a run on collateral from happening. Whats happening at the moment, and we mean now, is surely going to test central bank thinking.

But we know there is only one tool in the shed and it is not financial reform.

Economic Nobel laureate Paul Krugman sums it up best , they’re not printing enough! Smartest guys in the room are arguing we need more!!. We’ve only got a hammer and its not working, we’ll just hit harder.

The roll call has started, the market drops 10% and those who’s lives depend on its rise are already calling for a another bail out.

So, there is no need to go into anymore detail than this, stand back, let this “correction” happen and load up for the final QE4EVA innings, which will fail dismally, again. Unfortunately the costs of not being in the market over this final blow off may be worth considering.

This is commentary and not financial advice but if one wishes to discuss strategy around this, the door is always open, the phone mostly on and internet works almost everywhere except the deep Amazon and South Stirling’s (Ranges), WA.

To mix it up we’ve created some headlines worth note. No need to mention the tectonic Chinese shift in Currency Wars, you should be able to feel it under your wallet/purse as you read this. More to come.

We need a bigger balance sheet!

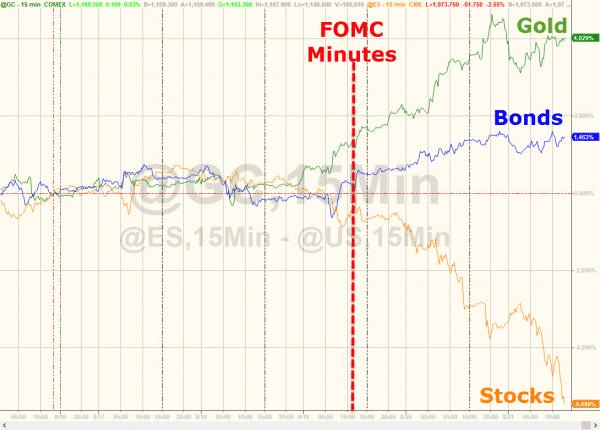

Market sends message to US Fed. Hike rates and we’re done.

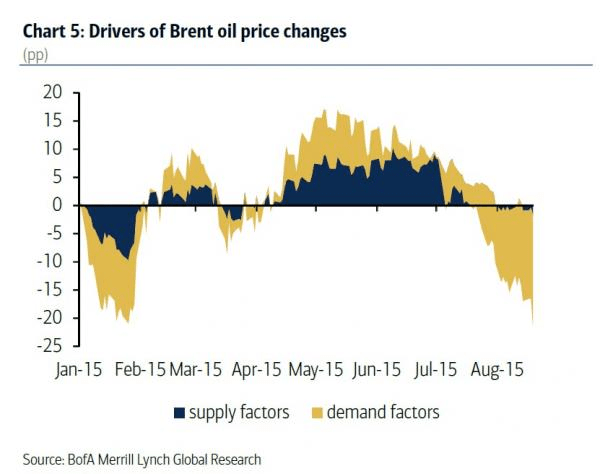

Energy, and the reason for its price falls are as follows.

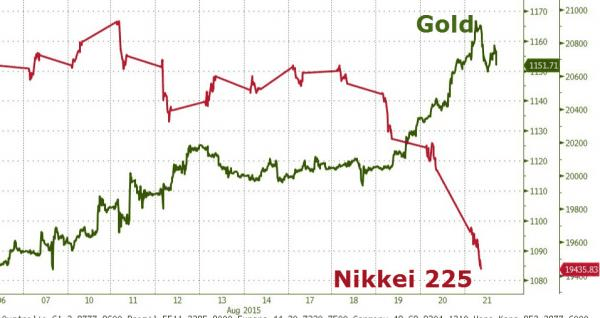

No commentary necessary for this one: Where’s that growth again?

Benchmarking Carry Trade Currency War

We Never get sick of this, #Winning

Recent Comments