Why was it this week that Australian investors woke up and asked themselves about the wisdom of supporting a capital raising for a big bank when they’ve been doing capital raisings in one form or another almost quarterly for many years?

We wonder if the penny has finally dropped that each raising puts shareholders further down the capital line. ANZ shareholders certainly think so today!

Debt funding a growing business. Just keep those divis coming!

Back to reality. We’re in the midst of a massive rout in commodities, the likes which we’ve not seen since 2007.

The effects of this are being felt most by Emerging Markets and Commodity currencies, like the Aussie dollar.

There is even some worry in the safe as houses, highly geared, Australian property market, as well as bank investors, that there may be some not so awesome economic headwinds coming our way.

As this plays out lets look at some issues.

Lets just start with, another FOMC “Fed” meeting comes and goes and still no dreaded rate rise.

First it was going to be April, then June and now, maybe, September. Golly gosh, the anticipation, its worse than Greece! So pull the trigger, whats the problem?

We’re told the “recovery’ is in full swing. But where, GDP Growth, Employment, Manufacturing?

Some serious noise around, preventing this rate rise, what is it? Could the problem be in the Bond market, as we’ve said all along?

The noise. Could that hissing sound be Central Banks holding a fire hose to the bond market, doing what they can to hold it together, or more to the point, liquid.

Lets face it, since 2008, the only thing that has changed in our financial system is that the size of the problem is larger.

The Bond Bubble Market (if there is one) is now well over USD199 trillion in size and if we were to include credit instruments that trade based on bonds, we’re well North of USD600 trillion.(Source:Phoenix Capital Research).

Not only is this exponentially larger than global GDP, (around 80 trillion) because of the global nature of the banking system this problem is SYSTEMIC.

To remind you, the solution to a debt problem is not more debt.

In the Asian crisis in 1997/98 (long forgotten) balance sheets were allowed to be written down and losses suffered but they came out better on the other side.

This time, the debts are so large nobody wants to be the one the bring on reckoning. Hence Greece.

This Boa Constrictor of debt is now being felt everywhere and coming home to roost in our backyard in the form of a rapidly slowing Chinese economy and falling commodity prices.

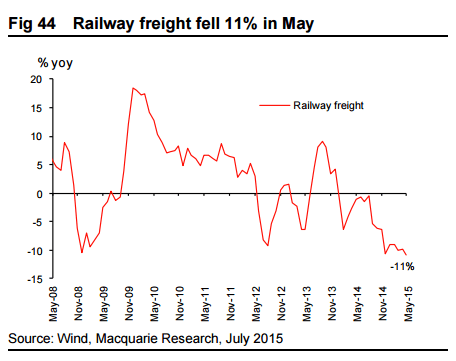

Look at Chinese Rail freight below.

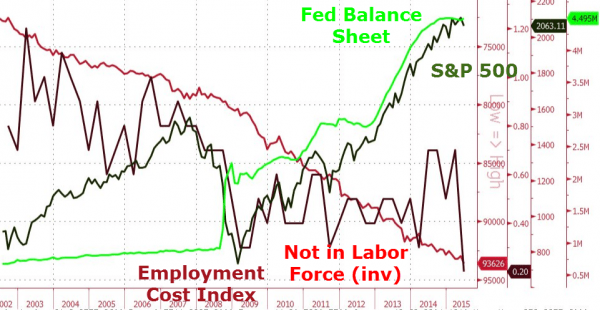

Not convinced that despite Central Bank Stimulus of15 trillion(and counting), zero interest rates and a booming Australian Residential property was enough to save the global economy and light then look again:

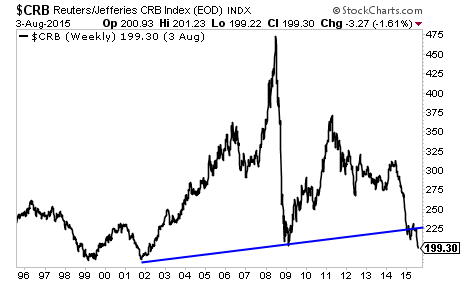

As the chart below may indicate, collapsing commodity prices may not indicate solid growth.

The Chinese stock market correction is relevant in a small way but the bigger issue is asset market deleveraging and the lack of political will in Central Bank thinking to let it correct.

And for all punters out there confused as to why the US job numbers appear all good, look and weep below. Weep for the unemployed who do not and can not claim benefits because they’ve been unemployed for too long and are better left off the numbers.They just don’t count anymore. Social nightmare.

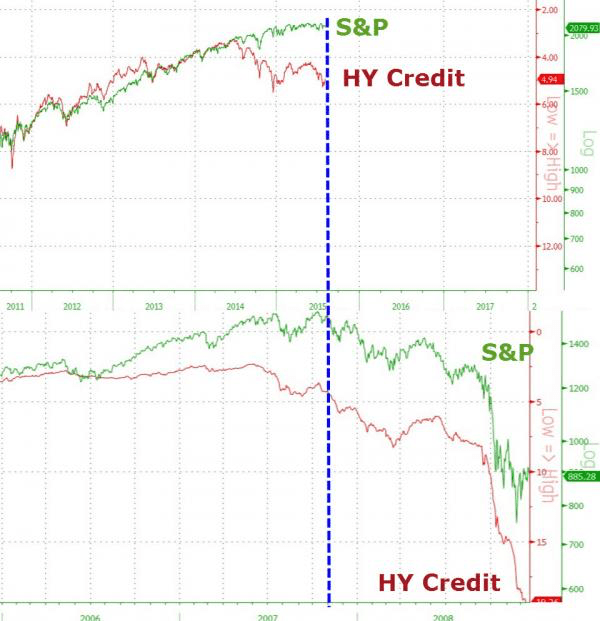

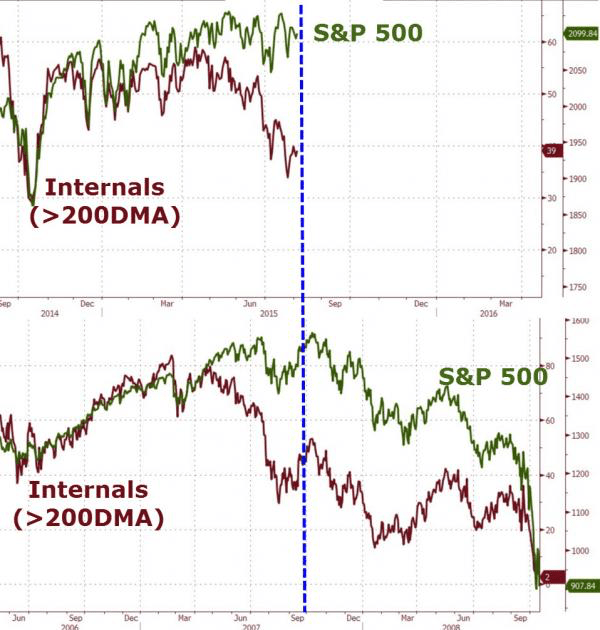

And if we’ve not made the point

Here we are:

Further more,

Maybe we worry too much and Central banks will rescue everything and everyone. Nothing to see here…..

Have a nice weekend.

Peace.

Recent Comments