We’ll find out tonight what Western MSM are going to make of this. In the meantime.

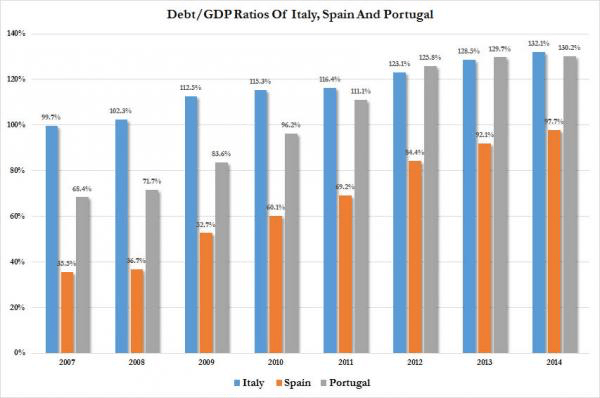

How about these guys below? Sustainable?

Figure 12: BRICs Leading Indicators, 1998 – 2015

Source: Ed Yardeni, www.yardeni.com

In China most real world indicators, most notably, railway freight traffic is down by almost 20% from the peak indicating weakness in industrial production (see Figure 13). Furthermore, sales of luxury goods have slowed down considerably. Audi – a unit of Volkswagen and the leading supplier in China’s premium auto market – announced that sales fell 1.6 per cent in May compared with the same month last year. Sales of BMWs and the BMW’s Mini cars were down 4 per cent year-on-year in May, which was incidentally the first sales decline in China in 10 years. Jaguar Land Rover (JLR), the UK carmaker controlled by India’s Tata Motors, had also declining sales. Sales of its SUV vehicles fell as much as 16 per cent in the first quarter and overall, JLR’s China deliveries were down 32 per cent year on year in May. Zero Hedge recently noted that, “The global auto industry in recent years has been betting heavily on China’s west, where they see potential for faster growth than in the more affluent – and car- saturated – cities along the coast and in the country’s eastern and southern manufacturing belts.” However, in the western provinces “Luxury-car sales appear to be faring even worse.” According to Chinese automotive research firm Ways Consulting Co “data show registrations of new Mercedes-Benz vehicles in the western province of Sichuan fell 6.9% in the first quarter to 3,944 cars, compared with a 50% rise in the same period a year earlier. Registration for BMW cars fell 9.1% in the first quarter to 5,450 cars from a 36% year-over-year increase in the same period in 2014.” All very pernicious, and pertinent data in my opinion – especially when seen in the context of the previous year’s performance.

Last month I rather unequivocally mentioned that we are in the midst of a colossal Chinese stock market bubble and that following a 40% or so correction, stocks could continue to outperform US equities (see Figure 14 of the June report). I still maintain this view, but this outperformance could very well occur with Chinese stocks declining less than US equities. Little comfort! For now though, it is unlikely that Chinese stocks will move above the June 12 high at 5,178 and a further decline of the Shanghai Index to around 3,200 is a distinct possibility (see Figure 14).

The May report also discussed how “flawed, incoherent, and inconsistent” Abenomics was in its attempt to revive the Japanese economy and that, according to Jim Walker, “It is much more likely to sink it.” Well, Japan’s May industrial production tumbled 2.2% month-on-month (and fell 4% year-on-year). Part of

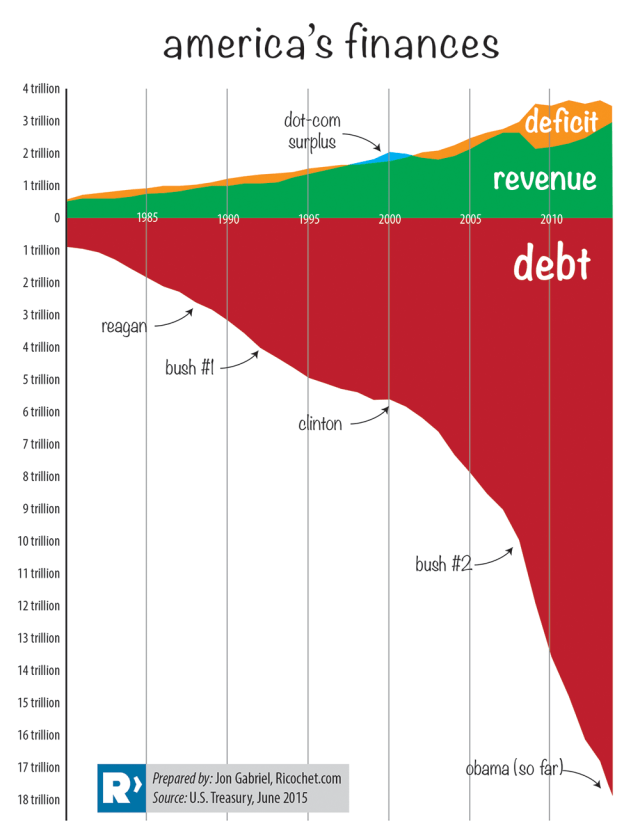

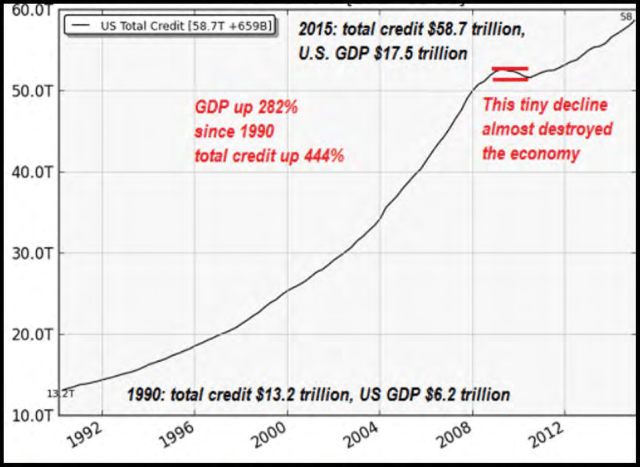

Japan’s industrial production decline is related to weakness overseas. Thai exports plunged in May by 5% year-on-year, and imports fell by 20% indicating domestic weakness. According to Walker, Korean exports (in US dollar terms) contracted year-on-year for four months in a row (they were down 11% year-on-year in May after a 7.9% decline in April). In the meantime, Korean manufacturing output has shrunk in six of seven months to April. The problem is that the world including the US is drowning in debts – burgeoning, unpayable, and soon to be unserviceable as well (see Figure 15).

Figure 15: US Total Credit (ex-unfunded Liabilities), 1990 – 2015

Source: www.mdbriefing.com

Excessive debts will inevitably lead to either very slow growth or – as I believe – to a renewed global economic contraction. In the context of excessive debts, Clive Crook writing for Bloomberg (June 4, 2015) quotes Karl Whelan, a professor of economics at University College Dublin, who explains “why it’s wrong to blame Greek Prime Minister Alexis Tsipras and Syriza for the mess. They didn’t preside over Greece’s borrowing binge — or, to put it another way, Europe’s lending binge. And by the time they came on the scene, gross and repeated errors of judgment by European Union finance ministers, the European Central Bank and the International Monetary Fund had wrecked the Greek economy.

Europe’s leaders wouldn’t let Greece default on its private debts when letting that happen (in 2010) would have made sense, and when the harm would have been small. Instead, they lent to Greece, with conditions, so that banks in the rest of Europe could be paid back for another two years. The result was to flatten the Greek economy while greatly increasing its debt burden. In due course, the crippling of the economy under the creditors’ direction brought Tsipras and Syriza to power.

Far from acknowledging their errors, much less learning from them, the creditor institutions are content to roll their eyes at Greek recidivism. IMF Managing Director Christine Lagarde has the nerve to call for ‘adults in the room,’ as though she finds this all rather trying and her patience is finally wearing thin. As Whelan fairly observes:

‘[S]he seems to have forgotten that the IMF were supposed to be the adults in the room for discussions on Greece from 2010 onwards. But rather than adopt an approach consistent with their usual policies, the European-led IMF decided that European countries deserved the opportunity to be saddled with particularly high burdens of debt to the official sector.

Europe, it turns out, has gained very little from European influence at the top of the IMF. The rest of the world should learn from the Greek fiasco that former European politicians can no longer be trusted with the leadership of this crucial institution’” (emphasis added).

I am less certain that the IMF is a crucial institution (rather I think it is a rotten and an obsolete institution), but I agree that European (and US) leaders can no longer be trusted. In addition, it should be obvious that the problems that led to the 2007/08 financial crisis and subsequent anemic global economic growth (excessive debts) cannot be solved with even more debts.

In my opinion, it would be a mistake to believe that recent weakness in equities was caused by the Greek problems. Greece may have been a catalyst for the decline but not the cause. However, if I am wrong and Greece was the cause of the decline we should be deeply concerned since Greece is a completely irrelevant player in the global economy. Therefore, if Greece was the cause of recent stock market weakness we should conclude that the financial system is completely unstable. As Alan Newman opined above, the S&P 500 and the NASDAQ have given a wrong signal by moving up when beneath the market’s surface the majority of stocks were already declining. Just consider that on Friday June 26, the S&P closed at 2102 just 1.56% below the May 20th all-time high at 2134, but there were on the NYSE 191 new twelve months lows. It is most unusual to have that many new lows so close to a market top (on June 29, when the S&P dropped by 43 points, there were 313 new twelve months lows). Furthermore, as FBN Securities’ O’Hara noticed something peculiar has been going on just before the US markets close at 4 p.m. EST each day. “We looked at the final 30 minutes of trading year to date and found the market has lost -2% over that time frame” (see Figure 16). According to O’Hara, “Large institutions use the closing liquidity to help facilitate their trades, and with the bias being to sell we mark this as a red flag.”

There are more red flags, which I explained in last month’s report. In general, I believe that the risks associated with over-extended asset prices (stocks in particular) far outweigh the potential upside potential for the next few months.

If stock market weakness persists Treasury bonds are likely to rebound. As I mentioned in last month’s report, I bought some 30-year Treasuries as a trade (not as a long-term investment).

I admit that gold and other precious metals are not performing well. However, given the fragility of the financial markets and the geopolitical tensions in the world I remain a buyer and holder of physical precious metals (and gold mining stocks).

Although I expect Asian REITs to decline somewhat in price I hold them for their dividends.

Macao gaming stocks, which I mentioned in earlier reports, are now in a buying range”.

Recent Comments