Hey, how’s that “recovery” coming along?

Today we present some points of disconnect with regard to the highly reported recovery.

The first, below, US GDP growth forecasts came out last Thursday. Who the hell still listens to economists consensus growth forecasts anyway. Almost as bad as cheerleading financial commentators telling how awesome the numbers are and people forgetting about them by the time they’re revised down months later.

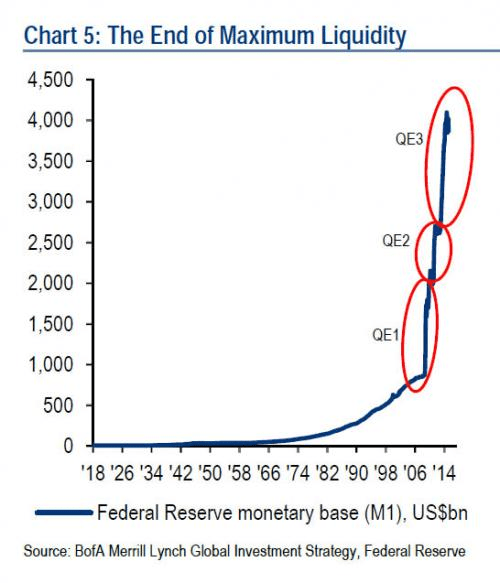

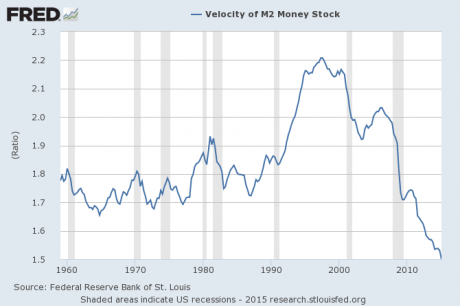

Where’d all this go?

It’ not showing up in the velocity of money.

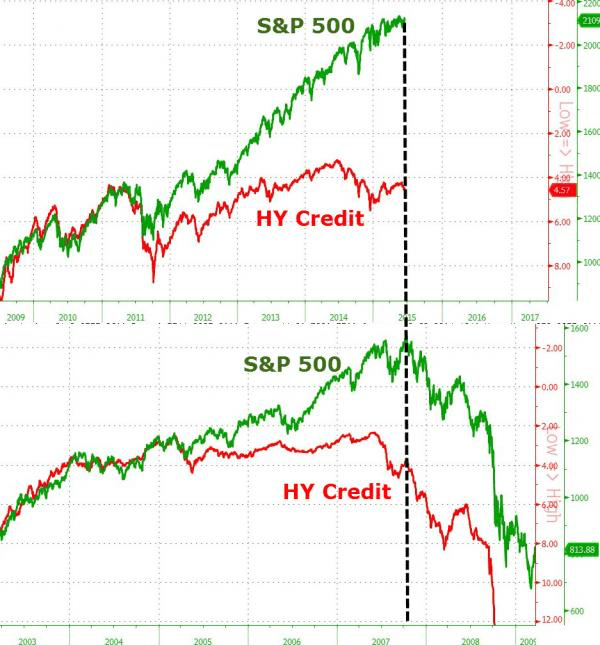

Despite the title of the email one may not see too much of disconnect below. If High Yield Credit remains a leading indicator of future stock movement we may be in for a bit of a rough ride.

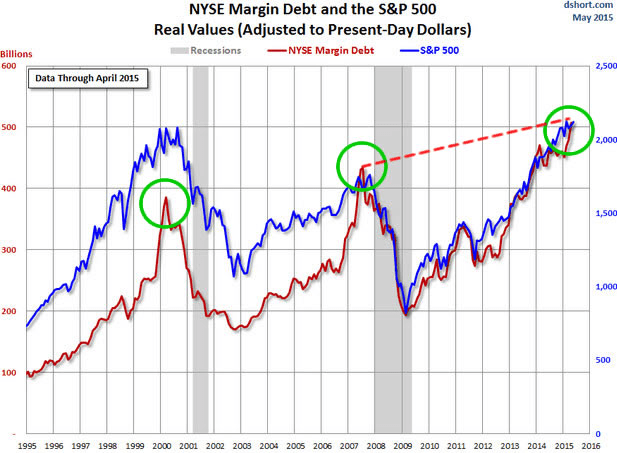

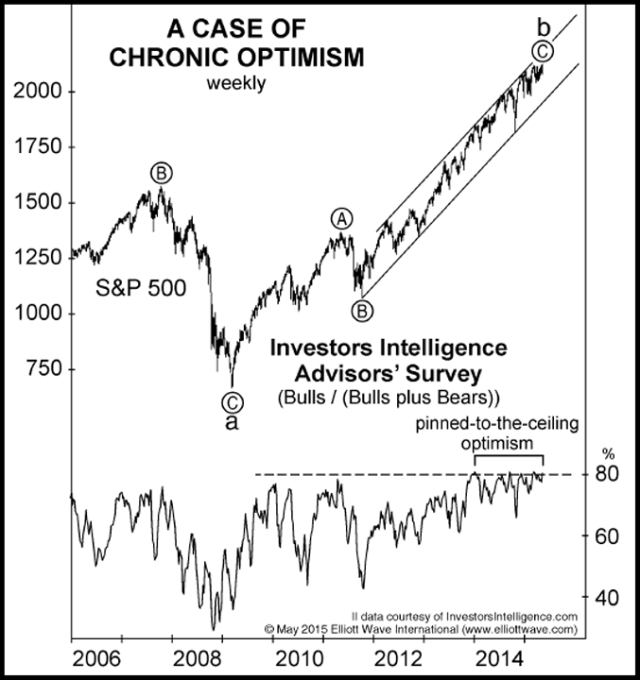

The scenario above is not on investors minds as it relates to the chart below, their capacity to gear up into market is at all time highs. The Fed has got your back,right, can’t lose??

Peak optimism??

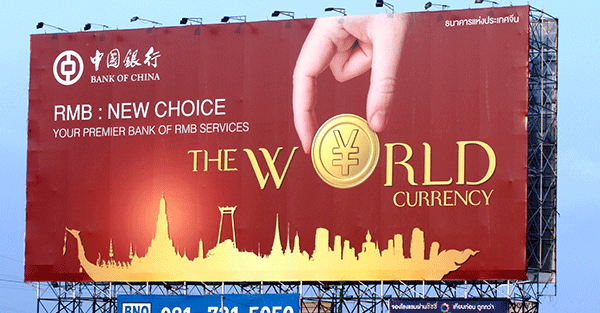

Complete Disconnection.

Disconnected??

Recent Comments