It’s not usual for peoples (folks, if you’re a US President) response to any critical thinking of current global economic policy to be, “well, we’ve come this far without distress, why can’t it continue”?

Continue it will, all the way to red line, maxed out debt, negative interest rates (a result of unsustainable debt levels) and, eventually, runaway inflation (increasing interest rates???), making a $10 note in your hand incapable of buying bag of lollies in a years time. We’re already on track with the first two and if your in the market for high end Manhattan or London property and Art, you could almost tick the third box. It will continue until it breaks. Where will you be when it does?

Yep, she might be right, the can may be kicked down the road for another 6 years, but we doubt it. Despite the efforts or our ever deceitful global leaders to maintain a failing status quo, nature will take its course, as it always does. Timing is hard predict. We just hope its by sensible economic reform and not war.

Doom and Gloom to some, opportunity to others. Diversification remains the best protection to a capital hit.

For the ignorance is bliss crowd, tune out now, because today, we’re going to give you a few more examples of some unnatural naturalness (if you believe MSM news).

The first may seem a little innocuous but it is the reason for recent stock market resilience and currency jack knife.

We’ve included our dumbed down explanation below the following chart.

Shortly after 6pm London time yesterday, The ECB’s Benoit Coeure told a non-public audience of hedge funds in London that “the central bank would moderately front-load its purchases in its quantitative easing program because of the seasonal lack of market liquidity in the summer.” The reaction was a 50 pips drop in EURUSD… but this was inside information was not released to the trading public until around 8am London time – and resulted in a 150 pip plunge.

If you do not understand the meaning of “front-load”, before “lack of seasonal liquidity” let us help. Bringing forward more money printing because we’re not entirely confident the system will make it through the time (Northern Summer) we’re all on holidays. You may find this bizarre, we do, but let this not blind you to the virtuous reaction of global markets. All up.

It just feels lie another dose of Hopiem to keep things on an even keel. Like:

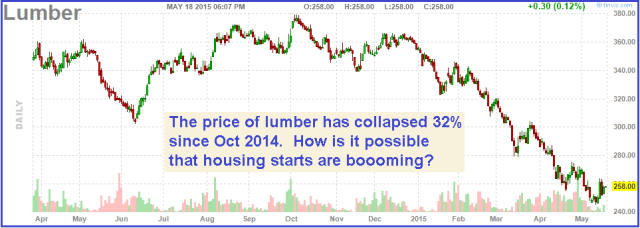

Poor housing numbers? Then just make them positive.

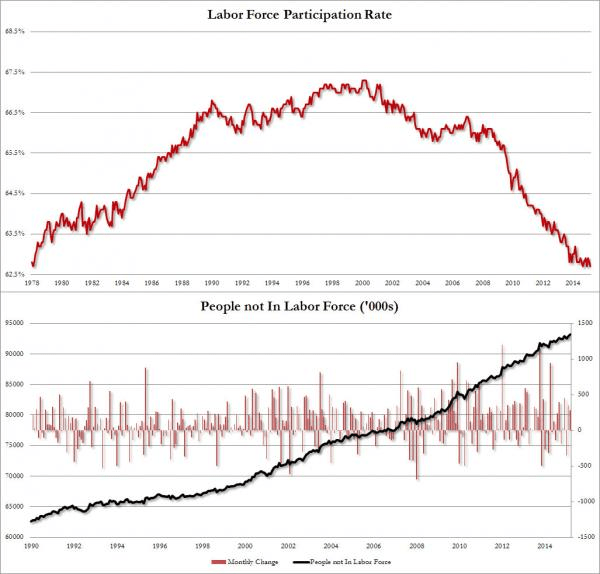

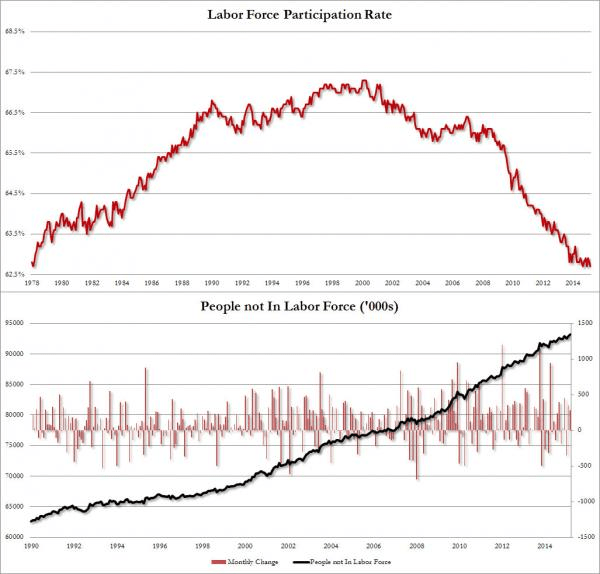

Poor job numbers? Just take out the unemployed.

Too much debt? Lets bring interest rates down and get some more!

Balance sheet pressure through asset write downs? Its ok, we’ll change the rules so you don’t have to mark to market, ever! The real law that saved global banks in 2009.

And, as above, if things get serious we’ll buy everything……front loaded!

And hope no one notices.

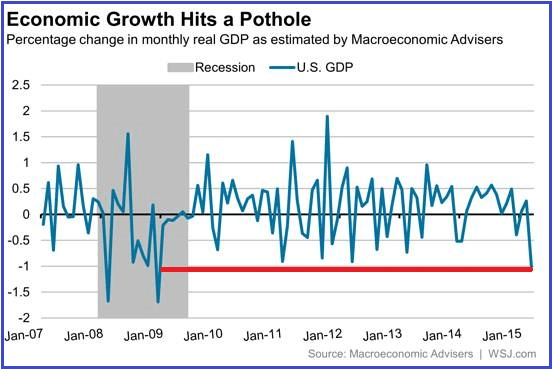

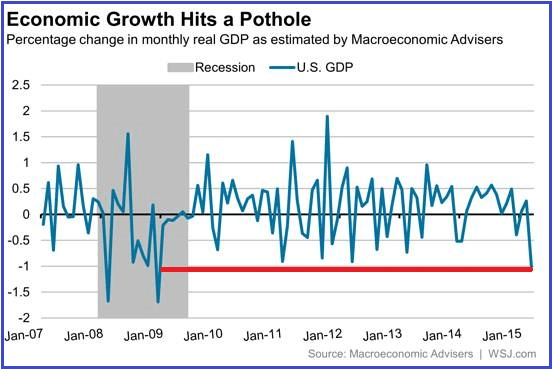

If these steps sound like desperation to you, you’re right. Two weeks ago, below, is what US GDP growth rang in at, the more positive Bloomberg estimate is on the right!. Soak it up while it’s still publishable!

How can you support the Mt Everest of debt mountains, Europe, US and Japan with such anaemic growth.

Its ok, its a rhetorical question. You just adjust the printing dial to 11, and print more. https://www.youtube.com/watch?v=EbVKWCpNFhY&spfreload=10

Its easy, lets give everyone 100 year loans at 0% and worry about it later because this is where the Greece thing is heading.

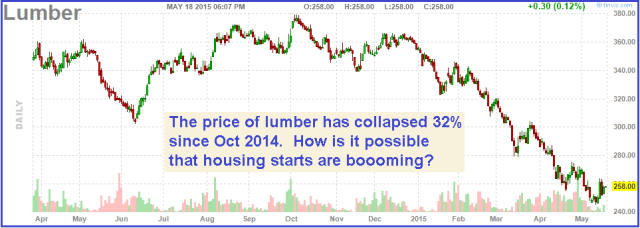

Back to the point, again, The US housing recovery: No need for timber anymore?? Unlikely.

Job Growth?

We could go on but you get the message, again.

Now, know what you own, be diversified and stay very, very alert!

Recent Comments