Sell in May and go away used to be a popular mantra among old time traders, once upon a time, before central banks decided they’d never let equity markets fall by more than 10%.

Before the budget comes down tonight we hope you’ve gone and done what our good government instructed you after last weeks rate cut, go out and borrow as much as you can (if you haven’t already) to help our economy grow. Still can’t believe Joe Hockey said that. This is relevant to the main story today. Credit, and its importance.

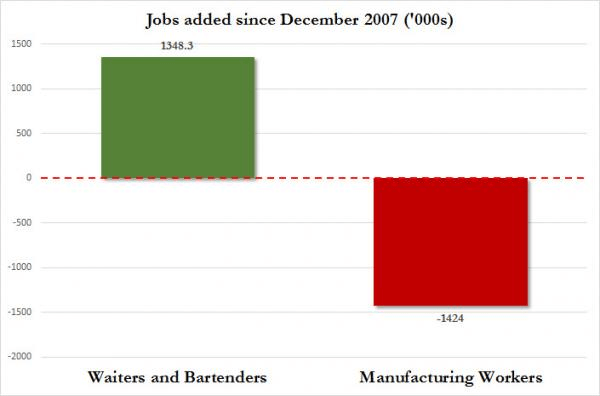

Before we get to this major story one cannot resist having a crack at one of the easiest targets for major bullshit hunters there is, the totally awesome US (NFP) job numbers.

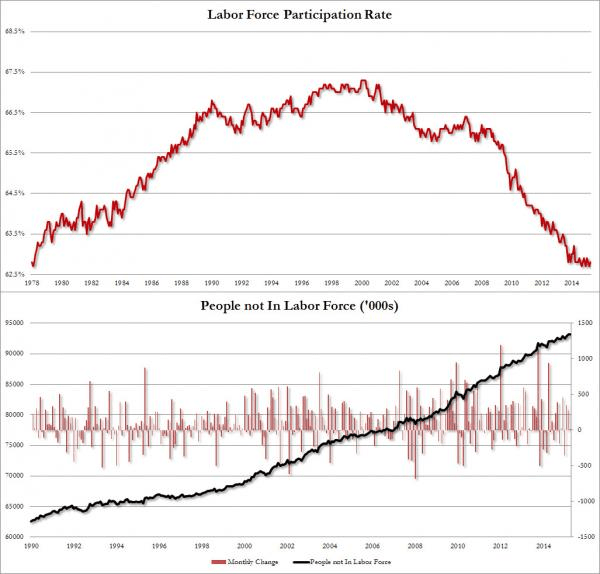

Lets just take a step back and look at what all financial commentators and stock markets celebrated. The lowest employment participation rate in 40 years along with incredible job growth in food services. The best part of this celebration is that a month later the numbers are usually revised down, going unnoticed by the same media!!

One, more serious, story emerged from last week. Bigger than the Federal Budget about to be laid down tonight.

All hell broke out in Credit markets. Bet you didn’t notice! It is important to understand why this is important.

The press constantly harp on “All Ords up this much” and “S&P or Dow Jones” did this. People come home from work, flick on the news by TV or Net and see “what the market did’ and ,perhaps, consider themselves informed.

Let us tell you right now, stock markets are a mere side show to the Big Top Circus that is credit markets. This is true throughout Europe, US and Asia, as it is everywhere.

This is the case because credit (Bond) markets are so much larger than Equity markets. The world revolves around credit. Our daily lives will be turned upside down when credit markets freeze up.

Without fully functioning credit markets distribution breaks down. Real Estate Market cease except cash purchases or barters. Companies cease to trade, being reliant on credit lines and letters of credit to trade. Currencies themselves will be effected as everywhere, they are backed or supported by and actually exist solely as a result of functioning credit markets.

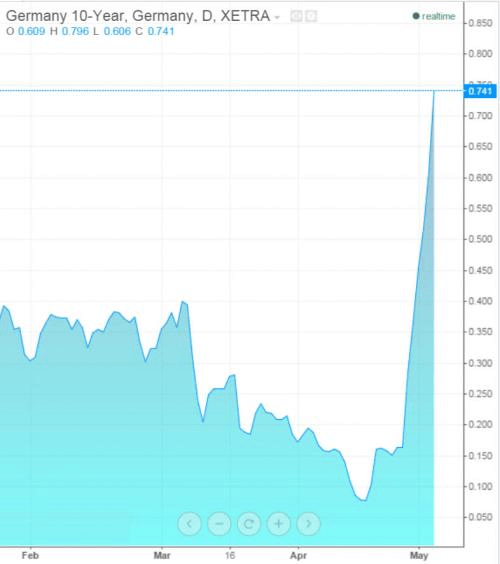

With the above understanding, what happened last Wednesday/Thursday night in credit markets may have been terrifying to some. Globally, credit markets began to sell off. Let’s take one example below – the German Bund. The fastest drop in history.

Remember, this was a global event. To put this into perspective, German Bond yields went from .59% to over .76%, a rise of nearly 30% in yields….within hours.

Germany is considered the safest credit in Europe. The 10yr bund was yielding under .05% just two weeks ago!!!

Within hours of US markets opening central banks stepped in and bought yields back to mostly ‘unchanged’. Who knows how much capital was needed to do this. A lot was done through derivative markets. Most tellingly, the following.

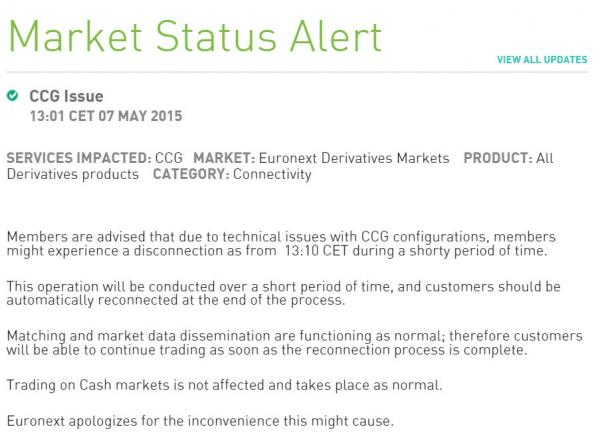

As massive derivative volumes flowed through from the mornings bond rout and managers scramble to reposition , Euronext (a major exchange) issues the markets with this!

Then, once “ORDER” is restored, this! 38mins later!

To make clear what happened, derivative markets broke and this gave central banks a chance to restore order.

Did you even know this was happening while you were sleeping on Thursday? Did you know when you woke Friday? Did you go through Friday and the weekend unaware that credit markets had melted down, broke and then rescued? Do you even understand why this is important?

If your having trouble understanding, Bonds prices have an inverse relationship to yield.

Why this is important is because it is only a matter of time before global credit markets do break down. Its a mathematical certainty because there is too much debt for the global economy to support. This is at a time when there is less than zero compensation (interest rate) to compensate for this risk.

Many think it may be an overnight event and spread within 48hrs. It may take less than 24hours. Had central banks not stepped in the panic may have spread to the US and into the close. Another round the next day and markets just might not have re opened.

The question for you is, were you prepared for markets to have not re opened yesterday morning? Do you know what you own and what you want to own should markets close and not re open for a couple of days or weeks?

The point being is we do not know how or when it may manifest but something is brewing behind the scenes and luck will favour the prepared. We do know that if something “bad” happens with the amount of debt, financial leverage and connected derivatives outstanding, the result will not be “good”.

This one episode should be enough to show you that you didn’t notice anything different. Business as usual, right? With central bank balance sheets rotten to the core they cannot save the world “forever” but then again, we (in Australia) have a long way togo before we look like Japan, right?

Recent Comments