Sometimes a story crosses ones path that causes ones back to straighten and just say, “wow”!

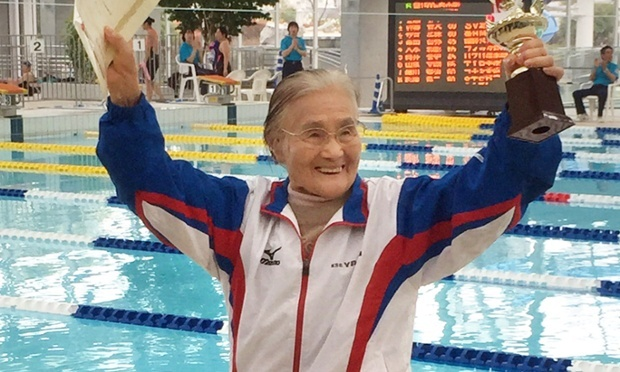

Yesterdays mornings news in Japan contained no better story than that of Mieko Nagaoka, 100 years old, who just set a world record for her age in a 1500m freestyle race (we won’t worry too much about the time).

The fact that she is not the only one to have completed 1500 at 100 years old is jaw dropping as well.

As active water sport participants we truly salute this feat.

How about living to 100 then? Just imagine what she has seen come and go since 1915!

Success, collapse, war, revival, boom, bust and now.

Given that the worlds oldest recorded human died recently, also Japanese, at 117, she may have a few more years to go and, therefore, may be a tad concerned about the current state of Japan’s economic trajectory, from the point of view as a saver.

Not sure what we mean? How about printing enough money to target a 2% percent inflation rate while interest rates are at 0, when in fact, the cost of many necessities of living continues to climb due to policy designed to “crush” the Yen.

This situation defines “ success” in todays modern economic model around the globe. The average person in the street in the street in Japan complains of the continuing rising costs of basic necessities, particularly fruit, while corporate Japan celebrates the spoils of currency debasement.

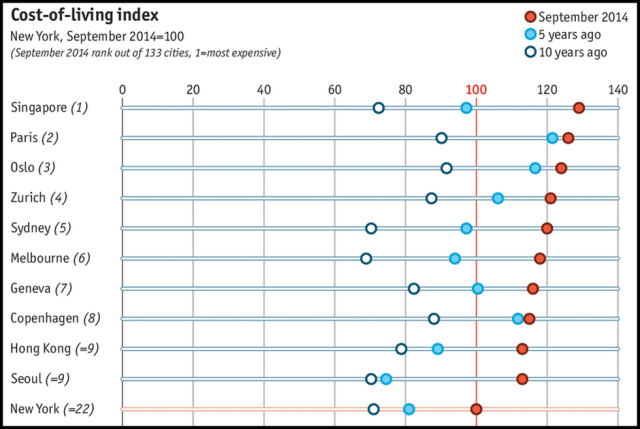

Out of interest, check the most expensive places to live, courtesy of The Economist.

You may ask what this matters to us in Australia. The answer is Global Central banks, including our own, are all on the Japanese trajectory. Beggar thy neighbour style.

It matters because as long as the debt excesses of the last 40 year debt binge remain uncleared (one can include here the quadrillion dollars of associated derivative paper created post 1998), governments and central banks will continue to implement policy to cope. This primarily includes printing masses of money and holding interest rates at 0 or below.

With this in mind, if you are a retiree, you might think to throw your lot in with this policy and put more of your hard earned into stocks because your income is falling.

The issues here are truly of capital preservation and diversification, including currency.

It’s hard to believe that the federal Government is actually flagging further punishment for savers through superannuation “reform”. We’ll have more to say on this in coming weeks.

In the meantime, we’re often asked what happens if something gives in this environment? What happens is the reason you are seeing intervention in virtually all markets these days.

It’s obvious the US stock market has been goosed up for years, mysterious buyers, just at the right time, the Japanese have openly stated the BOJ enters the stock market to add “liquidity” and in Europe its much the same, and, of course, the obvious intervention in the paper gold market to keep these policies “looking good” is also unsustainable.

The bond market is even more of a joke to savers. To its extreme there are almost no bond traders left in Japan because the BOJ IS THE MARKET! Negative bond yields abound in Europe in the face of a dire economic background.

All of this successfully gives investors the impression that stock markets are also to be “supported” thus enticing frustrated savers into taking more risk by moving more into the stock market.

So, back to what happens when something gives. If you guessed more money printing you’d be right. But the problem is that it won’t work and its not working. There is nothing left but major reform. The type that should have occurred after the credit fiasco in 2007/08.

When legendary fund manager, William Kaye was recently interviewed for RealTV, he was asked what the main differences are between markets now and and 1990, when he first set up shop in Hong Kong from the US.

His response was immediate, then there was natural price discovery in markets then, now there is none. Now, derivatives are the most important price determinant and Central Banks have expanded their balance sheets to a point never seen in modern economic history.

Pretty much sums it up. He went on to add. “You must understand over 5000 years of history there is always an end point for this type of money printing and currency debasement. When the inevitable freeze over comes, you’d better be ready”.

As we’ve expressed here before, the Bank of International Settlements, the IMF and now the AIIB have a road map for the way out. One can already see movement at the station. Possible reweighed Global SDR currency, rebalanced to a more trade weighted inclusion of China and other recently risen players, as well as gold. Its the only end game. Be patient.

Persevere with capital preservation strategies, the opportunities will far outweigh in the long term.

Recent Comments