In todays note we’re going to remind you why it is that investors need to remain on guard in their hunt for yield and not disregard systemic issues.

Why is it do you think investors in Nestle’s 4yr bonds are prepared to accept a negative interest rate?

Why is it that record volumes of government debt have moved into negative yields since the ECB became the first central bank in the world to begin charging banks to hold their surplus cash last June. More than €1.5tn of euro area debt maturing in more than a year now pays a negative yield, according to JPMorgan, compared with nothing a year ago?

German debt now has negative yields on bonds with maturities up to six years, as does Denmark. The Netherlands, Sweden and Austria all have negative yields on debt up to five years while Swiss bonds are now negative up to 13 years.

One theory is that investors are becoming more concerned about return of their capital than return on capital. Some may say it’s just the weight of Central Bank liquidity from emergency stimulus measures, aiming to kick start growth (and inflation) in their economies. Both are correct.

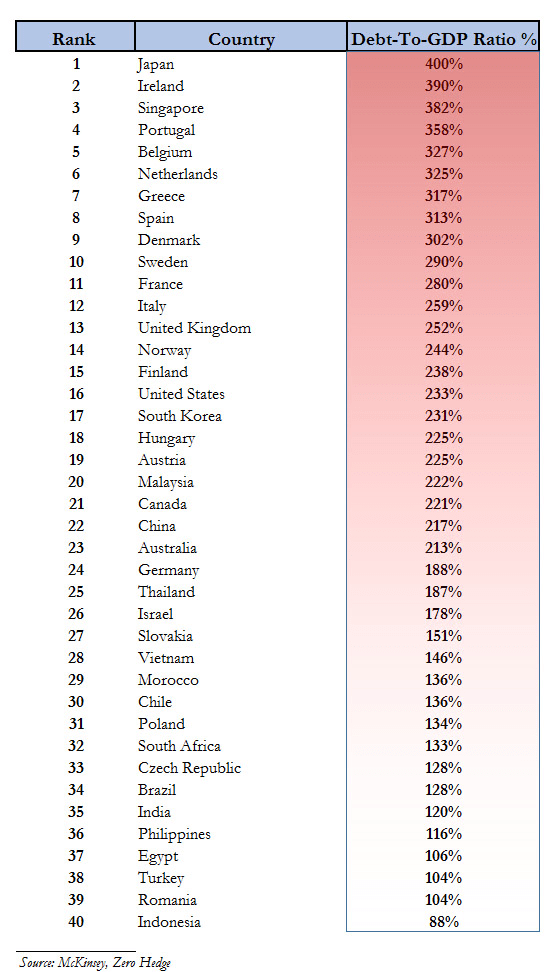

The real issue, as you’ll see in a chart below, is the shear size of debt mountains, globally and the paper derivative daisy chain that is connected to it.

It’s pretty obvious this system is desperately in need of reform but this will not, unfortunately, happen voluntarily. Mother nature is imposing her will more forcefully by the day.

Not to worry, the ECB starts its QE money printing program next month! More and more. This is the reason, one cannot afford to be completely out of shares and continue hold a balanced portfolio, including a sensible allocation to precious metals.

Below is what the possibility of more money printing has done for the US!

And globally:

Howabout that debt chart below! Australia only coming in at 23! No need to worry about this low ranking, we’d certainly be near the top if private debt was included.

To go on from this, The Wall Street Journal reported last week that some large European Banks are likely to fail the US Federal reserve Stress test in how they measure and predict potential losses and risks.

A number of banks were mentioned, including our favourite, Deutsche Bank. DB is also the institution with the largest exposure to Greece! The inevitability of “the deal” is revealed.

Actually, the explanation that Deutsche Bank is lacking in its “risk management” department should be enough to give one a chill, especially when one considers the second big problem. Then again, technically it not just a second problem: it is some 62.2 trillion problems, which is what the gross notional exposure of all derivatives on the Deutsche Bank balance sheet is pre-netting (and as Lehman showed us, netting only works in a perfect world in which there isn’t one single counterparty failure: if there is, there is no netting and gross instantly becomes net, simple as that).

So a bank which has €54.7 trillion, or a little over $62 trillion at today’s exchange rate, in derivatives – a number that is 20 times greater than the GDP of Germany – just failed a central bank stress test due to lacking governance and risk management controls and, just maybe, has insufficient capital? What can possibly go wrong?

Recent Comments