Is this the answer to a debt problem? Take more debt and pretend the current debt doesn’t exist by extending it so far into the future it doesn’t warrant concern? On the current trajectory, in many Western economies, will you be paid by banks to take a loan and pay to have your money stored in such a secure place? Don’t laugh, its really happening. More debt on more debt to solve a debt issue.

This is the current conundrum Greece faces. The real issue here is not just Greece. The eyes of Italy, Spain, Portugal, France, UK, US, Japan and, ah well, lets just call it the entire Western Keynesian economic model has their eyes on this dog and pony show.

No need to worry about Greece yet, according to the EU, they haven’t properly encouraged a “bank run”! Really, who still has their money in a Greek Bank account?

The answer is, those who’s economic lives have already been destroyed by the ill-conceived policy of previous Greek administrations and their EU masters. Surely there cannot be much left to take?

It’s true, there is not much left to take but there is so much more to give! The European Bureaucrat answer to all this is extend and increase the loans, pretend they don’t exist and time will take care of the rest.

The only negotiation here are the terms. This will happen. Unfortunately, Greece will not leave the Euro, Ze Germans will not allow any write downs of debt as the banking system does not have the collateral to absorb it and it will all be extended out to eternity, buried in some far flung accounting galaxy, never to be spoken about again. Just never mention the “default” word, ever and things will just move right along, just like they always have. This and “haircut” are the two words you will not see in the wash up of this debacle.

As the tension builds, then fades, as you may wonder how a deal got done, remember this, a left wing Socialist Party does not exist with out providing more free shit and a parasitic beaurocracy cannot survive a system reset without change, the item to be most avoided.

Is this the new normal?

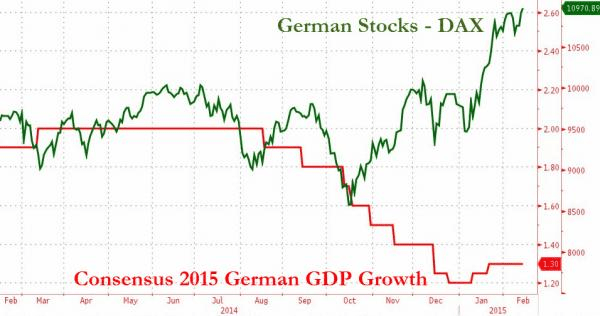

German Investors hope things get even worse.

How about this for some awesomeness.

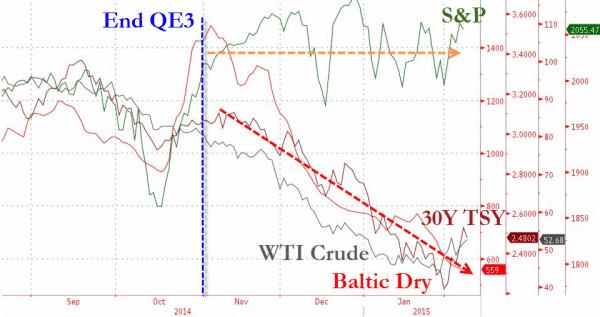

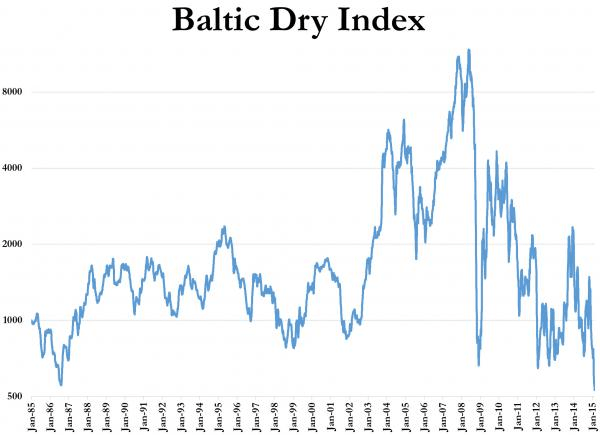

How about the collapse of bulk shipping costs? Mal-investment-driven excess supply, debt-saturated inequality-driven demand shrinkage, or both?

Just to finish, some comment on the Euro situation.

According to a poll by German ARD television, 68 % of Germans oppose a debt cut for Greece.

61% said if Greece renounces on its international obligations, as Syriza threatens to do, it should leave the Euro.

And Italy……..

Beppe Grillo’s Five Star movement – with 108 seats in parliament – is openly calling for a return to the lira. Mr Grillo proclaims that Syriza is carrying the torch for all the long-suffering peoples of southern Europe, as it is in a sense. “What’s happening to Greece today, will be happening to Italy tomorrow. Sooner or later, default is coming,” he said.

Nor is that prospect too far-fetched. As Dutch author Willem Middelkoop has written in his 2014 book The Big Reset: War on Gold and the Financial Endgame,

“A system reset is imminent. Even before 2020 the world’s financial system will need to find a different anchor. … In a desperate attempt to maintain this dollar system, the United States waged a secret war on gold since the 1960s. China and Russia have pierced through the American smokescreen around gold and the dollar and are no longer willing to continue lending to the United States. Both countries have been accumulating enormous amounts of gold, positioning themselves for the next phase of the global financial system.”

Maybe it’s just another far fetched story waiting to be proved fact, who knows. Its just fuel for thought in the current one way street of Central Bank omnipotence.

Footnote: FOMC minutes (comments from US Fed officials) confirm that everything is still so awesome that they are considering keeping rates at Zero for longer!!! Surprise. Didn’t see that one coming! Rate rise anyone?

Recent Comments