“Everything is awesome” is the song you need to see the Lego movie for. If you haven’t, its worth it. The Lego Movie is one of those classic kids films with adult theme overtones that half the adult population (being kind) don’t get.

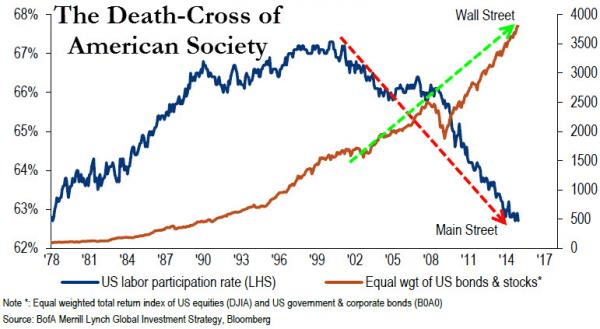

Before we get onto the main topic of todays note, we present to you one the best summaries of “everything is awesome” after another “knock the lights out” awesome job number last night in the US.

Attempts to mask the fact the number of Americans working full time is at a 36 year low are a total embarrassment and have consequences.

More awesomeness below.

We don’t have much to say about the Greek/Eurozone Tragedy as we’ll just see how it rolls, this is a good summary of how it looks.

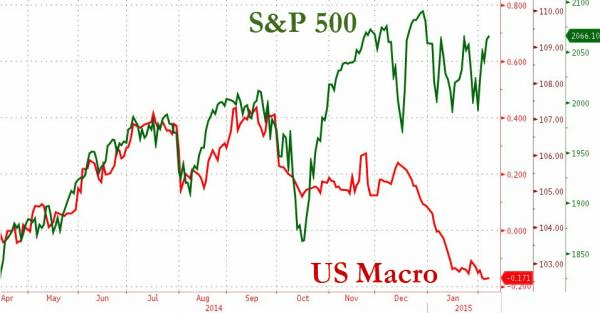

There’s no point breaking down bullshit job numbers, instead, we’re going Going to focus on one of the other effects of the totally awesome jobs numbers last night. The gold price.

Yep, down 2.5% on the back of recovering US economy, a collapsing Eurozone and 0 interest rates around the world the worlds largest economies. There low because if they went up, there is so much debt that economic growth would slow even faster.

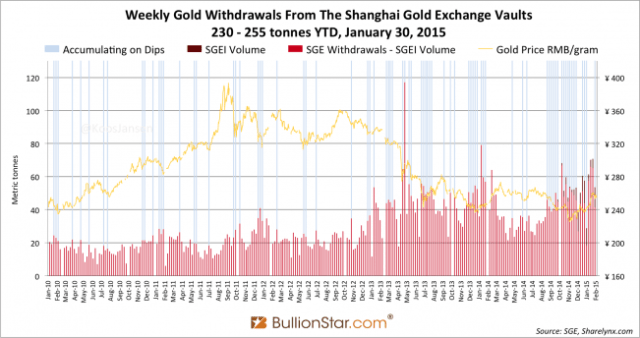

The mystery to us is that the Chinese, Indians, Russians(Evil) , Germans, Dutch, Danes, Turks, Persians, Mexicans and now even Belgium (among others), don’t seem to be buying into the awesomeness. They seem to be clamouring to buy or repatriate the completely unawesome yellow metal.

Something truly awesome is, why would it be that for the month of January, there were 255 tonnes withdrawn from the vaults of the Shanghai Gold Exchange? At this pace they’re on target to withdraw 3060tonnes form the system, never to been seem by a Western Central Banker, ever again.

We do know that there is always strong demand leading into the Chinese New Year so this type of monthly amount may not continue. It can’t. If it did, it would swallow, by itself, entire global mine production.

On the back of the above stated withdrawals we have no idea how much gold the worlds largest producer (China), produces now. Its not disclosed and most certainly nothing gets exported!!!

How long Global Demand can outstrip supply is not known to us.

The whys are easy. A rapidly rising gold price (or even just rising) signals all is not awesome in the Fiat currency world and needs to be controlled.

The wash up is physical demand is rising and supply is falling as its less profitable to dig the useless yellow crap out of the ground.

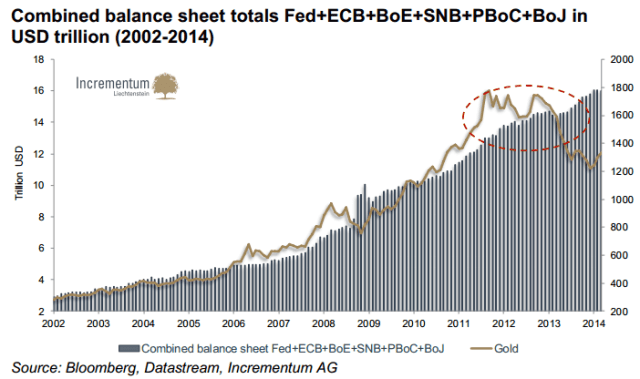

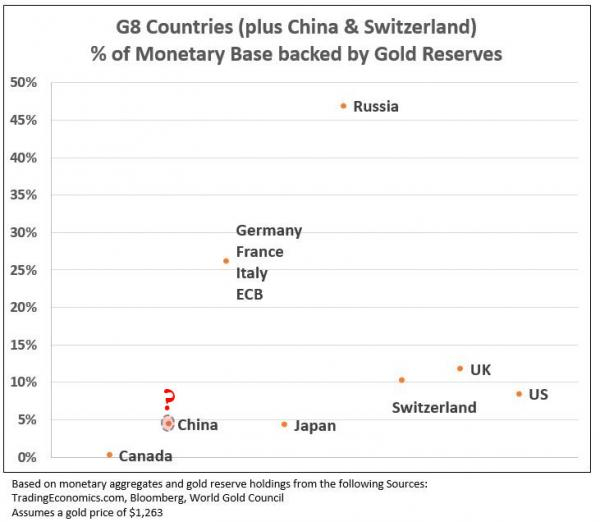

As Central Bank balance sheets go SUPA NOVA in 2015, what is this chart below going to look like?

So what are we dealing with as far as Monetary Base updates go if the SHTF.

While Russia’s relative gold holdings, relative to its fiat exposure, are truly impressive, the real question we, and anyone esle should have about the chart above, is where does the red question mark representing China’s gold as a % of its monetary base, currently lie. Yes, we know what China’s gold was in early 2009 when the PBOC gave its last official update to the IMF, but to assume this has not changed in 6 years is ludicrous, especially since as Zero Hedge first showed back in 2011, citing a Wikileaked report of what China’s Foreign Exchanges Administration reported on the topic of China’s rising gold holdings. From the source:

“China increases its gold reserves in order to kill two birds with one stone”

“The China Radio International sponsored newspaper World News Journal (Shijie Xinwenbao)(04/28): “According to China’s National Foreign Exchanges Administration China ‘s gold reserves have recently increased. Currently, the majority of its gold reserves have been located in the U.S. and European countries. The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold’s function as an international reserve currency. They don’t want to see other countries turning to gold reserves instead of the U.S. dollar or Euro. Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar’s role as the international reserve currency. China’s increased gold reserves will thus act as a model and lead other countries towards reserving more gold. Large gold reserves are also beneficial in promoting the internationalization of the RMB.”

So don’t be surprised if and when China provides its next long overdue gold holdings report, if the Chinese dot is located above Russia’s.

Be very careful how far down the “chasing yield over capital protection” rabbit hole you go. It may be a long way out and the exits may be crowded. Balance and positioning are important.

Sometimes the hardest thing to do in investing is wait for the right opportunity to come along.

Recent Comments