As January goes, so does the year? We hope not.

So quickly have the economic/monetary/geopolitical sands moved over the last 29 days, some investors may have been “Big Chrissie Bashed” blissed enough to have let the water pass under the bridge. Wise.

For those interested, Europe has been the main event. The Euro experiment express train is really starting to pick up pace toward its destination.

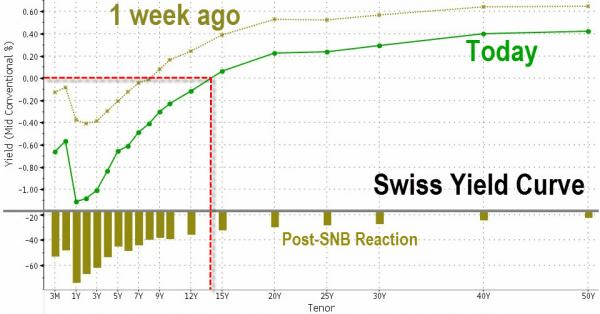

We think the Swiss Central Bank throwing in the towel of currency management takes the prize for surprises so far, 30% movement in one day, after saying just 4 days before, unequivocally, they wouldn’t depeg their currency to the all important Euro, they did. WOW. Wait for more bodies to appear from that one but don’t forget, in this world of high stakes derivative leverage, there are winners too. We just hope the losers don’t start the domino’s moving.

Not so surprising was the European Central Bank UNLEASHING its “Quantative Easing” bond buying program a week after the SwissCentralBank released itself from € protection duty. Related story? No doubt.

So, how’s it all working out? Regardless of the the geopolitical situation in the Middle East, the soon to be last ditch efforts of the European €60BILLION per month “Quantative easing” stimulus package is, by far, the largest story for so many reasons. Regardless of the fact that, politically, Europe is falling apart, it seems time to look at the effects of this Quantative Easing thing.

Firstly, easing of what? Are you paying less to service your debt? Does 0% for 100 years sound good? Do you feel you have to move your money from “cash” into Bank stocks for “yield”? Welcome to the party. You’re all in.

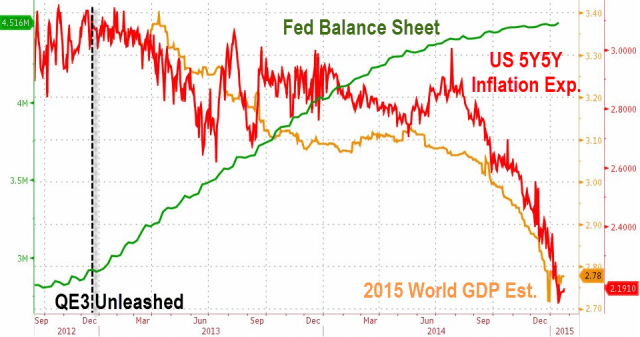

Japan, too, is all in but the US have put their 6 years of QE, “on hold”, for now.

Do you not wonder where its all gone and why?

A strait A, well educated, Financial Institution Employed employee is, generally, going to tell you that things are on the up and up and all this money creation is going into infrastructure and constructive spending, leading to a rise in economic growth, as it has in the US.

This is not true. Global economic growth has been falling for the last 4 years, despite the creation of these life saving programs. It has not worked and we are in the “reform before war” camp.

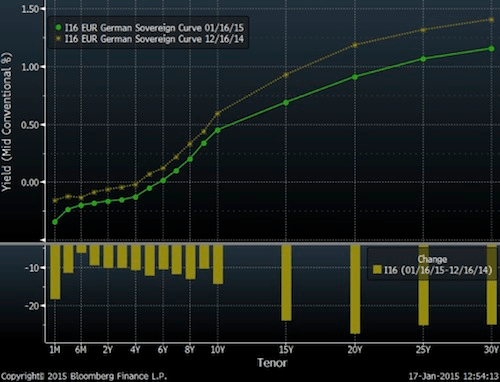

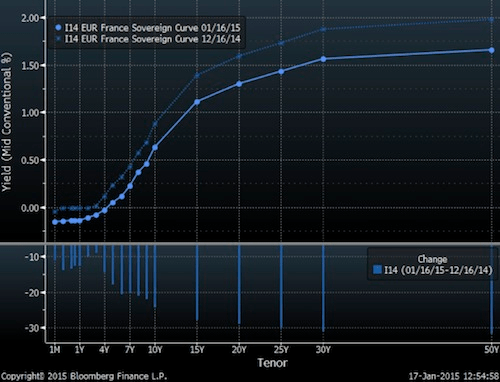

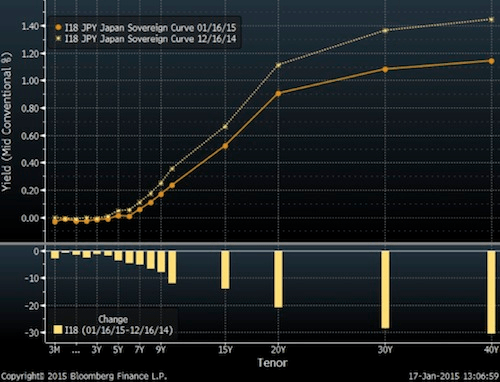

The charts below tell you the past and future, they represent the cost of money. Buying a French 4yr bond and having to pay to hold it (negative yield) is beyond a joke. Banks in many constituencies in Europe have negative interest rates. You are actually charged to hold your money in some banks.

Why? Too much debt, keep rates low (negative??) and provide lots of hopium to the system so it doesn’t blow up? Does it have an end? We don’t know, but Edna Mode says, “luck favours the prepared”!

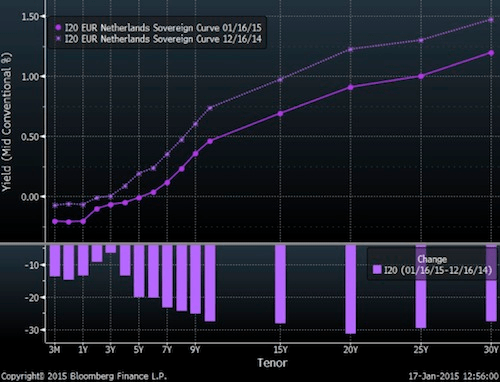

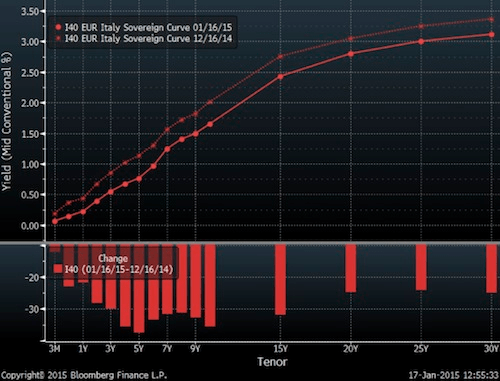

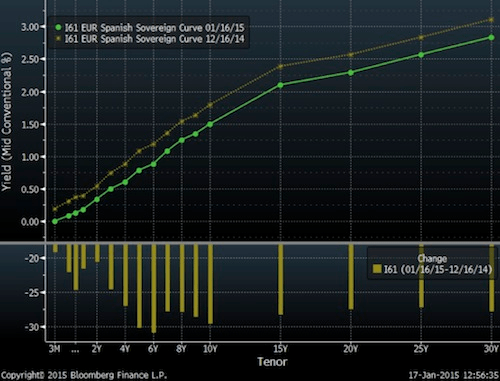

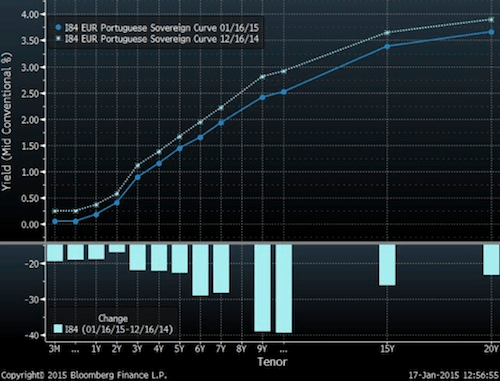

Lets look at some charts. They’re from two weeks ago but haven’t really changed.

Pop your money in a Swiss 1 year bond for –1.2%. That’s a minus sign in front of the 1.2%.

You’d be better off in Germany, just.

Seriously, can you understand a world where French four-year bonds have a negative yield? Or where their 10-year bonds yield about a third of the US rate?

Netherlands rates turn positive four years out – whoopee.

Meanwhile, Italy has debt-to-GDP of 133% and growing by 4-5% a year and a 10-year bond yielding less than that of the US 10-year. Can we have more?

Spain – all positive, but with a 10-year that pays less than Italy’s.

Gotta love the Portuguese 10-year at 2.97.

Japan’s 7-year is almost negative (+0.1%), who cares anyway, they so need…..ah, don’t worry about it.

Stocks, anyone??

For those that got this far, we’ll get to gold on the weekend! Useless yellow shite.

Recent Comments