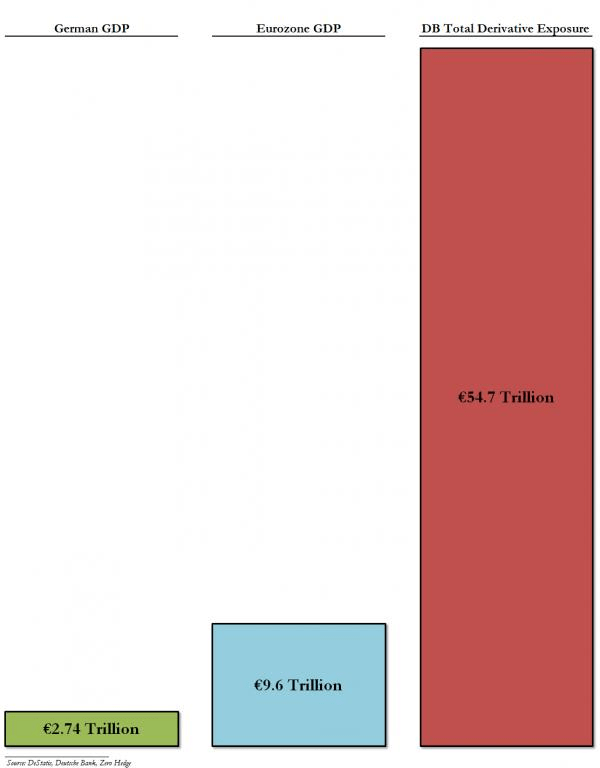

“To give some perspective regarding size here consider that the credit default swap market based on housing that nearly took down the system in 2008 was $45 trillion at its peak in 2007.

In contrast, the global bond market is well over $100 trillion today.

And it’s growing rapidly.

Indeed, US corporates are on track to issue over $1.5 TRILLION in debt this year alone. Not only will this be an all time record…it will be the third consecutive all-time record for corporate debt issuance.

Part of the reason that the bond market has become so enormous is because few entities, particularly sovereign nations, have the cash handy to pay back debt holders when their debts come due.

As a result, many of them are choosing to roll over old debts OR pay them back via the issuance of new debt. The US did precisely this in the last few months issuing over $1 trillion to cover for the payment of old debt that was coming due.

So the bond bubble is not only over $100 trillion in size…it’s actually GROWING on a month-to-month basis.

Reading all of this is no doubt concerning. However, the situation becomes much worse when you consider that over 81% of ALL derivatives trades are based on interest rates (BONDS).

Globally, the interest rates derivative market is an unbelievable $555 TRILLION in size.

These are trades based on interest rates that in turn are based on the bond bubble. Thus, the significance of the bond bubble simply CANNOT be overstated. Banks and other financial entities have literally bet an amount equal to over SIX TIMES GLOBAL GDP on interest rates.

This is why Central Banks are absolutely terrified the moment a sovereign nation comes close to defaulting. Consider that Spain’s bond market is just $1 trillion. But the derivatives trade market based on Spain’s bonds is likely well north of 10X this amount. Same for Greece.

This type of leverage is extremely dangerous. Small movements can wipe out entire capital (collateral) bases in very short periods of time.

This is THE BUBBLE!. This is the bubble and, potentially something we continually need to be wary of in 2015.

There has been no reform to this problem.

To remind you of how this looks for Europe’s largest bank.

Yes, a potential lack of collateral is concerning more entities than us.

Which, of course brings us on to news in the mysterious world of paper and physical precious metals.

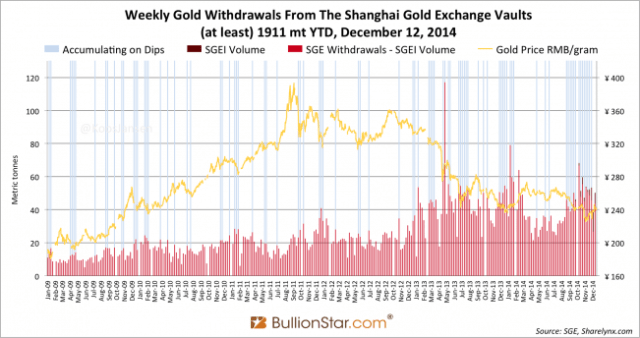

In the physical world, even with a collapse in the Russian Rouble, China, India and others continue to accumulate precious metals at amazing rates.

This week we added Austria to the growing list of European countries looking to repatriate their Gold Bullion to home soil from the safety of London and New York.

Russia has made it clear they’re not selling and actually added another 18 tonnes in November. https://www.bullionstar.com/blog/koos-jansen/

The Chinese are finishes their purchases for 2015 with a bang as wholesale demand hits North of 1900 tonnes for the year to December 12.

The bottom line is, physical demand continues to grow from varying sources as supply falls with the price, resulting in this massive transfer of of Bullion from West to East.

Paper markets can be summarised this way. This what Mario Draghi had to say when asked what type of assets the ECB is going to buy to hold the ship together: https://www.youtube.com/watch?v=YasCHR1pZ7w

Many people say it make take many more years for this to “pan out”. We think not but time will tell.

We look forward to helping you find some “gems” in these markets over 2015.

Merry Christmas and Happy New Year. We hope it’s a safe one for you.

Recent Comments