Before we go to the straight out malarky of the Physical Gold market lets have a quick run down on some other serious matters that are going to have a great effect on the price of your currency, energy, other goods as well as investments.

We mentioned last week that the trashing of the Japanese currency by Japanese policy makers will have consequences. They’ve no other way of dealing with their economic woes. So far, USDJPY cross has moved from 100 to 118 and on its way to 150, according to some analysts.

Lets through some colour round the issues. If your a Chinese competitor and the competition has just reduced its prices by 25%, what will you do?

25% in 6 months is a TECTONIC SHIFT in currency markets, unless you’re Venezuela or Zimbabwe.

More to the point, if you’re a German competitor and the same thing happens, you’re even more worried. Throw in the slowdown in China (global??) with that and orders are dropping off fast.

Have you noticed the response? The first one is already public. The Chinese, “unexpectedly”, dropped interest rates last Friday. First retaliatory salvo fired.

The second has been hinted but yet to be revealed entirely.

So far, because the Weimar disaster remains distant but not out of view and the main reason the Germans have been reluctant to allow a full scale, Japan, US style money creation experiment to enter Europe policy.

The gloves are now off and the European political elite of Brussels are licking their lips. A trillion Euro (yes, a trillion used to be a big number) stimulus, supported by Germany, designed to throw the Euro under the oncoming currency war bus!!!

Like the 100:1 derivative levered global Bank desks and Hedge funds, we wait with shortened breath. Be READY TO BUY on this news.

In the meatime…….

Why in the hell does the Netherlands announce last week it has repatriated 122 tons of Gold from abroad (US)? This request was first hinted at back in January 2013. Laughs? Germany gets 20 tons over the same period when it requested 300.

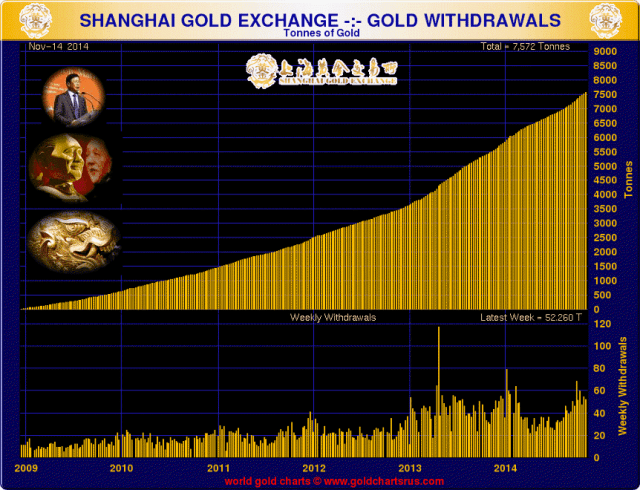

After you look at this you can also note that Indian (sub continent) importation of the useless stuff is up 133% YOY and the Russian import chart looks parabolically more than the the most important one below, Chinese (only 52 tons for the week ended 14/11/14).

And if you think this is strange, how about we throw France into the, “can we have our gold back” one lane freeway.

“First Germany, then the Netherlands, perhaps Switzerland this weekend, and now the French right-wing Front National, which shockingly came first in May’s European parliament elections, and whose leader Marine Le Pen is currently polling in first place in a hypothetical presidential election (in both a first and run off round), ahead of president Hollande, has sent a letter to the governor of the French Central Bank, the Banque de France, demanding that France join the list of nations which have repatriated, or at least tried to, their gold.

From her letter, here is the full list of French demands (google translated):

- Urgent repatriation on French soil of all of our gold reserves located abroad.

- An immediate discontinuation of any gold sales program.

- Conversely, a gradual reallocation of a significant portion of foreign exchange reserves in the balance sheet of the Bank of France by buying gold at each significant decrease in the price of an ounce (recommendation 20%) .

- A suspension of any financial commitment or loan contract would wager that our gold reserves.

- At the patrimonial and financial balance of the 2004 gold sales transactions ordered by N. Sarkozy.”

Gee, didn’t see that in The West this morning. In fact, you’ll be lucky if you see this in any Western media.

If you think that holding an allocation to precious metals is a useful idea, you’re certainly not alone. Every time the metal gets cheaper, physical demand rises, putting more and more pressure on fractional reserve delivery systems.

By the way, the Swiss main stream media has gone “all in’ telling its citizens the financial world they know will end if they vote “yes” on the 30th. This will not be a Black Swan event but its certainly captured the imagination of many.

Recent Comments