Wow!

There was no shortage of news in Financial Markets this week so we’re pleased that the best was left to last from those great central bankers of Japan.

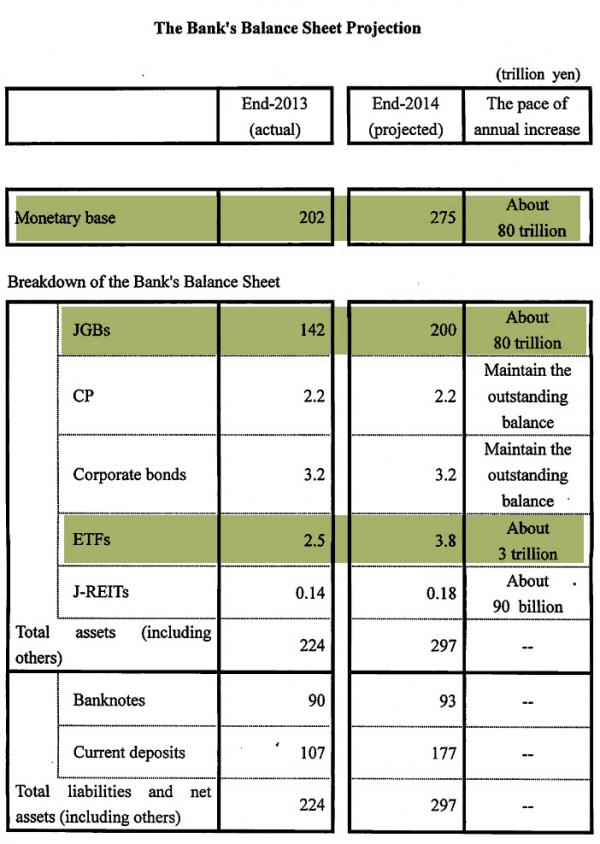

Bank of Japan (by a 5-4 vote) raised its bond-buying program from JPY 70 trillion to 80 trillion… and triple its ETF buying to JPY 3 trillion

Not quite the kitchen sink but very, very close. Roughly an extra 100B on top of the 700B USD equivalent. It’s a much smaller economy but they’re really going to give the USFeds 4.5trillion dollar balance sheet some competition. Bullish.

Haven’t seen this sort of stock market action since 2007. So without further ado, presenting, todays Nikkei 225. UP 5% IN ONE DAY>

Just 2 days after announcing the taper of emergency stimulus in the US, the Japanese take up the baton in a big way.

In a surprise move given all the recent congratulatory rhetoric from Abe and Kuroda on breaking the back of Japan’s deflation and bring about recovery (forgetting to mention record high misery index, surging bankruptcies and a crushed consumer), theBank of Japan (by a 5-4 vote) raised its bond-buying program from JPY 70 trillion to 80 trillion… and triple its ETF buying to JPY 3 trillion. This move, on the heels of more confirmation of broader foreign asset purchases in Japan’s GPIF sentUSDJPY instantly gapping 1 big figure higher to 110.30 and Nikkei futures instantly rose 400 points. S&P futures are also surging. And with the infinite QE bank on, Gold and Silver, tank! Go figure.

- *BOJ UNEXPECTEDLY TARGETS BIGGER EXPANSION OF MONETARY BASE

- *BOJ TARGETS 80T YEN ANNUAL EXPANSION IN MONETARY BASE

- *BOJ SEES RISKS IN CHANGING DEFLATIONARY MINDSET

- *BOJ AIMS FOR ANNUAL INCREASE OF 80T YEN IN JGB HOLDINGS

- *BOJ EXPANDS PURCHASES OF ETFS TO 3T YEN

- *BOJ: ETFS TRACKING JPX-NIKKEI INDEX 400 ELIGIBLE FOR PURCHASE

- *BOJ: WILL CHECK RISKS, ADJUST POLICY AS APPROPRIATE

Yep, they’re going to buy everything, stocks, bonds, Real estate and really expand the monetary base.

This is a 13 trillion yen increase, about another 100 billion USD, over the 600 billion pace they are already pursuing.

So all this money printing, positive for gold? Think again, Gold was slammed.

Wait until the Europeans read this play book. It’s really hard to see which economy is in deeper shit. The show goes on.

Attached you’ll find a very interesting piece from Grant Williams on an interesting referendum in Switzerland at the end of the month.

Something to look forward to for beaten and broken Precious Metal investors. We’re sure you’ll find it informative.

Have a great weekend.

Recent Comments