Stocks rise on back of rising global growth prospects, the headlines say.

What they should say is, “stocks rise on the back of central bank jawboning, more stimulus needed”.

Yep, it was US Fed speaker, james “Jim” Bullard (the name says it all), who chimed in Wednesday last week and said, “based on the data (lack of employment or GDP growth), the FED should delay ending its QE4EVA stimulus program”.

Combine this with the irrepressible, whatever it takes, ECB Chairman, Mario Drahgi’s promise to buy every bond available with freshly printed Euro’s and the global markets (Equities and Bonds, French 10 yr bond yield = 1.3%) are off to the races again.

Whew, things were looking a bit dodgy there for a couple of weeks or. Thank goodness for omni potent central bankers, saving the day, again.

But wait, are they saying we’ve had 15 trillion dollars worth of fiat pumped into the global economy over the last 6 years and its not working? This number does not include China because, really, who knows whats going on there.

Why? According to Nobel prize winning economist, Paul Krugman, it is because we haven’t had enough Fiat created yet. We definitely need more. We certainly know US Fed members listen to Mr Krugman so this is something we really look forward to.

Lets turn the sarc tag off for a minute and back up a bit.

If one looks back over 200 years of economic history (maybe you shouldn’t but we don’t mind the activity) one finds a very consistent pattern with financial crisis.

The private sector blows up then governments come in to save the day through stimulus, debt monetisation and growing Frankestienly large in the process. Like the debt, the cost of managing a super sized social payment system cripples the economy. Think, parasite growing too big for the host, what happens?

In the 30’s, unemployment fell for a few years after 1929 and stock markets rallied more than 200%. People naturally thought they were out of the woods. Central bank rescue. Then government became the problem. Not the private sector.

This is the phase we are entering now. Its true, we’ve been telling the same story for a while now but our understanding is growing as markets reveal themselves.

Investing these days is about managing uncertainty. The global fininaincial system has never been more levered up and debt never higher. As a consequence we live in a very fragile economic state.

Truth is we don’t know what the trigger may be or when it may occur. Could be tomorrow or in 5 years time. We need to manage this uncertainty but sometimes, as we’ve seen with gold over the last 3 years, the timing can be tricky.

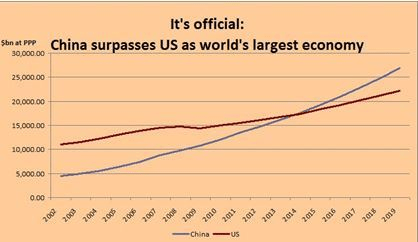

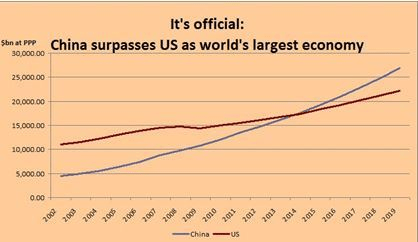

Meanwhile, more on China.

Source: FT

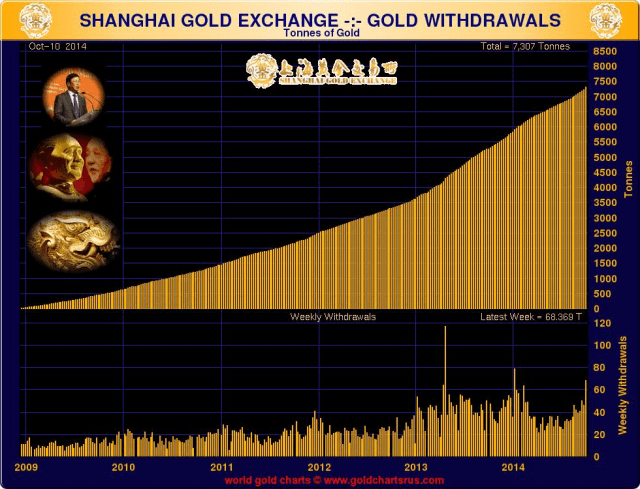

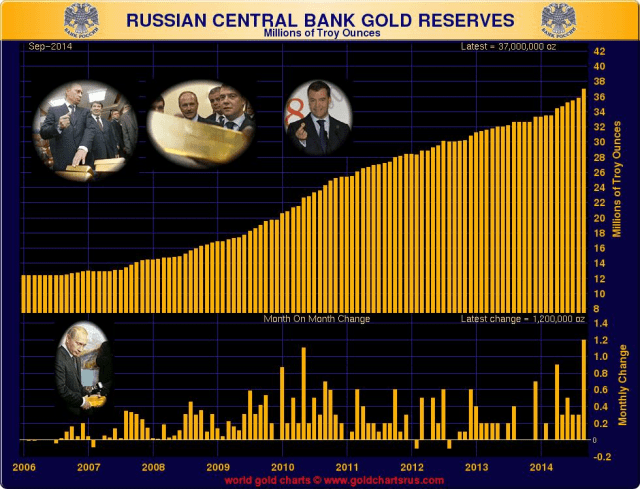

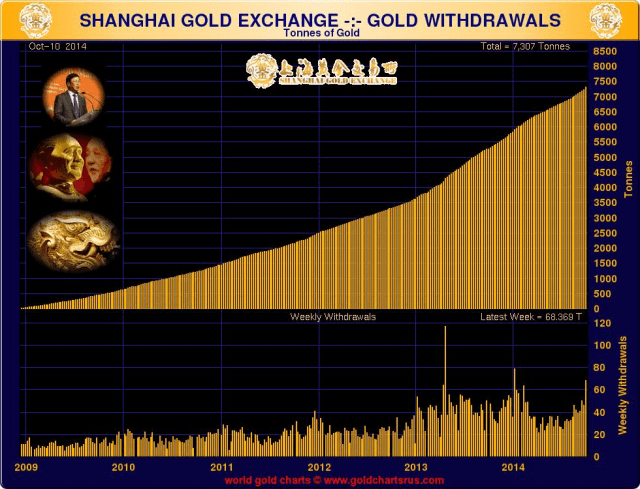

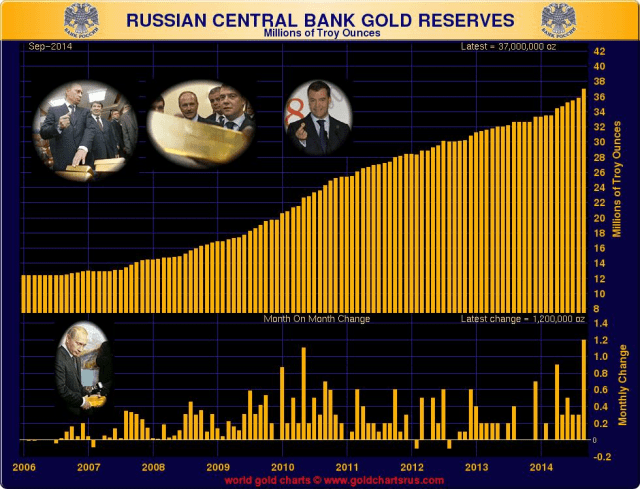

More on gold too. Can somebody from Western Central banking please ring the Chinese, Indians, Russian, Arabs, Thai, Turks and a dozen other gold accumulating central banks and tell them that the barbaric shit is WORTHLESS? They’re not getting it. It has no industrial use, no dividend, is too hard to transport and way too hard hard to store.

That’d be 68 tonnes, for the week!!!!!!!! This is only wholesale demand, does not include govt. Govt officials, at a conference last weekend confirmed 2013 wholesale demand at 2200 tonnes. Reply to this if you want the link to read.

Pesky Russians.

Recent Comments