What do equity Markets Think of this Monetary Policy?

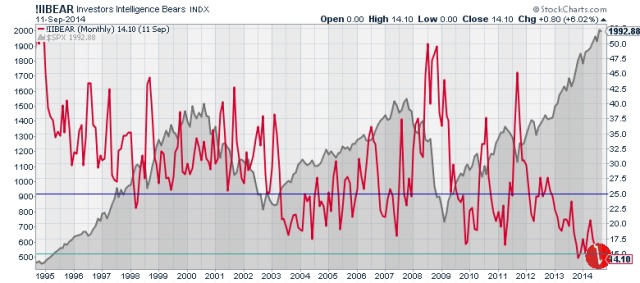

OK, now that everyone is on the same side of the boat………..

Not far behind the instantaneous reports of economic recovery on the back of Yellens mumble is the monkey hammering of precious metal prices on the Comex paper casino. It’s funny that no one has informed the Chinese, Indians, Russian, Brazilian and many other central banks that continue to accumulate physical gold that they have no need for this useless yellow metal.

With a Fed hinting at exit strategies, gold has tumbled to 2014 lows (and almost in the red year-to-date) as traders apparently forget Japan, China, and European central banks continue to (or are set to) print more money into the global reflation trade. It appears that as the West continues to sell ‘paper’ gold, the East remains enamnored as the PBOC (peoples bank of China) announced this morning:

- *CHINA TO FORM SHANGHAI GOLD BENCHMARK, PBOC GOVERNOR SAYS

- *PBOC CHIEF ZHOU: GOLD MARKET IMPORTANT PART OF FINANCIAL MARKET

- *SHANGHAI GOLD MARKET HAS TO AVOID SYSTEMIC RISK: PBOC’S ZHOU

Furthermore, traders have noted physical buying interest continues in the Asian region as premiums rise in China and India.

As Bloomberg reports, PBOC’s Zhou says Chinese gold market is crucial:

Gold market is important component of financial market and can help diversify financial market, People’s Bank of China Governor Zhou Xiaochuan says at ceremony in Shanghai for Shanghai Gold Exchange.

China to form a “Shanghai gold” benchmark: Zhou

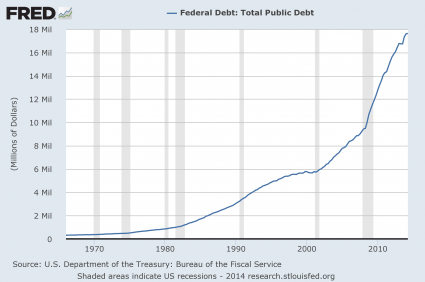

The above 3 charts should tell you where serious investment risks exist outside the geo political spectrum. But be in no doubt what Central Bank response will be to ANY rise in this risk will be from Central Bank. MORE!. This used to be negative for currencies of Governments indulged in this policy, measured against gold.

We reiterate that if you own shares, make sure you know the revenue and balance quality of the company, keep plenty of dry powder and high grade, low cost gold producers will be looked back on as one of the most oversold asset classes in recent times.

Recent Comments