In exchange for weapons and protection, the Saudis would sell their oil for US dollars, then reinvest those dollars back in the United States.

This was a matter of life or death for the dollar at the time; Nixon had closed the gold window three years before, and a massive devaluation of the dollar ensued.

Ensuring that the world’s most traded commodity would only be priced and settled in US dollars was absolutely critical in propping up the currency.

Looking back, it was a brilliant strategic move. The rest of OPEC followed, and this sealed the deal for US financial, political and military supremacy for decades.

The petrodollar was born.

Today, oil remains the most widely traded commodity in the world. And since EVERY nation either buys or sells oil, it means that every nation holds US dollars.

Rather than just sitting on a pile of paper currency, though, foreign banks, governments, and central banks can tend to hold US Treasuries, i.e. US debt.

This means that the US government has a nearly unlimited supply of foreigners to pawn off its dollars, debts, and deficits onto.

The rest of the world toils away to produce things. They work in the fields, manufacture products in factories, pull oil and gas out of the ground.

But that’s not what they do.

The US government arrogantly commands every bank in the world to report to the IRS. They drop bombs, send in drones, and invade foreign nations.

They spy on their allies and enemies alike. They freeze foreigners out of the US banking system and fine foreign banks for doing business with countries they don’t like.

It’s unbelievably stupid. Their behavior practically begs foreigners to abandon the dollar, and the US.

And it’s starting to happen, right in front of our very eyes.

The US has shown that it’s willing to go to war to support this petrodollar system”.

So lets check on how that’s coming along. Sometimes it’s hard to work out where the main front is. Iraq, Ukraine or Afghanistan.

The following from Zerohedge:

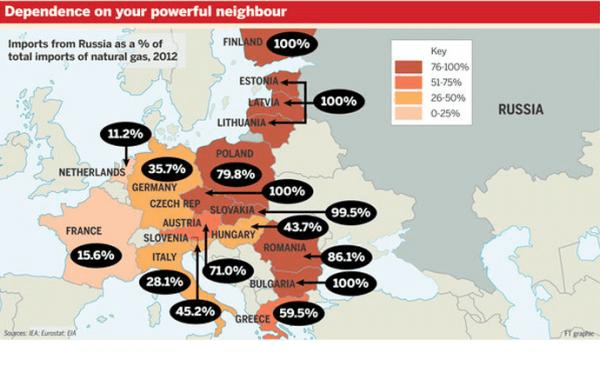

“Until this moment, the main reason why everyone mostly dismissed Europe’s sanctions against Russia is that despite all its pompous rhetoric, Europe consistently refused to hit Russia where it would hurt: its energy titans Gazprom, Rosneft And Transfneft. The reason is simple: by imposing sanctions on these core energy exporters, Europe would directly threaten the stability of its own energy imports (Russia accounts for up to 30% of German gas imports), and as winter approaches with every passing day, playing with the energy status quo would seem like economic suicide. This all appears to have changed last Friday, when as the FT reports from a leaked copy, Europe’s latest sanctions round will boldly go where Europe has never dared to go before, and impose sanctions on the big three: Rosneft, Gazprom Neft and Transneft.This is what is known in game theory terms as a major defection round.

It also means that suddenly the stakes for Russia, and thus Europe, just got all too real, as Putin will now have no choice but to really ramp up the retaliatory escalation, which following the food ban can only mean one thing: a staggered reduction in gas flow to Europe.

It also means something else: recall that it was just ten days ago when it was reported that Gazprom would begins accepting payment for oil in Ruble and Yuan.

If today’s news is confirmed, Europe’s dramatic shift in sanctions strategy means that Europe’s embargo of both the US Dollar and the Euro will accelerate as Russia further intensifies its shift away from both the west and the petrodollar. The only and clear winner here: China, which will almost certainly step in to provide the funding Russia needs however on Beijing’s terms in effect making the symbiotic link between Russia and China even stronger, forcing Moscow to rely almost exclusively on China for trade and funding relations, and suddenly give Xi Jinping all the trump cards.

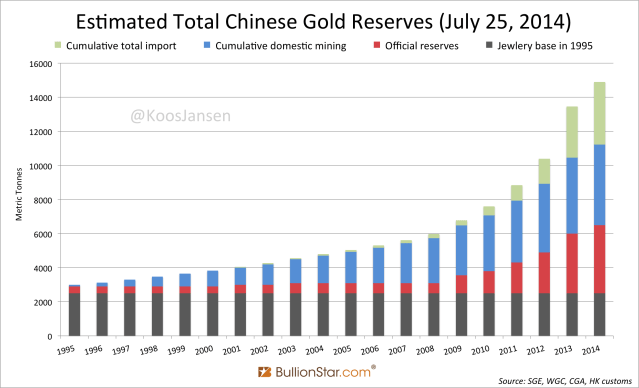

What China’s president will do, now that he has all the leverage in the world to call shots both to the West, the East, and of course, Africa, remains unknown, although those thousands of tons of gold imports that mysteriously enter the country and are never heard from again, may provide a hint.

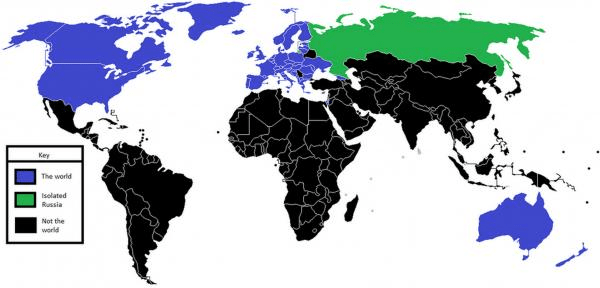

As the West moves to further isolate the Russians lets have a look at it from another view.

Recent Comments