As European Leaders work out who’s in and who’s out as a result of voter backlash across all EU member countries we await for the next instalment of the only game in town. Central Bank largesse.

The result was hardly a surprise for people that understand most of the Eurozone sits on unemployment rates North of 20%. It may be a bit of a surprise to the million Euro a year bureaucrats in Brussels, living in luxury whilst attempting to meddle in every once free market, from fish to cheese. People are exasperated.

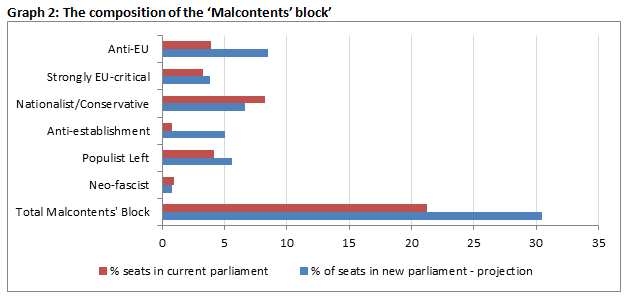

For those pressed for time, here is the one-chart post-mortem of what happened in the weekend elections for European Parliament: the malcontents block, or the anti-EU and protest parties, soar and now control nearly a third of all seats, up nearly by 33% from a fifth currently, in the parliament they all predominantly loathe.

For those with a bit more time, the following breakdown, from the same source, may be of interest.

So what does this mean for investors?

The good news for share investors is, so far, we have only seen Japan go “all in”. The Japan experiment, better known as Abenomics, seems to be moving along swimmingly with interest rates responsibly low. A Japanese 5 year government bond will currently reward you a yield of 0.175% on your hard earned (not so hard if you’re a Wall St Bank).

International investors vote with they’re feet as far as this is concerned. The Bank of Japan is now the only market for JGB’s.

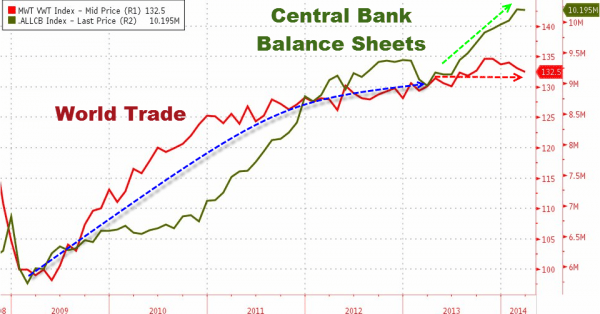

Could this be what we have to look forward to from the US and Europe in the next stage of The Great Financial Reflation. Such as it was in Europe over the weekend, as the call becomes louder to leaders to do more to stimulate growth and bring down unemployment, so will the central banks of Europe and the US oblige, with MOAR.

Investors know, these days, that rising unemployment and falling GDP growth is great for markets. Just look at US equity markets, another all time high in the last session.

The big decision for those with cash on the sidelines is, will there be another sell off before the next/last big blow off?

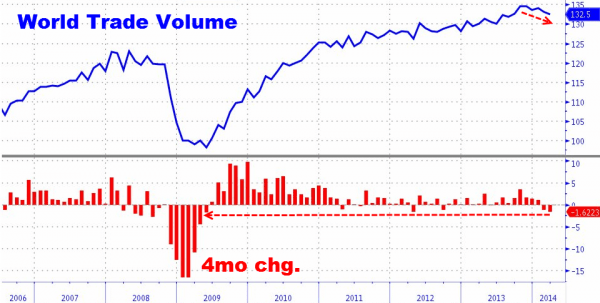

World trade seems to need more.

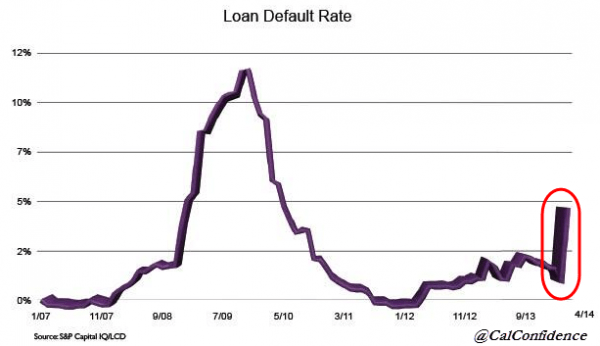

A rising loan default rate in the US should hurry things along. Quick, more is needed.

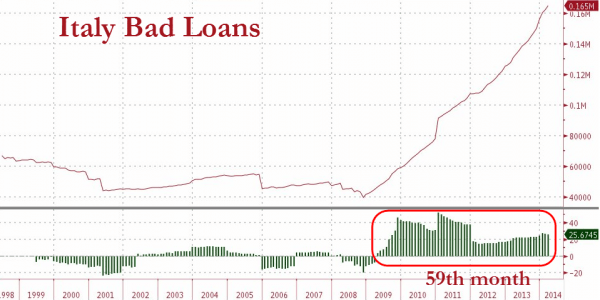

Portugese, Spanish and Greek problems are well known but it sure looks like the Italians could use more.

Yep, 12 trillion dollars of stimulus later. We must need more.

Recent Comments