We’ve waited for things to escalate in the Ukraine before assessing any economic fallout, so not much to report there except it’s still escalating and it will be nice to see NATO back off from what has already been another monumental miscalculation. Crimea is gone. Lets hope they all leave it at that.

Later below, we’ll inject some basic commentary on how our current mini correction in the stock market is coming along and what stopped it in its tracks last night.

But the story that needs to be shared from this week and the last is, as reported on 60 minutes, the markets are rigged! Really? By whom? The 60 billion per month of US “market stimulus”? The entities that have the Greek 10 year Bond paying the same as the US? Obviously things are all fixed in Europe!

By now, even the average person in the street is aware of market rigging (is control a better word?) shenanigans across most major global markets. The most recent revelation, conspiracy to fact, relates to the famed dark pool of High Frequency traders. The push back from main stream media has been embarrassing.

Once again, it’s been left up to authors/journalists like Michael Lewis to expose this latest “discovery” through his recent book, Flash Boys. http://www.goodreads.com/book/show/20604826-flash-boys

We highly recommend this as a must read for those with a passing interest on yet another way insiders have found to “game” the system, written by an author with an incredible knack of making the complex sound simple and incredibly interesting.

A story of how High Frequency Traders (HFT’s) have found and small edge in technology, giving them a small gain on millions of daily transactions, making them the single largest contributor to daily volumes on global equity markets. Of course this done under the noses of toothless regulators, who join the chorus of corporate TV business commentators in defending them on the basis of “providing liquidity”.

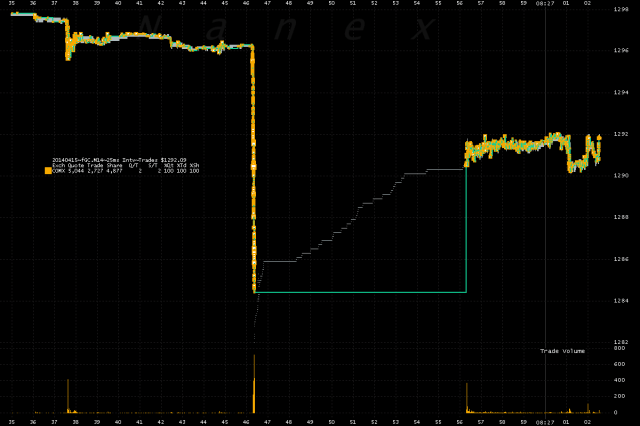

On the same note but in another market, how about this below for liquidity?

“It seems the two words “fiduciary duty” are strangely missing from the dictionary of the new normal asset management community. This morning, shortly before 8:27am ET (the usual time of this activity in the gold market), someone decide that it was the perfect time to dump thousands of Gold futures contracts worth over half a billion dollars notional on NO NEWS AT ALL! This smashed Gold futures down over $12 instantaneously, breaking below the 200DMA and triggered the futures exchange to halt trading in the precious metal for 10-seconds”! It ended up recovering to over 1300 but even if the reported pace of Chinese buying has slowed, IT HAD TOO. Refiners can’t keep up.

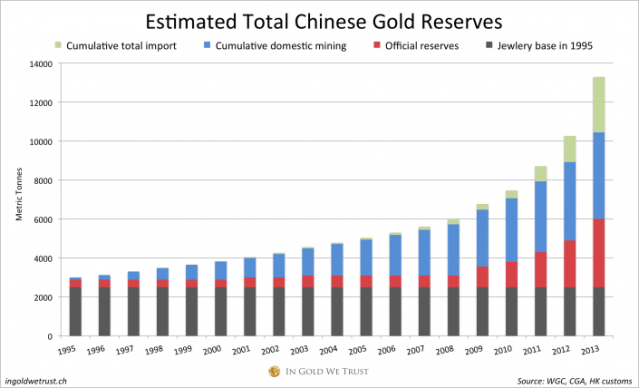

This continual and obvious price suppression using a derivative paper market has consequences, continued rise in physical demand from many areas. The main area is China.

The fact is, China has taken 585 tonnes so far this year, according to analyst Koos Jansen. Its on track to import close to the entire global production number itself. The other gold is being supplied by Western Central Banks, even though Germany can’t have its. You must understand a low gold price is central to keeping confidence in the value of the current global reserve currency and everything must be done to keep this status quo, for now.

But it’s the cumulative consequence that is starting to take shape.

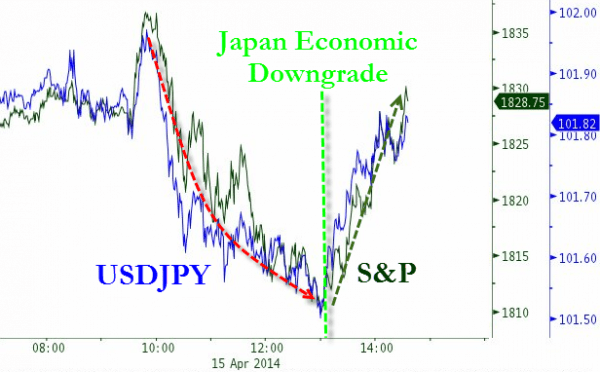

So back to more market related trends. Bad news is good again!

The bounce in the US last night was triggered by nothing more than the announcement of a Japanese Economic downgrade. Bad news, right? Wrong. This was great news because you know what this means for the country with the greatest public debt to GDP ratio in the OECD? MORE! More stimulus printing, as its working so well. (Australia holds the dubious rank of No 1 in the private debt to GDP ration race, well done, so far).

Yep, back to bad is good.

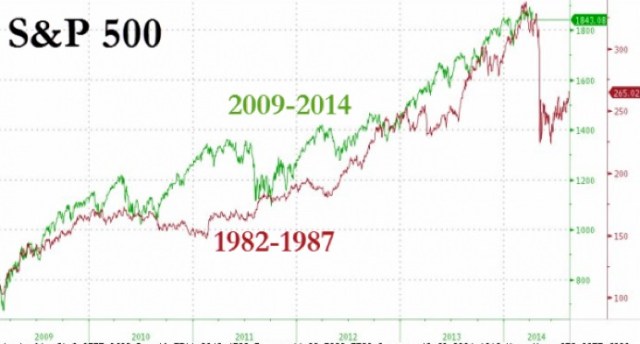

Or is it? Why can’t markets be allowed to fall? There are some similarities with other periods but we know this time its different. No inflation, keep printing.

Recent Comments