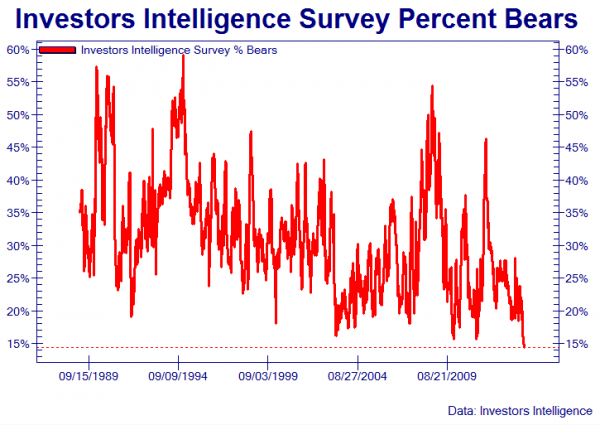

Last week we saw the capitulation of one of the last true contrarian investors, Hugh Hendry, of the famed Eclectica Macro Global Fund in London.

Hendry’s “come to Bernanke” moment did not come easily: The manager acknowledged his changing stance may be viewed by some investors as a ‘top of the market’ signal, but said he is not concerned by the prospect of a crash:

“I may be providing a public utility here, as the last bear to capitulate. You are well within your rights to say ‘sell’. The S&P 500 is up 30% over the past year: I wish I had thought this last year.”

“Crashing is the least of my concerns. I can deal with that, but I cannot risk my reputation because we are in this virtuous loop where the market is trending.”

Sadly, his last statement is just the latest confirmation that we’re in the New Centrally-Planned Normal, FOMO or Fear of Missing Out (the trend, the media appearance, the herd, the year end bonus, you name it). And like that, everyone is now on the same side of the boat. Below this chart, we’ll show you why.

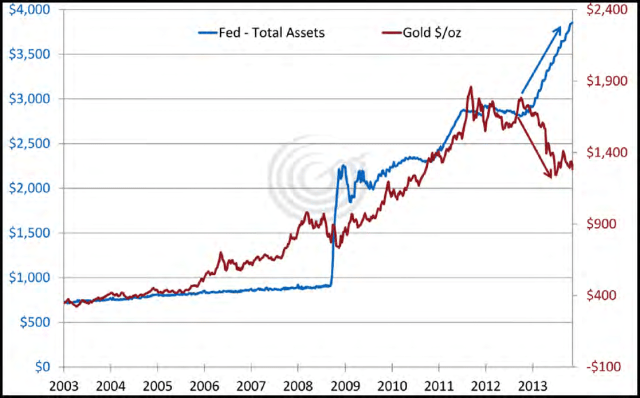

This is the why, below. The Fed now owns MORE THAN

This is the why, below: The Fed now owns MORE THAN 30% of THE ENTIRE GOVERNMENT BOND MARKET. This means that market participants who would normally buy these “assets” are being forced to buy other assets, like shares, pushing the market and valuations to 1999 type, and, possibly beyond.

What you really need to understand is that this central bank strategy is GLOBAL and if we were to look at the same chart for Europe and Japan, it may well be MORE! Hopefully we’ll get some MORE bad economic news soon, leading to MORE money printing, leading to faster rising real estate and stock markets!

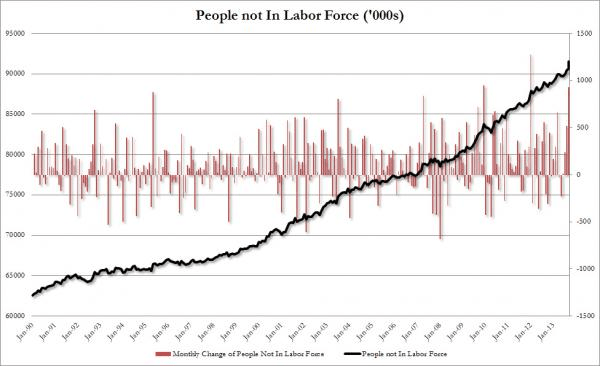

As markets rise and the media reports of the success of central bank printing, we’re not sure whether the newly unemployed people in the US (nearly 1 million, or 932,000 to be exact, in just the month of October, to a record 91.5 million) will agree this is all working!

This was the third highest monthly increase in people falling out of the labour force in US history (once they fall out they don’t appear in the unemployment numbers). At this pace, the people out of the labour force will surpass the working Americans in about 4 years. Just remember this when the US reports “better than expected” non-farm payroll numbers this Friday.

And on other things not natural…

Paper Gold makes another crack at its June lows as Premiums for the physical metal rise in Asian Exchanges.

If you haven’t, you may need to prepare yourself for $100 dollar daily moves as the creaks in this system get louder and louder.

For those interested in one of the best Economic presentations of 2013, please follow the link to the presentation Grant Williams gave last week in Perth, at the ASFA (Super Fund Association) conference.

Recent Comments